The Enron Scandal 2001, is generally but wrongly attributed to market failures. Specifically, audit failure and poor ratings from Credit Rating Agencies (CRAs) did not reveal Enron’s false accounting.

As explained elsewhere, the conflict of interest among CRAs who purposely overrate the firms is due to regulation from the SEC. The common view seems to be that competition itself is the culprit. When CRAs must compete against each other, the firms will choose the CRA who offers the best evaluation. If they seek profit and do not want to lose clients, they will give the best ratings, regardless of the risk of the firms. In reality, those CRAs do not care about loss of reputation thanks to their status of NRSRO, approved by the SEC. This gives the (false) impression to investors that the opinion of CRAs is very reliable. Since the SEC bears the role of the regulator, investors may believe the market is under control, and thus become less vigilant. Since the SEC has created an inflated demand for ratings, it is not surprising that investors don’t want ratings from non-NRSRO institutions. Lowenstein (2008) describes these problems. CRAs should merely sell opinions. But since the SEC has given so much importance to the CRAs, these agencies realize they have a captive market, and reputation is not something they fear to lose.

Jeffrey Alan Miron (2006) argues that the regulation from the SEC even creates moral hazard. Under SEC regulation, the CRAs would comply with whatever the SEC requires them to disclose, but this means the CRAs do not comply with the desire of the investors.

Prime among these is repeal of the corporate income tax. One way for investors to punish corporate misconduct is by bidding down the company’s stock price. Investors cannot easily do this, however, without accurate information on corporate accounts. The corporate income tax complicates these accounts enormously by encouraging projects that make no sense other than tax avoidance. Such projects would disappear with repeal of the corporate income tax, and transparency would mushroom. Relatedly, regulation hinders transparency by breeding non-productive behavior designed to avoid this regulation. It is no accident that Enron’s main activities were electricity, natural gas, and communications, all highly regulated sectors.

A key problem with SEC regulation is that it gives corporations an excuse for disclosing too little. When a regulator tells corporations they must disclose X, Y and Z, many disclose exactly that and no more. And, having complied with this regulation, they say to shareholders, “We’ve done what we’re supposed to do.” Without SEC regulation, investors would demand whatever information from corporations they desired, or shift their money elsewhere.

Still a further cost of the criminal / regulatory approach is giving individual investors a false sense of security. Under current policy, investors can delude themselves that buying and selling individual stocks, or holding a non-diversified portfolio, is reasonable, since it seems the federal government has “taken care of” corporate fraud. In fact, no individual company is ever safe, and diversification is a key form of protection. Under the contracting approach, investors would be on notice. They would demand clear indications of honest accounting and reward firms that provided it, rather than making a blanket assumption of no misconduct.

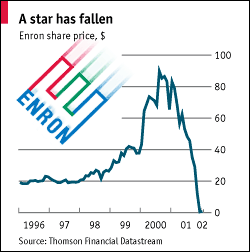

Donald J. Boudreaux (2009) believes that insider trading, if not outlawed, would have prevented the Enron Scandal. The insiders, knowing what happens within the firm, can trade based on inside information, and the true value of the firm will be reflected in the stock market much earlier.

Each corporation should be free to specify in its by-laws the types of information that insiders may not trade on. Any insiders who trade on such information would violate that firm’s by-laws and, hence, subject themselves to suit by that firm. Corporations whose by-laws prohibit all or some insider trading will have standing to sue anyone who violates their by-laws. People who trade on inside information not protected by corporate by-laws would be acting perfectly legally.

Won’t corporations simply make all of their inside information off-limits to inside trading?

No. The reason is that corporations must compete for that most demanding and vigilant of all clients: capital. Shares in a corporation whose by-laws prevent insiders from trading on, say, knowledge of executive malfeasance will be a riskier—and a less attractive—investment than shares in a corporation that doesn’t proscribe such insider trading. Corporations that allow trading on inside knowledge will enjoy a lower cost of capital than will corporations that prevent such trading.

Padilla’s (2005) article is very useful to better understand the consequences of this kind of regulation. He characterizes it as self-defeating. The regulator doesn’t know whether the insiders communicate the information to a third party. The only way to prevent them from communicating to others is to prohibit access to the relevant information. But that means the person in question cannot perform his task, his fiduciary duty. The problem worsens when several persons have access to the inside information, which would happen on a daily basis in the course of their duties. Some individuals are not even employed, as they work on a temporary basis for the corporation and yet have access to that information. It’s impossible to detect who was the first carrier of the information. To make things worse, the more complex the network through which the information flows, and the more distorted the information is going to be, because individuals may have different interpretations and different ways of communicating the information.

How should the regular proceed to detect insider trading, then ? Padilla cites Spiegel & Subrahmanyam (1995) on this matter :

First, the RA [regulatory authority] establishes a rule, which stipulates that if a certain random variable (e.g., the price move during a trading day) exceeds a certain exogenous threshold, and the trader in question has traded during the day, he will be prosecuted for illegal insider trading. Second, investors obtain information and trade. Third, the RA observes the size of each investor’s trade and the transaction price. The RA also observes any subsequent price changes. … Based upon these observations, and the rule established in the first stage, the RA determines whether or not to prosecute particular individuals (Spiegel and Subrahmanyam 1995, pp. 9-10).

A sign of any abnormal trading volume of a trader and transaction that is suspect in its timing considering the disclosure of a material information, or if the transaction took place prior to a significant subsequent price movement, will be considered by the regulator that the transaction has been realized on the basis of inside information. At the same time, those having more accurate information are more likely to predict when the regulator is going to suspect insider trading.

Spiegel and Subrahmanyam (1995, p. 27) argue that “insiders with the most accurate information will be the most difficult to prosecute by the use of circumstantial evidence. This is because these agents are the ones best able to adapt their strategy in financial markets to avoid being investigated by the regulatory authorities in the first place.” In other words, since the regulator’s criterion to trigger an investigation is when the price move during a trading day exceeds a certain threshold, insiders with inside information being the most able to make more accurate predictions regarding the future stock prices are also going to be the most able to predict when the regulator is going to suspect that non-public information has been circulated and insider trading has been taken place. Insiders with more accurate (inside) information are, consequently, going to rationally modify their trading strategy in order to avoid the stock prices reaching the threshold above which the regulator will start investigating insiders’ transactions. Therefore, the argument goes, it is the individuals with poor (less accurate) information, the ones who are less able to predict the magnitude of the stock price changes resulting from their transactions, who are going to most likely trigger the investigations and are going to be prosecuted on the basis of circumstantial evidence. In other words, when the regulation of insider trading relies on statistical evidence to detect and prosecute insider trading, as it is mostly the case today; the population of individuals who are going to be prosecuted will consist essentially of people who have traded on the basis of immaterial information; that is to say, of innocent people.

It should be noted that insider trading can also be passive, i.e., insider trading without any securities transaction. This will happen when an individual in possession of inside information decides to cancel a securities transaction, not to buy or sell stocks. The regulator, of course, cannot detect this form of insider trading.

Another problem emerges when the insider makes a decision based on inside information that is not followed by the public. Since the outcome ultimately depends on the other market participants, if they react (and interpret) in different ways as the insider did, then he will not make profit or may effectively lose its money.

All this is consistent, Padilla says, with the (few) studies showing absence of a negative effect of regulation on the profitability of insider trading. One study (Seyhun, 1992) even finds evidence of greater profitability during the period with higher sanctions. Another study by Bettis, Ducan & Harmon (1998) shows that “despite insider-trading regulations, insiders continue to extract significant gains from nonpublic information. Insiders not only continue to purchase shares before “good news” and sell shares before “bad news” but, actually, their trading volume has increased over time. The magnitude of abnormal returns realized or losses avoided also show that insiders trade on the basis of inside information”. And as demonstrated by Seyhun & Bradly (1997), insiders avoid trading around events being the object of great scrutiny by the regulator.

Padilla cites studies (e.g., Bhattacharya and Daouk, 2002) that show enforced insider trading laws correlate with greater level of liquidity and lower costs of equity. He argues that “by increasing the market liquidity, the regulation has given the ability to strategic insiders to better hide their informed trades. With more liquid markets, insiders’ trades become noisier and do not show up as fast as in illiquid markets where volumes are small and unusual trades show up very fast (Bris 2000, p. 9)”. The regulation creates the illusion there is no insider trading, and as a result, investors are going to participate more. Padilla believes that the “regulatory authority will not be able to distinguish informed trades among the large volume of transactions realized on the markets neither will they be able to observe abnormal volume or price changes”.

Due to having larger blocks of stocks, large shareholders are more likely to sit on the board of directors, supervising the management of the firm. For this reason, having access to inside information allows them to evaluate accurately the performance of the managers. Active shareholding thus reduces agency costs. Their active role becomes even more important in case of high firm-specific risk, where there are frequent changes in relative prices, technology, and market shares, because it results in higher difficulty to disentangle endogenous effects (managerial decisions) from exogenous effects (unpredictable random factors).

As discussed above, short selling is an important check against bad management, and this is even more true for large shareholders. When things are out of control, short selling could be the only way for them to minimize their losses.

He argues there is also empirical evidence (Beny, 1999) that insider trading laws discourage large shareholders and ownership concentration among large shareholders.

For instance, in pursuance of (under) Section 16 of the Securities Exchange Act of 1934, owners of more than 10% of equity are considered as insiders along with every officer and director of the corporation. Accordingly, Section 16(a) requires them to report all their trades in equity securities on a monthly basis. Moreover, in Section 16(b), also entitled insider’s short-swing profit rule, these insiders are prohibited from trading when the purpose is to realize short-term profits; that is to say, profits resulting from the purchase and sale of securities in a six-month period, except in very limited circumstances. 14 Finally, Section 16(c) prohibits short sales of stock. As a result, this insider status and the restrictions that accompany it automatically burden the large shareholders with additional costs such as having to report their transactions, having to justify their actions, and facing potential legal costs.

14 An important note regarding Section 16(b) is that it presumes that any succession of two transactions in the opposite direction (purchase/sale or sale/purchase) realized in a period less than six months, is necessarily and indisputably based on the use of inside information. As a consequence of this automatic causality established between transactions in the opposite direction and use of inside information, Section 16(b) does not require that a proof is established that there was use of inside information.

These laws discourage large shareholding, which has the advantage to undertake proxy fight, e.g., votes regarding installation of new management, etc.

Against the negative view of regulation, Maug (1999) advances the idea that insider trading for large shareholders will remove their incentive to monitor underperforming companies. The reason is that when insider trading is not regulated, the managers will have incentives to communicate in advance inside information about negative developments to the large shareholders. As a result, they will sell their stocks at higher market prices instead of intervening in the company, and their interest will thus not be aligned with the interest of minority shareholders. But Padilla argues that Maug is right if everything else is held constant, but since we do not live in this world, the idea is fragile to violation of that assumption. To illustrate, large shareholders face substantial capital gains taxes upon sale. So, the advantage of selling is less obvious. Furthermore, large shareholders may engage in monitoring because they prefer dividends while small shareholders favor capital gains because of tax considerations. Maug also argues that if the firm is compelled to disclose all material information to the market in a timely manner, outside monitors would be able to make optimal decisions in order to maximize the value of the firm. But some material information needs to be kept confidential, due to the presence of competitors on the market.

Laws disfavoring takeover measures also protect bad management insofar as they do not require shareholders approval (Padilla, 2002, pp. 24-29). In general, regulations resulted in a shift of power from shareholders to managers.

Carden & Murphy (2008) advance the argument that the prohibition of short selling protects poorly managed firms. Investors would have, otherwise, hedge themselves against probable bankruptcies. By the same token, a firm which is not getting attacked by waves of short sellers will be considered as a robust institution. Regulation, thus, removes crucial information and makes the financial market more vulnerable to cases like Enron.

Boudreaux Donald J. (2009). Learning to Love Insider Trading.

Carden Art, & Murphy Robert P. (2008). The SEC Short Sells Us Down the River.

Lowenstein Roger (2008). Triple-A Failure.

Miron Jeffrey Alan (2006). How to Avoid More Enrons: Legalize Fraud.

Padilla Alexandre (2002). Can Agency Theory Justify the Regulation of Insider Trading?.

Padilla Alexandre (2005). The Regulation of Insider Trading as an Agency Problem.