In this book, Selgin showed that private coinage was a viable solution to government monopoly. Both theoretically and empirically. Great Britain's industrial development was threatened because the government failed to provide small change, partly because it couldn't fight counterfeiting. Then, dozens of new issuers entered the market, and tokens became the dominant small-change currency in many areas. Good private tokens drove out bad regal coins. This is another proof that Gresham's law only occurs when the government forces the acceptance of debased coins or money substitutes.

Selgin, G. A. (2008). Good Money: Birmingham Button Makers, the Royal Mint, and the Beginnings of Modern Coinage, 1775-1821. University of Michigan Press.

Foreword, by Charles Goodhart

This book details the fascinating history of the development, production, and use by the private sector of token copper coins during the early years of the Industrial Revolution, 1787-1817. The Industrial Revolution moved workers off the land into factories and thereby greatly increased the demand for small-value transactions money, to pay the wages and to allow the workers some choice in their use of their wage receipts to buy food, drink, and other goods. For a variety of reasons, nicely described by George Selgin, neither the Royal Mint nor commercial banks were willing or able to provide such small-value currency. There was a dearth of small change available to pay wages. The shortage was so severe that it was proving a serious hindrance to the industrial development of Great Britain.

Where there is a shortage, there is also a profitable opportunity to satisfy that demand. Selgin tells the story of how the private sector, led by Anglesey copper mine owner Thomas Williams and by James Watt's partner Matthew Boulton, started to strike its own token copper coins. As part of his effort, Boulton built the world's first steam-powered mint. The enthusiastic public reception of Williams's and Boulton's prototype coins led to the opening of numerous other private mints, which eventually supplied Great Britain with hundreds of tons of copper pennies, halfpennies, and farthings.

Since these copper coins were neither full weight nor legal tender (e.g., for the payment of taxes), what made them (locally) acceptable? There were, I believe, three criteria for this. First, the suppliers of the coins promised to make them redeemable (convertible), on demand, either into gold or silver coin produced by the Royal Mint or into Bank of England notes. Second, that promise was credible because the supplier was often a rich, established, well-known local industrialist or merchant. Third, the coins were well made by innovative and complex techniques that were difficult to counterfeit. Indeed, so successful and acceptable were some of these coins that they were at times preferred to the scarce and often badly worn (and easily counterfeited) regal copper coins that had been previously coined by the Royal Mint.

Nevertheless, despite the success of such coins in filling a vacuum, the authorities were far from happy with having part of their nation's coinage privately produced. This concern was aggravated when private producers moved on from the issue of copper tokens to the issue of silver tokens and even to the issue of gold tokens, as was done by Reading's John Berkeley Monck in 1812 (see chap. 6). Of course, any suggestion that the authorities might make such private coinage illegal would make holders tend to take up their redemption option (i.e., to run from the currency), thereby making complaints against private currencies self-validating. Anyhow, goaded by Monck's threat to create a private gold standard, the government under Spencer Perceval moved to make private coins illegal. The government was prevented from doing so immediately because of the lack of alternative (small-value) coinage, but eventually, on New Year's Day, 1818, the passing of almost all private coins became illegal. Only tokens issued by the Sheffield and Birmingham workhouses were temporarily exempted.

The story that Selgin has to tell is nowadays largely unknown and is both important and gripping. There are many interdisciplinary facets to this book. It throws light on, among other things, major chapters in the histories of coinage and numismatics, of the industrial revolution and engineering developments, and particularly of Birmingham and the manufacturers of that great city.

But Selgin and I are both monetary economists (and monetary historians). The main lesson of this book for him is that the private sector can produce and provide good money (hence the book's title) that may in some (technical) respects be better than the government's own money. I certainly agree that when the government fails to provide a satisfactory money, substitutes will be forthcoming, whether foreign money (e.g., U.S. dollars) or private tokens. But to me, the main lesson of this book is not so much about whether money should be produced by the public or private sector but the support the book gives, in my view, to the Cartalist theory of the essence of money. In effect, the balance between the metallic content and the face value of a coin represented the credible commitment of the issuer. Local confidence that an IOU could and would be honored meant that coins could generally be accepted and used in exchange. The better the credit of the issuer, the wider the circulation, and the less need for intrinsic value of the money object.

Selgin, I would guess, sees the almost universal provision of currency by the state as an unnecessary and undesirable consequence of coercion to protect a profitable monopoly (seigniorage). In contrast, I see the state's role in this respect as the almost inevitable consequence of the fact that the state is - admittedly in large part because of its coercive and tax powers - the most creditworthy institution in the country. Whichever of us may be correct, it makes no difference to the fact that this is an excellent and fascinating book.

CHAPTER I

Britain's Big Problem

Coining Words

What was behind Great Britain's small-change shortage? One economic historian's answer - that the Royal Mint's "obsolete" equipment kept it from meeting "the heavy demands of an expanding industrial society" (Whiting 1971, 20) - won't do: it was, as we shall see, not so much the mint's equipment as its policies that prevented it from supplying enough small change. Understanding those policies means coming to grips with some monetary jargon, which isn't all beer and skittles. Fortunately, the jargon is here mainly confined to the next few pages, after which it seldom turns up.

[...]

Gresham's law only takes effect where officially undervalued coins cannot command a premium, for such a premium might make up for the coins' official undervaluation, removing the usual motive for melting or lightening them. It also has to be the case that officially overvalued coins are taken at face value (or by tale), rather than at a discount (or by weight), because a discount applied to officially overvalued coins would have the same effect as a premium on legally undervalued ones. These requirements have often been satisfied historically, thanks to the inconvenience of valuing coins at other than their face values and also to legal tender laws, which often prohibit the passing of official coins at anything save their official ratings. [15]

A Standard "Blundered Into"

As far as British officialdom was concerned, the pound sterling, the shilling, and the penny continued throughout the eighteenth century to be silver monetary units, as they had been since Queen Elizabeth's day - corresponding to twenty, one, and one-twelfth shillings, respectively. As we have seen, gold guineas, which had had a free-floating value for a time, were assigned an official value of twenty-one shillings in 1717. From that point onward, Britain was officially committed to bimetallism, with both gold and silver coins commanding unlimited legal tender status for most of the remainder of the century. [25]

[...]

The spontaneous switch to gold units took place in part because of the increasing scale of payments, which made gold coins convenient for an increasing share of transactions, but also because the full-weight silver coins so abundantly supplied during the Great Recoinage of the 1690s had taken flight or had become badly impaired (Ruding 1840, 2:87). The term shilling thus ceased to have a clear meaning when reckoned as a quantity of silver [...]

By agreeing, implicitly, to treat the shilling and the pound as gold units while using worn silver coins as mere counters or claims to gold (to be accepted at face value only in limited quantities), merchants were able to avoid confusion and to keep things civil. Workers, however, were hardly better off than they had been just after the Glorious Revolution, for they were seldom, if ever, paid in gold and were often compelled to receive silver coins by tale. To save silver for larger purchases was to expose oneself to a loss, so this added up to real hardship.

What happened to all the good silver coins? Gresham's law happened: silver was overvalued relative to gold at the time of the Great Recoinage and remained so for a century afterward, despite Newton's decision to fix the value of the guinea at twenty-one shillings. Newton's effort to stem the outflow of silver appears halfhearted in retrospect, for although he lowered the mint ratio to just under 15¼ to 1, the new ratio was still well above the market ratio. So silver kept right on flowing east, where just thirteen pounds of it might buy a pound of gold.

"Let the Vulgar Wait"

On paper, as we've seen, the Royal Mint's copper coins were full-bodied coins, allowance being made for coining costs only; in reality, their nominal value was for most of the century roughly twice the market value of the copper they contained. They, too, were tokens, in other words - ones that also were all too easy to counterfeit.

While fraudulent coppers multiplied, authentic copper coins grew more and more scarce as the eighteenth century wore on, partly because many genuine copper coins, "underweight" as they were, were melted down to be turned into still lighter fakes, but also because the mint chose periodically to stop coining copper altogether, and did so even while industry pleaded for more. So there was never enough good regal copper coin around to make very small change with, let alone to fill the void left by the exportation of silver.

Some coinage historians blame the shortage of regal copper coin on officials' disdain for the metal, which mint officers condemned as "base in virtue and dishonorable" (Powell 1993, 50).

[...]

But the mint's disdain for copper, considerable though it may have been, was just one aspect of a more complicated picture. Although mint indentures didn't provide for any copper coinage until the nineteenth century, the coining of copper was frequently made possible from 1672 onward through royal warrants procured by the Treasury in response to the public clamor for small change. While the mint produced very little copper coin between 1700 and 1728, it issued substantial, if less than adequate, quantities of farthings and halfpennies between 1729 and 1753 and again in 1762-63 and 1770-75 (see fig. 1). [28]

[...]

The explanation for the pattern is twofold. First, the token nature of regal copper coins, (that is, the fact that they were valued at over twice their metallic worth), together with their indifferent - if not wretched - quality, caused them to be aggressively counterfeited. Legitimate copper coins were sometimes melted down and turned into a larger nominal stock of lightweight fakes. The mint thus found itself inadvertently boosting the output of spurious copper coins whenever it tried to add to the quantity (and improve the average quality) of genuine ones.

Second, both real and counterfeit regal coppers tended to make their way from publicans' tills to the strongboxes of London brewing companies, where they piled up. Banks wouldn't take them, and the mint never seriously entertained the idea of providing for their redemption.

[...]

In response to complaints from London brewers and merchants and also in order to stop the flow of raw material to counterfeiters, the mint ceased producing copper coins from 1701 to the accession of George I in 1714, from 1755 to 1762, from 1764 through 1769, and yet again after 1775. Each of these attempts to relieve London of its surplus copper coin was, however, met by another chorus of complaints, from different sources. For in the provinces, many tradespersons and, after 1775 especially, manufacturers and mining companies found themselves shorter than ever of decent coins for making change or for paying their workers.

Indeed, even when the mint was producing copper coin, the coin might never get to some places where it was most needed, for royal warrants made no provision for the distribution of copper coins, delivering them in five- and ten-shilling packets at the Tower only. That made Tower halfpence a bad deal for anyone outside London, since the mint "sold" its coins at their full face value. Many provincial manufacturers, especially those in the far north, found the burden of the delivery cost too great to bear and therefore had either to hope that new Tower issues would trickle up to them somehow or to turn to copper counterfeiters, who at least had the virtue of delivering their products for no more than a modest markup above cost.

Brummagem Ha'pence

Understandably, shortages of official small change boosted the production and circulation of all sorts of unofficial substitutes, including large quantities of counterfeit copper coin.

[...]

Some writers lay the blame for such obvious frauds on widespread illiteracy. But while illiteracy might conceivably account for someone being unable to tell the difference between "GEORGIUS III REX" and "GOD SAVE US ALL," it can't explain all the plain and decidedly underweight halfpence. A better explanation is that the lack of legitimate regal copper coins and (before 1787) the lack of any commercial substitutes forced people to accept obvious fakes rather than forgo payment entirely.

Publick Virtue?

"In point of fact," Feavearyear (1963, 169) observes, "so long as the Government was unable to find a method of providing the country with a sound and adequate coinage [counterfeiting] was a good thing," as the counterfeiter "tended to fill up the void" and "could do no harm to the standard."

There is much to be said for this view: after all, people needed small money, and the poor needed it most of all; and even shoddy money was better than nothing. Paradoxically, the very badness of the clumsiest counterfeits made them particularly benign, because such miserable coins could only gain acceptance where good coin was in short supply. "Bad" halfpennies can for this reason be said to have made the general public better off than it would have been otherwise.

[...]

"Good" (that is, convincing) counterfeits were another matter, for while they also appeared to alleviate shortages, their ability to fool even Royal Mint authorities meant that they could be placed into circulation even where legitimate coins weren't in short supply, potentially leading to a surplus. So long as official coins weren't redeemable, such a surplus could drive the entire stock of small change to a discount, seriously undermining the efficiency of exchange. If, however, official coins were made convertible into full-bodied ones on demand, the multiplication of good counterfeits would undermine their convertibility by exhausting the issuing authority's reserves of legal tender. Good counterfeits thus threw a wrench in what might otherwise have been a smoothly working small-change system. Rather than simply making up for shortages of official coin, they deserved at least part of the blame for those shortages, for as long as the Royal Mint had reason to fear that its tokens might be convincingly and profitably copied, it didn't dare offer to redeem them; and as long as the mint refused to redeem its tokens, it couldn't address local shortages without adding to surpluses elsewhere.

Commercial Coins

Deprived of small banknotes, ignored by the Royal Mint, sick of having to deal with bad shillings and doubtful halfpennies, and unable to make do with such except by aggravating, if not further injuring, their workers, manufacturers and other businessmen desperately sought some other source of relief. Finally, in 1787, one of them decided that if the mint wouldn't supply his firm with decent small change, he'd do it himself, by issuing private tokens bearing his firm's own markings. Others followed his example, and before long, Great Britain found itself equipped with a brand-new "commercial" small-change system.

[...]

That the law proscribing private tokens was still on the books made renewed resort to such tokens during the late eighteenth century risky. Despite this, the new tokens were issued on a far vaster scale than their seventeenth-century predecessors had been - a scale exceeding, in the space of a decade, the combined regal copper issues of the previous half century. The new tokens proved to be some of the best and most beautifully designed coins ever made anywhere. They were also the first token coins to be sufficiently counterfeit-proof to carry redemption pledges credible enough to make them current not only where they were issued but, in some cases, many miles away.

CHAPTER IV

The People's Money

Every Man His Own Mint Master

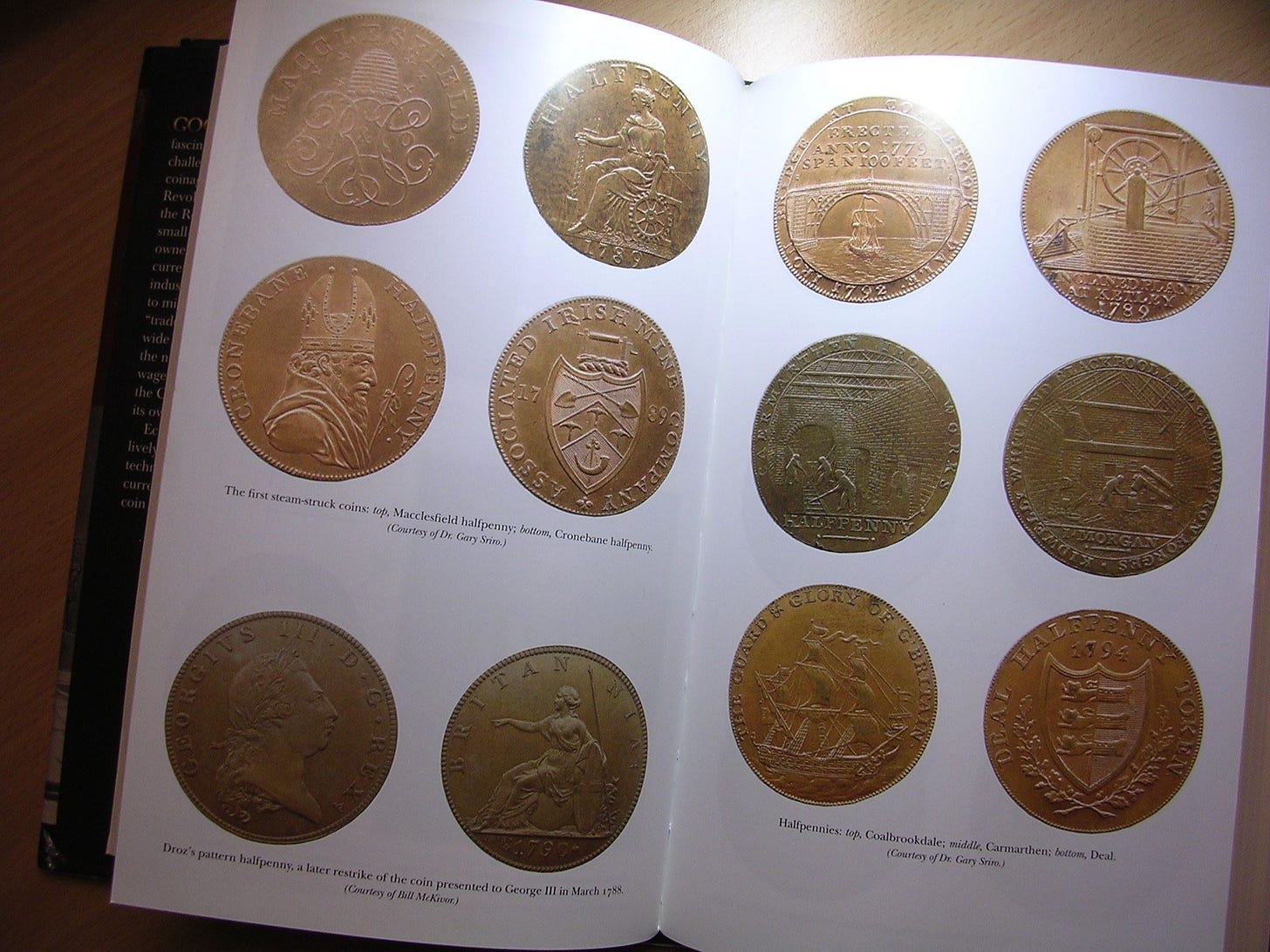

"All the copper coin in Wales," John Ferrar (1796) wrote while traveling there in August 1795," "is heavy and good." In Ireland, the "Cronebane" halfpennies of the Associated Irish & Hibernian Mine Company-Roe & Company's sister operation - together with "Camacs" issued by its bitter rival, the Hibernian Mining Company, almost entirely replaced regal coin and would continue doing so well into the nineteenth century (M. Smith 2002). [...]

The early "industrial" tokens were just the beginning, for their success brought forth a flood of new entrants into the business. The commissioning and issuing of commercial coins, which had been the preserve of a few industrial and mining firms, was taken up by all sorts of small businessmen - grocers, drapers, silversmiths, malsters, and pretty much anyone whose dealings generated a need for small coin. Well, not just anyone: even small-scale token issuers were almost always persons of good standing in their communities, whose token issues were generally modest in comparison with their capital and command of credit.

The expansion of new token issuers reached its peak in 1794, when sixty-four new tradesmen became coin issuers (Elks 2005, 23). Regal copper, in the meantime, was being resorted to less and less: in a reversal of Gresham's law, good money was driving out bad. "Provincial halfpence are," wrote Dundee coin collector James Wright Jr. in 1795, "the most common current coins of the present day," having "in some districts ... almost totally supplanted the very base and barbarous national copper currency" (Wright 1797, 1).

[...]

A given quantity of commercial tokens also went further than a like quantity of regal copper, because tokens, being redeemable, returned to their sources to be reissued again, whereas regal copper tended to make a one-way trip into retailers' tills or wholesalers' strongboxes, where it piled up uselessly. In economists' jargon, commercial coins had a higher "velocity of circulation" than regal ones.

From Buttons to Blunt

Button making was typically a cottage industry, with most masters taking on one or two journeymen only. A few large-scale firms did exist - the most famous, John Taylor's, was so large that its metal sweepings alone were worth one thousand pounds annually - but these were exceptional. Here, too, commercial coining resembled button making, with a relatively large number of small operations competing with several large ones. Because intense competition afforded no opportunities for complacency, technical innovations were pursued by both small and large button makers, who accounted for a substantial share of the many patents granted to Birmingham entrepreneurs: during the last decades of the eighteenth century, scarcely a year passed when a patent wasn't granted to at least one of them (Prosser 1881, 55). [12] Among other sorts of patents were ones related to improved screw presses and stamping equipment, six of which were issued between 1761 and 1800. [13] Of course, for every patented innovation, there were (then as now) numerous others for which no patents were sought (Berg 1994, 269). It seems safe to assume, therefore, that even small-scale button makers furnished themselves with efficient machines, many of which also came from Birmingham, including "fast thread" presses that could close dies with a quarter turn only (instead of two complete turns) and presses equipped with automatic blank feeders. [14]

Enduring Impressions

Many of Klingender's favorite tokens were designed by John Gregory Hancock. Like many other great Birmingham die sinkers, Hancock apprenticed at Soho, his father having bound him to Boulton in 1763, when he was just thirteen (MBP 236/102). He undertook his first token commissions, including the original Parys Mine Druids, as John Westwood Sr.'s business partner and front man. Hancock's Druids, displaying (in Klingender's words) a pleasing "combination of severely classical forms with Ossianic romanticism" (Klingender 1953, 43), got things off on a high note. But when Hancock turned to his next project - Wilkinson's Willeys - he traded classical symbolism for a blend of gritty realism and industrial publicity that would form the pattern for many tokens to come. Although most issuers didn't go so far as to put their own portraits on their coins, many followed Wilkinson's lead in depicting their factories and storefronts or "the latest achievements of industrial technique," through engravings "masterly in their clear and harmonious presentation" (ibid., 41-43). In some instances, the detail is stunning: factory interiors are depicted brick by brick; ships are rigged down to the last ratline; and engravings of machines seem fit for a patent specification.

Have a look, for example, at the Plymouth halfpennies of Shepheard Dove, Hammett & Company - a hemp and flax manufactory founded, according to Bell (1963, 30), "as a philanthropic venture to give employment to the poor, and to provide for the education and clothing of indigent children." The coins, which were struck by Lutwyche, celebrate Plymouth's sailcloth industry: a woman spins yarn on their reverse, while a man weaves the yarn into canvas on their obverse.

[...]

Designs like those engraved by Hancock and the Wyons had the unintended effect of turning commercial coins into valuable historical documents. "Issued by the people, they tell of the people, and become imperishable records of that most important estate of the realm.... They indicate to us their occupations and their skills, their customs and modes of life," says Llewellyn Jewitt [...]

To suggest that all or most tokens depicted scenes of industry or commerce would, however, be quite misleading, for in truth their designs run a cultural gamut.

The devices shewn upon them were legion. . . . Effigies of kings, queens, bishops, peers, statesmen, warriors, men of mark in science, art and literature, ... commemorations of national or local events; presentments of natural objects ... and of man's ingenuity in cathedral, college, fort, harbour, ship, mine, factory and canal; graven structures of antiquity ... ; pieces of theological, political, or social satire; quaint advertisements of exhibitions, businesses, or wares; men depicted at work at various trades, or angling, shooting, orating and boxing; birds, beasts, fishes, insects, plants and flowers; arms, crests, flags and emblems; musical instruments and musical notation. (W. DAVIS 1904, XIV)

[...]

Why did the private sector turn out such nice coins? It did so, first of all, because nice coins were good publicity. At a time when there was no national press and when advertisements still consisted of mere notices, tokens "were one of the few media where persuasive - even aggressive - advertising could flourish" (Mathias 1962, 36). Although every token was good for some sort of publicity, the treatment of tokens as advertising platforms is most obvious in some tokens issued by retailers. [...]

But private coin issuers had a second, still more practical reason for commissioning coins of the highest possible quality. Such coins were harder to counterfeit, or to counterfeit convincingly. Their issuers were therefore better able to spot fakes and thus avoid redeeming them.

Token Mania

What the collectors did not anticipate (and would certainly not have welcomed) was the profound influence their innocent pastime would have on the future course of commercial coining. "Token mania" was to give rise to a plethora of new tokens, most of which were never meant to serve as money. Once they realized that tokens were being acquired to be put in curio cabinets, coin makers and issuers went to more pains than ever to endow them with attractive or otherwise desirable engravings. But that was the least of it, for once they realized that collectors couldn't resist a rare token, the private mints started making runs of tokens aimed exclusively at them. Before long, the market was being flooded with "instant rarities" (the phrase is Richard Doty's), including deliberate mutations of genuine trade tokens. Some of these bore altered legends or edge markings and issuer's names that were either misspelled, entirely fictitious, or randomly "plucked from some [trade] directory" (Elks 2005, 29).

Confusion Worse Confounded?

According to Elks (2005, 38), whose conclusions are based on a painstaking study of nearly eight thousand extant tokens, token counterfeits are almost always a quarter to a third lighter than the genuine tokens they imitate. Such "scandalously light" tokens were, according to a contemporary observer, "easily distinguished from the genuine ones" (GM, january 1795, 34): because counterfeits were cut to the same diameter as genuine tokens, spotting them was just a matter of observing their thinness.

Also, the quantity of counterfeit tokens was, to quote our contemporary source again, "trifling in comparison with the Birmingham halfpence [i.e., fake Tower halfpence] formerly in circulation" (ibid., 33-34). Most tokens were never counterfeited at all. The exceptions were almost all tokens issued on a large scale, including all the industrial issues of the first "act" of the commercial coinage episode (Elks 2005, 165-67). According to David Dykes (2004, 168), the "very ubiquity" of these tokens "attracted the attention of the counterfeiting fraternity on a considerable scale." Because they involved numerous authentic die variants, large-scale issues made it harder to keep track of frauds by comparing coins.

Yet even the most prominent of all private tokens were never counterfeited on a scale approaching that which undermined the regal copper coinage. Thus, among a thousand-odd tokens supposedly issued by the Parys Mine Company, Elks discovered only forty-two counterfeits - or just four times the rate of counterfeits among British one-pound coins today. [25] The low figure is no doubt due in part to collectors' diligence, but that diligence reflects the relative ease with which Druid fakes could be identified. The far greater incidence of counterfeit regal copper coin reflects, first, the fact that regal coins were made on a still larger scale than Druids and, second, the fact that the Royal Mint's relative lack of die-making expertise gave rise to especially large numbers of legitimate regal coin variants. Moreover, as we've seen, the deteriorated state of most outstanding regal coins made copying them convincingly mere child's play.

The prevalence of "industrial token" counterfeits may also have reflected a decline in the production of counterfeits over time. That decline occurred in part because the multiplication of legitimate small-scale token issues eroded the scope for counterfeiting, both by reducing the market for fake tokens and by reducing the share of tokens that lent themselves to faking. As David Dykes (2004, 172) explains, small-scale issues enjoyed a local circulation only, which depended on their being routinely redeemed. For the most part, they moved quickly from their source to local inns and alehouses and then back again, allowing frauds to be discovered in short order. Counterfeiters therefore left them alone, and it was precisely for that reason that local issues came to be preferred to nonlocal ones, even when the latter were (purportedly) from firms of great standing.

"When the principal tradesman of Norwich and later Ipswich decided ... to take only those tokens issued by fellow townsman," Dykes writes, "they were adopting a measure of self protection against anything that was not a known quantity in their own vicinity" (ibid.). The same tendency was, by the way, observed with respect to banknotes, with the public preferring provincial notes to those issued by the Bank of England - in part, perhaps, because of local loyalties, but also because provincial notes were less susceptible to forgery.

In some respects the small size of country bankers' issues enabled them to indulge in producing high quality notes by methods which could not be used to produce notes in quantities needed by the Bank [of England]. Also their notes often circulated in localized areas and so would be identified as forgeries sooner. (HEWITT AND KEYWORTH 1987, 46)

As local token issues became more prevalent, token counterfeiting became less worthwhile. Indeed, it became more or less pointless, because anyone set on issuing light and irredeemable tokens found it easier to do so in an aboveboard way, by issuing anonymous tokens for general circulation. The emergence of a collectors' market, in the meantime, offered a far more lucrative outlet for the efforts of determined false coiners: the making of mules and other "instant rarities."

It may be thought that this last change made little difference, for a collectable fake is still a fake, whether or not one chooses to label it a "counterfeit." But from an economic perspective, fakes aimed at collectors were quite unlike ordinary counterfeits, for they went straight from manufacturers to crooked coin dealers, chiefly in London, who retailed them at prices "well above their face value" (Dykes 1997, 117; Bell 1963, 9). Because specious tokens aimed at collectors never circulated, any confusion or loss suffered on account of them was borne not by the general public but by collectors, especially by gullible collectors. It isn't the case, therefore, as Peter Mathias (1979, 203) claims, that specious tokens aimed at collectors "increased the difficulties of using tokens as money." Laborers, in particular, had no reason to fear them. On the contrary, they would have been lucky to find a mule or two in their pay packets.

Token experts have, unfortunately, adopted the practice of calling specious tokens of all kinds "counterfeits," and so have mislead others into thinking that the public at large was imposed on by the proliferation of "counterfeit" tokens after 1794. A closer look reveals that this proliferation was almost entirely aimed at collectors. Thus, when, in a 1796 letter to The Gentleman's Magazine, Charles Pye laments the fact that tokens are being "counterfeited for the worst of purposes, to impose upon the publick," the "counterfeits" he has in mind are actually mules ("the obverses and reverses mixed on purpose to make variety, and the inscription on the edges varied for the same purpose"), and "the publick" refers not to ordinary persons but to Pye's fellow token collectors.

The manufacturing of this rubbish, or, as it may properly be called, wasting of copper, has been systematically brought forward; and collectors have purchased without considering that they were manufactured for no other purpose than to impose on them. (GM, DECEMBER 1796, 991-92)

That anyone at all should have been bamboozled by fake tokens is a pity. But to the extent that false coining hurt collectors only, it called not for a coinage reform but for more caution on collectors' part. Caveat emptor.

In short, counterfeiters played considerably less havoc with the commercial coin regime than they played with the regal coinage. That fact is remarkable enough. But it becomes still more remarkable when one considers that the counterfeiting of commercial coins, far from being a hanging matter, was legal - or practically so, for no statute prohibited it. It was perhaps an instance of fraud, or "passing off," under common law, but if so, public authorities never troubled themselves to apprehend persons guilty of it. That genuine tokens were themselves of doubtful legal standing - the seventeenth-century ban was still on the books - didn't help either. Had the state bothered to track down and punish makers of false tokens as aggressively as it did makers of false regal coin, the token regime would presumably have proven still more counterfeit-resistant.

Next let's take up the alleged decline in the overall quality of genuine tokens over time. Sharp, for instance, writes (1834, i-ii) that early tokens, including the Parys Mine Druids, contained "nearly their nominal value in copper" but that this ceased to be true when coining was taken up by less scrupulous "publishers" who sought to enhance their profits by skimping on copper. More recently, Mathias (1979, 202) has spoken of "a deterioration in [commercial coin] standards as widespread in its own way as the original failings of the regal copper coinage." Elks (2005, 37), finally, holds that standards started slipping in 1792, with new issuers turning out "very light tokens ... as a means of making a little extra profit." He adds, significantly, "There is no reason to believe that there was any rise in the price of copper at this time."

Besides begging the question of why early token "publishers" failed to exploit profit opportunities later ones couldn't resist, such claims are factually incorrect. The earliest tokens, Parys Mine Druids included, weren't worth anything close to "their nominal value in copper," which was just as well, since they would otherwise have been melted in short order. Though later tokens were indeed lighter, their "intrinsic value" was generally about the same as that of the Druids and was higher than that of Tower halfpence, for the price of copper did rise during the 1790s. As table 3 shows, that rise tended to offset the decline in tokens' average weight, leaving their intrinsic value unchanged.

[...]

One must recognize, first of all, that only several hundred of the six thousand-odd token types experts have identified are versions of genuine commercial coins, as opposed to anonymous tokens, political and private coins, and tokens made to fool collectors. [26] That's still a large number, to be sure. But just how much chaos did it cause? Considered from the public's perspective, the presence of a variety of authentic token designs was not necessarily a bad thing: as we've seen, it actually served to make counterfeiting more difficult, by limiting (and in many instances avoiding altogether) die variations for any particular coin type.

What if ... ?

The survival of some strictly "local" coins might eventually have given rise to specialist coin changers or brokers, analogous to the banknote brokers who plied their trade in the antebellum United States, where legal restrictions also limited the growth of branch banking. The note brokers, who had their headquarters in various large cities, offered to purchase notes at discounts that reflected any perceived risk in addition to the actual cost of returning notes to their source for redemption. They also made their price lists available, along with "counterfeit detectors" aimed at alerting merchants to fraudulent notes. Token brokers might have offered similar services to British retailers, thereby making it easier for them to accept tokens from faraway districts.

CHAPTER VII

Prerogative Regained

Half a Loaf

The most frequently heard complaint against commercial tokens was that they were "lightweight," "debased," or lacking in "intrinsic value." ... That silver tokens, considered as mere bits of metal, were worth less than their declared values was true enough. But while tokens for general circulation, including most of Morgan's products, contained relatively little metal, most genuine commercial tokens were relatively heavy: the difference between their face value and their "intrinsic value" was usually between one and three pennies in a shilling, depending on the market price of silver. [2] Part of this difference - perhaps one penny's worth - covered issuers' minting, carriage, and insurance costs. Because the tokens could be redeemed at any moment and were bound to be returned when more official silver coins became available, their issuers could hardly expect to profit from them. On the contrary, if the price of silver fell, token issuers would end up taking a licking.

[...]

A final criticism of commercial tokens was related to the claim that they were underweight. However, it had to do not with the quantity of metal in them but with the source of that metal: local tokens were said to have been made from melted Bank of England tokens. The allegation implied that instead of helping to address the shortage of decent coin, local token issuers aggravated the shortage by treating Bank dollars and tokens as raw material for their own metallic IOUs.

Such were the charges against "local" tokens. Were the charges valid, and, if they were, did they justify outlawing commercial coins? Concerning the coins' "local" character, at least some managed to secure wide, if not nationwide, acceptance. "We know for a fact," writes numismatist D. R. D. Edmunds (1966, 181), "that [some] local tokens did circulate quite acceptably outside their town of origin." In a follow-up to his letter of December 4, 1811, to Boulton, Zach Walker himself reported finding, on the basis of coin samples collected by London's principal coach companies, that tokens' circulation was "not confined to the mere neighborhood of the Manufacturers" (quoted in Withers and Withers 1999, 21). [3] Token issuers in different towns sometimes agreed to receive each other's tokens, just as banks might agree to receive each other's notes (Mays 1991, 79). Tokens issued by manufacturing firms with establishments in various districts tended to circulate in all of those districts. For example, tokens issued by Birmingham's copper companies circulated not only around Birmingham but also in far-off Swansea, where the companies had their smelting works (Dykes 1954, 349). Such exceptions made it inaccurate to stigmatize all commercial money as "local."

More fundamentally, while coins that circulated nationally were, other things equal, better than local ones, this hardly justified suppressing local issues while national coins were scarce. Local coins were, presumably, better than no coins at all. The same might be said for anonymous tokens, although they might have been scarce themselves had legitimate tokens not been threatened.

As for tokens' lack of "intrinsic value," there was, first of all, no flood of counterfeit Bath tokens, as Francis Ellis had predicted. Nor did Whitchurch and Dore fail to honor their redemption pledges. Other silver token issuers also kept their promises, despite being forced by the government to retire their tokens en masse. Moreover, the gap between tokens' nominal value and their intrinsic worth, far from being an unpardonable defect, was the only thing that kept them from succumbing to Gresham's law.

[...]

As for the claim that local token makers had been melting down bank silver, although William Chaloner (1946, 24) refers to "a considerable body of evidence" supporting it, one searches for that "body" in vain. As we shall see, the British government itself eventually denied that substantial quantities of Bank tokens had been melted by local token makers or otherwise.

Wolf!

No local token issuer could, for example, simply cry up the nominal value of outstanding coins to keep them from being melted or otherwise withdrawn from circulation, as the government had felt compelled to do in attempting to keep Bank tokens from disappearing. But local token issuers did something much better: they promised a fixed value for their tokens relative to the nation's standard money, which they guaranteed by pledging to redeem their tokens on demand. If the government had evidence of such pledges being broken, it kept such evidence to itself. If the government thought that subsidiary coins ought to bear a value rigidly tied to the value of the metal they happened to be made of, rather than to that of the nation's standard money, then it knew less than local token issuers did about the requirements for a practical small-change system.

Having skated onto thin ice, Vansittart proceeded to plunge through it. In addition to suggesting that the government could keep new Bank tokens from being melted by routinely adjusting their face values, he denied that substantial quantities of Bank tokens had been melted down in the past. They had, he said, merely gone into hoards, from which they would emerge "when the new issue of Bank tokens takes place, and the competition of Local Tokens is withdrawn" (ibid.). Thus, in making its case for a new issue of Bank tokens, the government tacitly absolved local tokens of the very "evil" that, according to Liverpool, was supposed to warrant their suppression.

CHAPTER VIII

Steam, Hot Air, and Small Change

Counterfeit-Proof Coin

One aspect of Royal Mint procedures made life easier for the average eighteenth-century counterfeiter no matter whose coins he chose to imitate. This was the mint's system - or, rather, its lack of any system - for getting coins to places where they were needed (Mathias 1979, 192-95; Craig 1953, 252). As we've seen, the mint, despite selling its copper coins at face value, made them available only at the Tower, instead of offering to bear the costs of shipping them to distant towns and factories. Because regal coins were inconvertible, once they were spent by their initial recipients, they made their way to retailers and publicans, who, being legally obliged to receive them in small payments, had helplessly to watch them accumulate, unless some manufacturer offered to purchase them.

CHAPTER IX

Conclusion

The commercial coinage story shows, most patently, that private coinage need not be a recipe for disaster. Despite what William Stanley Jevons claimed, the effects of competition in coining weren't all that different from its effects in other realms. Makers of inferior coin didn't "drive the best trade" (recall, for instance, how Williams's heavy pennies were eagerly accepted, while Wilkinson's light versions were refused). Nor did competition unleash a "natural tendency to the depreciation of the metallic currency" (Jevons 1882, 82). On the contrary, most commercial copper coins were heavier than their government-supplied counterparts; and although they tended to get lighter over time, the lightening only served to compensate for a rising price of copper and so allowed the private coins to steer clear of the fate that awaits any legally undervalued money. In short, Gresham's law, understood simply as the proposition that "bad money drives out good," was far less in evidence under the commercial coinage regimes of 1787-99 and 1811-17 than it had been under the older regime of state monopoly.

Commercial coins proved to be relatively "good" money for several basic reasons. Unlike regal coins, they could be refused, even in small quantities, by retailers and publicans who disliked or distrusted them. Consequently, their issuers, unlike the British Crown, could only hope to keep them current by promising to redeem them in gold or Bank of England notes. Token issuers therefore saw to it that their tokens were hard to imitate. Commercial mints, in turn, had to vie for the services of the world's best metal engravers or risk seeing prospective clients go elsewhere. Such concerns were utterly foreign to the denizens of that cluttered cloister that was the old Tower Mint.

Selwin would have loved reading about the Medieval bills of exchange

it was a grassroots paper money made solely of IOUs