Free-banking revisited: the Chilean experience 1860-1898 (Ignacio Briones 2002)

The empirical evidence we report shows that during the free-banking period (period in which Chile experienced two important wars and a civil war), inflation was low and stable most of the time.

Introduction

Besides the publication of monthly balances and upper issuing limits linked to a fraction of the effective capital they constituted (150%) the Chilean banking system didn’t establish other major limitations for the creation of issue banks. [...] During this period bankruptcies were rare, the number of issue banks increased over time for most part of the 1860-1898 period, while concentration rates reached reasonable levels at some stages. Furthermore, during the free-banking era, economic growth was important and the domestic capital markets strongly expanded in all its branches (Briones 2001).

The banking law of 1860

In Courcelle’s words emission could not go naturally beyond the real market demand for money. Courcelle’s argument is as follows. Under competitive supply of money any excessive emission from any single bank would only cause a loss of its credibility among noteholders. As a result, these would quickly convert their notes and thus cause the bankruptcy of the bank. Since no banker desires a default, this natural mechanism imposes a responsible behavior when issuing notes. But if Courcelle argued that financial difficulties could not come from an excessive emission, he nevertheless pointed out that problems could result from a poor management and a bad portfolio of liabilities rendering banks unable to pay their debts at a given moment. Courcelle claimed that, in order to avoid this potential adverse scenario, banks needed no more than a reasonable amount of capital to respond to their obligations.

The main features of the 1860’s banking law can be summarized as follows.

· Convertibility: Notes had to be paid in specie (silver or gold) in sight and on demand (Art. 26 and 27).

· Freedom of entry: The law stated that every person apt to begin commercial activities can base a bank of issue (Art.1)

· Capital as issue backing: One of the key distinctions of the Chilean banking system is that the law did not force the banks to hold a metallic or specie reserve backing against its emission but just a minimal capital. We are thus under a variant of the pure fractional reserve model. The Chilean law restricted the stock of issued notes to 150% of the paid capital (Art. 29). In addition, it established that the paid capital could only be constituted by specie or short term (less than 6 months) debt of “very well known and solvent people” (Art. 6). Notes had to be double-coupon numbered and signed by the bank director and the Governor of the Casa de Moneda (the State). One coupon had to stay at the Casa de Moneda as a control of the registered emission (Art. 14).

· Transparency and Accounting information: The law of 1860 obliged banks to publish detailed monthly balances that had to be transmitted to the Finance Ministry (Art. 8 and 30). In addition, the President of the Republic was in charge of revising the accounting information when a new bank opened (Art. 5). Besides, the Law of 1860 obliged banks to indicate in a special account of the balance the loans to its managers and directors (Art. 10). Non-compliance with these arrangements entailed important fines (Art. 24 and 25).

· Corporate governance: The law also established a series of conditions preventing frauds and aligning administration and noteholders interests. For example, the director of the bank was obliged to constitute a stock guarantee for an amount of 10 % of the total bank capital against the obligations engaged by the bank during his mandate (Art. 9).

Furthermore, owners had unlimited responsibility against the bank duties (Art. 26). This meant that if bank asset were eventually not sufficient to pay its liabilities, bank owners had to respond with their personal wealth.

Subsequent institutional changes: the inconvertibility era and the gold standard period

In 1878 the Chilean banking system experienced an important liquidity crisis. The major Chilean banks such as the Banco Nacional de Chile and the Banco de Valparaiso (together accounting for almost 60% of the total deposits and for 55% of the total bank notes) experimented a severe diminution of their specie reserves as long as notheholders run to convert their notes. Faced with the huge difficulties of the country’s biggest banks and for many reasons we do not develop in this article, the Government prevented them to default.

As a result, on July 23rd of 1878 the Government passed a Law establishing the forced reception and the inconvertibility of the bank notes. At the same time, the law constrained banks to cumulate specie reserves or bonds in order to redeem their notes once convertibility would be resumed. In principle this law had to be transitory, just providing time to banks to improve their specie reserves before returning to convertibility. The initial date of return to the full convertibility was set at August 31st 1879 but immediately another law (September 6, 1878) delayed the convertibility until the Mai the 1st 1880. During the whole inconvertible period the freedom of entrance and the right of banks for issue notes prevailed.

Nevertheless, the banks had no more the exclusivity of note issuing since, starting at 1879, the State begun to print its own notes (fiscal notes) and became rapidly the major supplier of paper money. In practice, the inconvertibility law established a limit for the amount of notes that each bank could be declared as inconvertible and allowed them to still issuing “convertibles” notes for a maximum amount of 150% of their paid in capital as it was established in the 1860’s former banking law. Nevertheless these “convertible” notes were quite different from the ones convertible in specie since banks had the right to simply convert them into their own inconvertible emission or into inconvertible fiscal notes.

On Mai the 1st 1880 the inconvertibility of bank notes theoretically ended. Nevertheless the inconvertibility of fiscal notes remained. As a consequence, even if in theory the banks were forced to convert their notes in specie, they could simply redeem them into inconvertible fiscal notes. The latter meant that, in practice, the inconvertibility régime went far beyond the 1880’s deadline. As a matter of fact it prevailed until 1895. After several years of debates during the 1890’s, finally on February 12 of 1895 the Parliament passed a law ordering a gradual return to convertibility starting on June the 1st 1895. To do so, Chile adopted the gold standard with an implicit gold exchange rate of 18d per Peso. The law stated that, on demand, fiscal notes were immediately (starting on June the 1st) redeemable in gold or in silver (only if the value of a silver Peso was over 18d). It also considered a complete conversion of the remaining (if applicable) fiscal notes by December the 31st 1897.

Regarding bank notes, the law forced the banks to cumulate a one to one ratio in gold, fiscal notes or bonds that must be deposited at the Casa de Moneda as a guaranty against the emission that had to be converted. The deadline for the full conversion of banks notes was set at December the 31st 1897. Meanwhile the bank notes that were guaranteed in the way we aforementioned were accepted by the State as payment for tax or other debts in favor of the State. However, by the end of 1898 the banks were not able to fully convert their notes. This is why on July the 31st a new law declared all the remaining banknotes as fiscal notes, reestablished the forced course and the inconvertibility and avoided banks to still issue paper money afterwards. The latter implied the end of the free-banking period as well as of this short period of convertibility and gold Standard era. Afterwards only the State was allowed to issue paper money.

Summarizing, we can say that from an institutional point of view the free-banking era can be split in three sub-periods. Between 1860 and 1878, the system operated under a régime of full convertibility in specie. During the following seventeen years, the context was one of inconvertibility and forced reception of notes as well as increasingly important State’s note issuing. The 1895-1898 period marked a short return to convertibility as well as the replacement of the bimetallic system by the gold standard criteria. Afterwards, inconvertibility was readopted (1898), and the State was in practice the only one allowed to issue paper money.

Number of banks

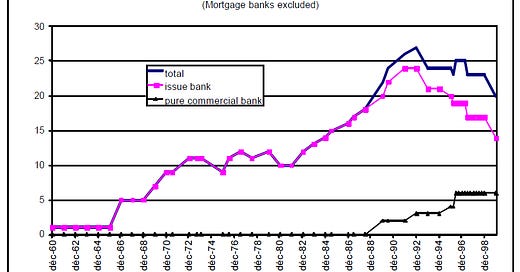

If in 1866 we count 5 note-issuing banks, by the beginnings of the 1890’s Chile’s number of banks reached a peak of 24 issue banks and ended the period (1898) with 17 institutions. During most part of the free-banking era, there were almost no pure commercial banks and it was only since the end of the 1880’s that they will attain some relative importance. Figure #1 presents this evolution.

During the whole period, 34 note-issuing banks existed at one moment or another. Table #1 reports these banks, indicating their founding year, the first year they issued notes and, if applicable, their closing date.

Bank failures

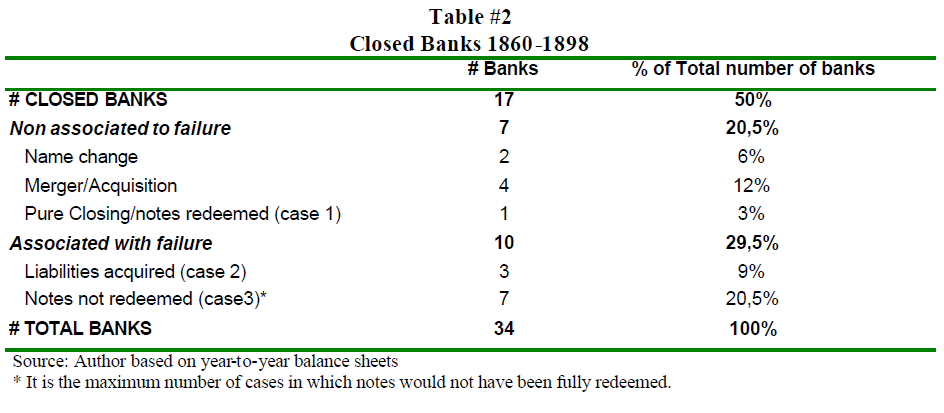

When looking at the number of issue banks that remained in business by the end of the nineteenth century (17) one might think that a half of them failed. The reality is more complex than this. For instance, let us say that a closed bank is quite different from a failed bank. Among the banks presented in Table #1, three of them - Banco de Mac Clure, Banco de Matte and Mac Clure and Banco de Matte - are exactly the same and a simple modification of its names occurred between 1854 an 1876 (i.e. there is not closed bank at all). In addition, four other nominal “disappearance” cases were not associated with banking failures but with merging and acquisition processes. These are the cases of Banco Sudamericano which was bought in 1873 by the Banco de Valparaiso and of Banco Agricola, Banco Nacional de Chile and Banco de Valparaiso which merged in 1892 creating the so called Banco de Chile.

Among the cases of closed banks, we are sure that Banco de Credito Unido redeemed all its notes before closing in 1897 (case 1). In three out of the ten remaining closing banks (Banco Alianza, Banco Ossa and Banco Consolidado) the liabilities were taken over by the Banco Nacional (for the first couple) and by the Banco de Valparaiso for the third. The latter suggests that these three institutions had a positive net worth and that the market mechanism described in case 2 operated. We do not have information allowing us to establish if for the remaining seven failure cases the liabilities were redeemed or not (and in which proportion). Therefore, we supposed the extreme case in which debts were not fully paid. Table #2 summarizes the aforementioned results.

Depending on the failure definition we adopt, the proportion of failed banks to the total number of banks that existed at one moment or at another during 1860 and 1898 would be between one fifth (20,5%) and something less than one third (29,5%). This last failure rate is in line with the evidence collected by Rolnick and Weber (1983) for the supposedly successful example of the State of New York during U.S. free-banking experience (36%) and is lower than the U.S. average rate (48%).

Let us focus on notes redemption and assume the extreme case where these seven banks were unable to pay no single note at all (this is the upper bound for losses due to unpaid noteholders). Expressed as a proportion of the total amount of bank notes in circulation, we find that the notes of the failed banks never went beyond 1,2%. In other words, these bankruptcies were associated with small banks which had a marginal effect over the whole system. The same conclusion is obtained when looking at deposits instead of notes. The losses that would have been suffered by the noteholders during these failure episodes can also be expressed as average annual rates in relation to the total stock of circulating notes (or deposits) for the whole period 1860-1898. This annual rate is about 0,25% for notes and 0,12% for deposits. The average loss rate for notes is similar (0,18%) to the one reported by King (1983) for N.Y. (1842-1863) as evidence supporting this successful example inside the U.S. free-banking system and is lower than the natural depreciation (because of utilization) of a metallic coin. Table #3 summarizes these results.

Table # 3 also shows that, with the exception of Banco del Sur, the failed banks had been in business for far more than a year. The latter, suggests that the Chilean free-banking failures were not associated with what is called « wildcat banking » ...

In fact, almost all Chilean failed banks have operated for more than three years (the average being of 7 years) and all of them were implanted in the most important cities of the country.

Competition

[...] under a reasonable competitive environment, one could expect to observe at least two things: 1) that there is not an excessive degree of concentration and that 2) if it is not the case, the concentration levels must be falling over time as new entrants try to catch the excessive profits of former banks.

In order to test these hypotheses, we provide two alternative indexes of banking concentration. The first simply consists in measuring the market share of the major banks (in this case the market share of deposits for the three major banks). The second is what is called Herfindahl-Hirshman index (HHI). Instead of taking only the major banks, this index has the advantage of including all existing banks in one single measure that calibrates for the relative weight of each bank.

In practice, for the HHI the standard criteria to determine whether the market is atomized or not, assume that values lesser than 0,1 represent a competitive market. Between 0,1 and 0,18 the industry is considered as having a moderate degree of concentration. Above 0,18 market is viewed as highly concentrated. The evolution of these two measures of concentration is presented in figure #2.

In fact, if in 1866 the three major banks accounted for 85% of the total deposits, by the end of the period this proportion dropped to 65%. ... Nevertheless, in absolute terms, concentration rates were always important [24]. In particular, as figure #3 shows, two banks - Banco Nacional de Chile and Banco de Valparaiso - had permanently accounted for more than half of the market.

[24] In any case, with the 28 banks operating today in the highly dynamic and competitive Chilean banking system, the five major banks concentrate near 60% of the total deposits.

The HHI complements this information but provides a more accurate picture of the story. [...] According to the criteria we defined earlier, concentration levels declined from “highly concentrated” by 1866 (0,33) to “moderately concentrated” by 1890 (0,17).

In addition the evidence presented indicates that this “competitive phase” can be split in two sub-periods. One corresponding to the first convertibility period (1860-1878) in which competitiveness increased (the HHI dropped to 0,19) and a second one associated with the inconvertibility period (1878-1895) in which concentration first re-increased and then declined again since the end of the 1880’s.

Capitalization and banking profitability

A complementary way to test the competition hypothesis consists in looking at the profitability of the banking system [...] As figure #4 shows, if by the 1860’s the annual average earning rate of the banking system was close to 17% of its paid in capital, by the 1890’s this ratio attained only 10%.

Until 1878 (first convertibility period) the banking returns were declining: profits fell from near 20% of the paid in capital to something less than 12%. [...] In opposition, the inconvertibility period seemed to have reverted this tendency. Immediately after the instauration of inconvertibility, the profits augmented. Despite the fact that numerous new banks have been established afterwards (specially during the 1880’s), until 1895 these high returns levels stayed relatively stable at around 18% of the paid in capital.

Finally, the return of convertibility that occurred between 1895 and 1898 caused a new decline in the banking earnings ratios. In a general way, all happens as if during the convertibility periods the market mechanism eliminating «excess profits » functioned. On the contrary, the inconvertibility era seemed to have operated as a kind of shield or protection for banks (or some banks) and their returns. As presented in figure #5, this conclusion is even more clear if one looks at what happened to the profitability rate of the major banks such as Banco Nacional de Chile and Banco de Valparaiso. During the first convertibility period their rates of return were declining and they ended the period with profitability rates below the market average. During the inconvertibility exactly the opposite happened and the major banks obtained gains well above the market.

Interest rates

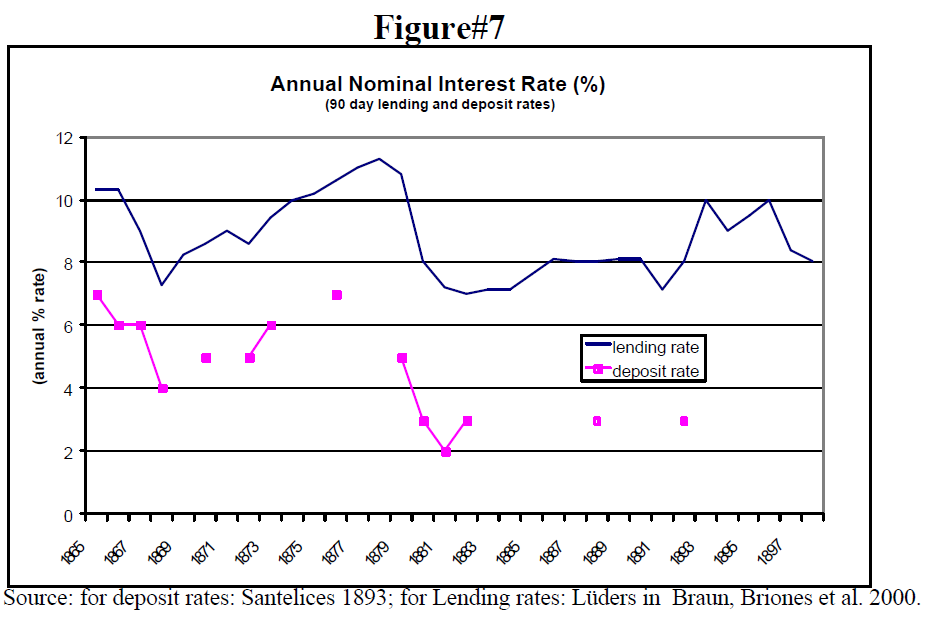

Figure #7 shows the 90 days lending and deposit rates. [...] The evidence presented shows that spread was quite lower during the first convertibility period (an average of 3,5% for the 1866-1878 period) than the one registered during most part of the inconvertibility era (5% on average for the 1878-1892 period).

Second, as we could have expected, the major periods of interest rate increases corresponded to the 1878’s crisis and the gold convertibility era (1895-1898) since during both episodes the banking system would have been experienced liquidity problems and a lack of confidence among noteholders. [...] in each of these episodes the interest rate increased only in « moderate » fashion as compared with the raise one could have expected in a deep liquidity crisis (from 8,5% to 11% during the 1878 crisis and from 8% to 10% at the end of the gold convertibility period).

Economic growth and capital market development

In addition we calculated a quantitative measure of the capital market development by reporting over time the ratio of total financial assets of the economy to GDP. If by 1870 the total financial assets represented only 40% of the domestic GDP, by the end of the century this ratio raised to 60%. During the same interval the stock market capitalization passed from representing 20% of GDP to levels close to 35%. In the same way, the mortgage market (representing the most important domestic private long-term market) increased from being near 3% of the GDP in the 1860’s to 15% of the GDP by the end of the century. Figure #8 summarizes these previous findings.

During the second half of the 19th century, the Chilean real GDP augmented by nearly four times. In particular, between 1860 and 1898 the real per capita GDP grew at an average annual rate of 2,1%.

Figures #9 to #12 present the evolution of international per capita GDP as a fraction of the Chilean per capita GDP.

Aggregate note issuing: from banking emission to fiscal notes

If one looks exclusively at the net emission (figure #13), one could conclude that note issue increased until 1895. In particular, between 1866-1895 its annual average expansion rate would has been of about 8,8%. As we aforementioned, this figure could be misleading. [...] Grosso modo, the circulating bank notes expanded just until the end of the first convertibility period but diminished afterwards until the period of gold convertibility. Why did the amount of circulating bank notes decline after the instauration of the inconvertibility in 1878? As figure #14 shows, the main answer can be found in the introduction of a second supplier of paper money: the State.

Because the fiscal note can be seen as a perfect substitute of the bank note, it is not surprising to observe that the bank notes in the hands of the public have diminished during the main part of the inconvertibility period. During the return to convertibility, both fiscal and banking notes must be converted in specie and this is the main reason explaining the huge drop in the total circulating notes (fiscal and bank notes ) between 1895 and 1898. After 1898, inconvertibility was readopted and private banks were, in practice forbid to continue to issue notes. As a result, the fiscal notes will be the only paper money in circulation afterwards.

Inflation rate and overemission

During the 1860-1898 period the average annual inflation rate was moderate (3,3%). Moreover, until the 1880’s decade its volatility was also low. Let us say that, in practice, until 1878 the Chilean economy had an almost fixed exchange rate ... and thus it functioned as a nominal anchor against inflation.

Not surprisingly during this period the average inflation rate was quite inferior (1,3% per year) to the average rate for the whole period and, for instance, of the inflation rate of the inconvertibility era. Since 1878 and because of the silver depreciation in the international markets, Chile’s bimetallic system moved to a de facto silver standard and the nominal anchor was lost.

We also have pointed-out that the State emission was by far superior to the banking one. In this context , it is not surprising to find that the major inflation episodes coincided precisely with massive increases in the emission of fiscal notes. Notice that just after the first fiscal emission (1879), the inflation raised immediately to 11%. Because no new major fiscal emission occurred afterwards until the end of the 1880’s, and also because the bank emission tended to decline, the inflation remained stable during the following ten years.

Nevertheless, by the beginnings of the 1890’s the fiscal emission more than doubled and, as a result, Chile experienced its major inflation episode: 22% in 1893 and 15% on average for the whole 1891-1894 period. Afterwards, between 1895 and 1898, the return to convertibility produced a dramatic decline in both State and Bank notes in circulation. As a consequence, Chile plunged into a brief deflationary process.

Furthermore, we can think that banks played exactly the opposite role than the one attributed to it by its critics. Because of the substitution effect between banking and fiscal notes, every time that fiscal notes expanded, the bank notes in the public hands diminished, avoiding this way a further increase in the domestic prices.

The banking system and the exchange rate depreciation

Between 1860 and 1878 the Chilean Peso lost 45% of its value against the British Pound.

In figure #17 we present the evolution of the 3 months exchange rate against the British currency as well as the effective bullion points for the arbitraged exchange rate.

As expected, until 1878 the exchange rate stayed almost perfectly within the bounds of the band we have defined.

First, during the convertibility period the specie backing of the banking system deteriorated systematically over time. Even if at the eve of 1878 this ratio still remained at reasonable levels (40%), this declining tendency would be the major factor explaining the banking panic that arose this year and the instauration of the inconvertibility as a way to help the banking system. Second, during the inconvertibility era, the specie backing didn’t augment but, at least, it remained stable (near 20%) until the beginnings of the 1890’s.

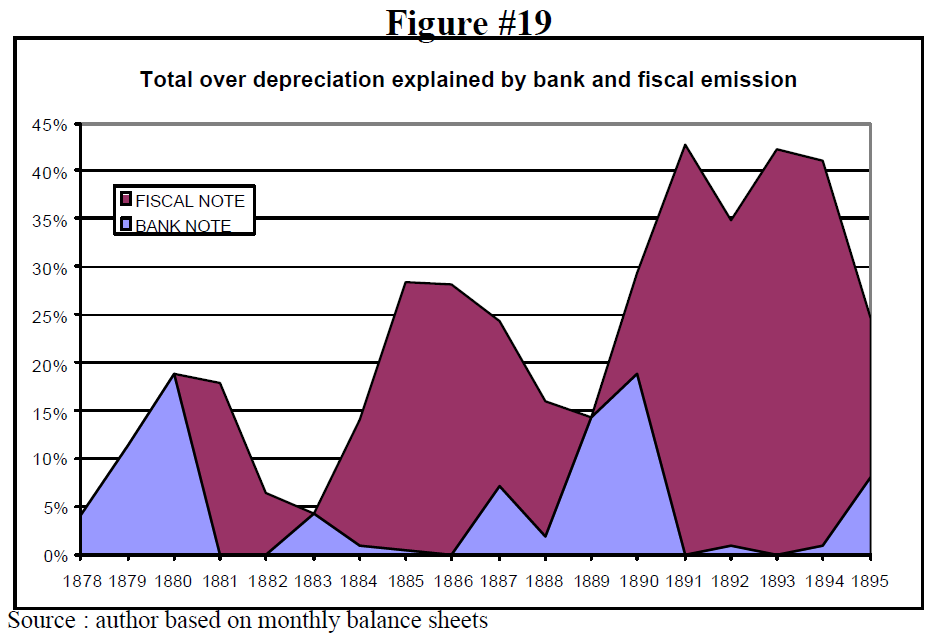

Third, and most important, if during the inconvertibility period the specie backing didn’t improve, in compensation the banks cumulated large amounts of fiscal notes in cash reserves allowing them to attain an average total backing ratio of near 85% of their total emission. The latter implies that the banks couldn’t have been fully responsible for the excessive depreciation that Chile experienced during the inconvertibility. Figure #19 presents our estimates on the share of the total excessive depreciation which is attributable to the bank and to the fiscal notes.

For an average excessive depreciation of near 23% during the inconvertibility period, the banks can only account for 5% and the fiscal notes for the remaining 18%. Moreover, with the exceptions of the immediate depreciation that occurred after the instauration of inconvertibility and the episode at the end of the 1890’s when the backing ratio of the banks declined, the major events of excessive depreciation were not related to an increase in bank notes. On the contrary, as figure #20 shows, it seems very clear that these were mainly associated with huge expansions of the fiscal emission.

Additional informations with regard to chilean free banking :

Do Economists Reach a Conclusion on Free-Banking Episodes? (Ignacio Briones & Hugh Rockoff, 2005)

In 1878, a big loan to the government was arranged and the amount of bank notes that could be received by the State at par implied a doubling of the circulation. This loan, of course, created strong incentives for the private banks to increase their issues and undermined convertibility. A deep financial crisis occurred in 1878, after which the government decreed the inconvertibility of bank notes and thus the depreciation of the local currency (Briones 2004).

As in the US case, it was commonly believed that minimally regulated banking had produced many bank failures in Chile. The data, however, reveal that between 1880 and 1898, cumulated losses for depositors represented just 2.5 percent of total deposits.

In 1898, due to the threat of a war with Argentina, a bank run has found the banks unprepared. To avoid a collapse of the economy, the state took over the banks' banknotes. (However, they were lent to the banks at a 2% rate, and so they kept an indirect influence on the issue of banknotes.)

"Essai sur la nature du papier-monnaie envisagé sous son aspect historique et économico-monétaire," by Guillermo Subercaseaux (page 9/36) :

The inconvertibility of bank notes in Chile (1878) also appears in a critical economic situation, especially for banks, and the financial situation or the government’s needs for money and the loans to banks contributed much to bring this. In 1879, emissions of fiscal notes are made which had no other purpose than to provide resources for the war. The new inconvertibility of 1898 was caused by the need to avoid bank panics, without the contribution of the financial factors there; it was rather a case of panic caused by the noise of war.

Further reading: Empirical Evidence for Free Banking