Like Ronald Reagan, Margaret Thatcher is usually and wrongly cited as a further evidence of market failure. Among the many problems denoted, the Poll Tax and the unemployment rate. The Poll Tax, as Rothbard explains, was not accompanied by a lowering of taxes. And, the high unemployment rate is, obviously, not the result of free market economics but instead arises as a result of the fight against the double-digit inflation.

Murray Rothbard, Making Economic Sense, 2nd Ed., chapter 62, pages 227-230 (1995 [2006]).

Mrs. Thatcher's Poll Tax

The concept of an equal tax per head is called the “poll tax,” and Mrs. Thatcher decided to bring the local councils to heel by legislating the abolition of the local rates, and their replacement by an equal poll tax per adult, calling it by the euphemism, “community charge.” At least on the local level, then, soaking the rich has been replaced by an equal tax.

But there are several deep flaws in the new tax. In the first place, it is still not neutral to the market, since — a crucial difference — market prices are paid voluntarily by the consumer purchasing the good or service, whereas the tax (or “charge”) is levied coercively on each person, even if the value of the “service” of government to that person is far less than the charge, or is even negative.

Not only that: but a poll tax is a charge levied on a person’s very existence, and the person must often be hunted down at great expense to be forced to pay the tax. Charging a man for his very existence seems to imply that the government owns all of its subjects, body and soul.

The second deep flaw is bound up with the problem of coercion. It is certainly heroic of Mrs. Thatcher to want to scrap the property tax in behalf of an equal tax. But she seems to have missed the major point of the equal tax, one that gives it its unique charm. For the truly great thing about an equal tax is that in order to make it payable, it has to be drastically reduced from the levels before the equality is imposed.

Assume, for example, that our present federal tax was suddenly shifted to become an equal tax for each person. This would mean that the average person, and particularly the low-income person, would suddenly find himself paying enormously more per year in taxes — about $5,000. So that the great charm of equal taxation is that it would necessarily force the government to lower drastically its levels of taxing and spending. Thus, if the U.S. government instituted, say, a universal and equal tax of $10 per year, confining it to the magnificent sum of $2 billion annually, we would all live quite well with the new tax, and no egalitarian would bother about protesting its failure to soak the rich.

But instead of drastically lowering the amount of local taxation, Mrs. Thatcher imposed no such limits, and left the total expenditure and tax levels, as before, to the local councils. These local councils, Conservative as well as Labour, proceeded to raise their tax levels substantially, so that the average British citizen is being forced to pay approximately one-third more in local taxes. No wonder there are riots in the streets! The only puzzle is that the riots aren’t more severe.

In short, the great thing about equal taxation is using it as a club to force an enormous lowering of taxes. To increase tax levels after they become equal is absurd: an open invitation for tax evasion and revolution. In Scotland, where the equal tax had already gone into effect, there are no penalties for non-payment and an estimated one-third of citizens have refused to pay. In England, where payment is enforced, the situation is rougher. In either case, it is no wonder that popularity of the Thatcher regime has fallen to an all-time low. The Thatcher people are now talking about placing caps on local tax rates, but capping is scarcely enough: drastic reductions are a political and economic necessity, if the poll tax is to be retained.

Bruce Bartlett, The Legend of Margaret Thatcher, Economix Blog (2011).

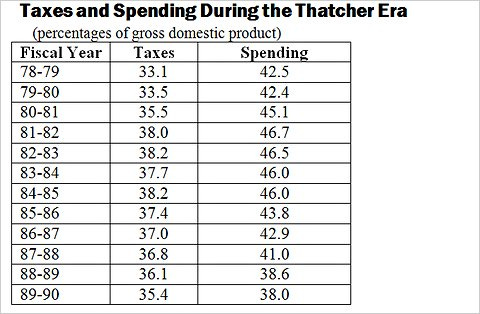

As this table shows, taxes as a share of the gross domestic product in Britain actually increased sharply during Mrs. Thatcher’s first seven years in office before falling in the later years. Even at the end, they were significantly higher than they were when she took office. Spending also rose during her first seven years before falling in Mrs. Thatcher’s later years.

To those familiar with Mrs. Thatcher’s tax policies, these data are not surprising. Although she cut the top personal income tax rate to 60 percent from 83 percent immediately upon taking office, the basic tax rate was only reduced to 30 percent from 33 percent. And in 1980, the 25 percent lower rate of taxation was eliminated so that 30 percent became the lowest tax rate.

More importantly, Mrs. Thatcher paid for her 1979 tax cut by nearly doubling the value-added tax to 15 percent, from 8 percent. Among those who thought Mrs. Thatcher was making a dreadful mistake was the American economist Arthur Laffer. Writing in The Wall Street Journal on Aug. 20, 1979, he excoriated her for taking with the one hand while giving with the other.

“The Thatcher budget lowers tax rates where they have little economic consequence and raises tax rates where they affect economic activity directly,” he complained.

In the 1982 forward to the British edition of his American best-seller, “Wealth and Poverty,” George Gilder was also highly critical of Mrs. Thatcher for failing to cut either taxes or spending: “The net effect of the Thatcher program has been a substantial increase in taxation on virtually all taxpayers.”

Although Mrs. Thatcher privatized many British industries and businesses that had been nationalized after World War II and sold off much of Britain’s public housing, in which the bulk of the working class lived, she did little to reduce the size of the nation’s welfare state.

In particular, Mrs. Thatcher, like all the members of her party, strongly supported the National Health Service, which provides national health insurance for every Briton.

... As Martin Wolf, a columnist for The Financial Times, told me, “Like all great politicians, Thatcher was a pragmatist, not an ideologue, who picked her fights carefully. She recognized that any head-on attack on the welfare state would have destroyed the party’s electability.”

... The lesson they should learn from her is that it is very hard to shrink the size of government even when a strong leader has complete control of the legislature, that it takes many years of arduous work to do so and that at the end of the day it won’t shrink very much.

Thatcher, advocating monetarist (not austrian) economics, was concerned about the high inflation rate at the time when she came to power. But the deflationary monetary policy aimed to reduce the inflation rate, ~18% in 1980 (source) with interest rates as high as 17% in 1980 (source), had its adverse effects and, as a matter of fact, the unemployment rate jumped from ~6% in 1980 to ~12% in 1985 (source). Whether or not Thatcher has chosen the right policy does not elude the very problem comes from the high inflation rate that already prevailed before the Thatcher administration.

There is otherwise some evidence that economic freedom positively affects economic performance, cognitive competences and education, even though intelligence is more important. See Heiner Rindermann (2008b, p. 316, section 5.4, and figure 7; 2011, figures 4 & 6; 2012, p. 110, and figures 1, 2 & 3).

Further reading : Ronald Reagan : Where is Free Market Economics ?