In Pop Internationalism, Krugman defends international trade. Several ideas are put forward. The shrinking in manufacturing sectors (and its related jobs) has domestic causes, in particular the growing share of the sectors of services in the GDP. International trade with low-wage countries has nothing to do with this. The United States buys most of its imports from other advanced countries, whose workers have similar skills and wages. Imports are not so much greater than exports in the United States. While foreign competition can reduce domestic income through the terms of trade effect, it had negligible effect on the United States notably because importation represents a small share of the U.S. GDP. A country tends to export more when its relative advantage is greater than the other countries. Comparative (rather than absolute) advantage is really what matters; that is, a country with lower productivity than another country in all of his industries will still gain from trade. Competitiveness makes no sense because the U.S. income growth would not be any different in a situation where all other countries grow at an equal rate than in a situation where all other countries have faster growth than the United States. A low-wage country, since it receives a large inflow of capital from a high-wage country, cannot have trade surpluses while having investment greater than savings (due to foreign capital) so they must run trade deficits. The formidable growth of the asian tigers, just like the soviet union before, is accounted for by growth in inputs (subjected to diminishing returns) but not by growth in efficiency (i.e., output per unit of input).

Below, I have selected the important passages of the books. They are highlighted.

CONTENT [Jump links below]

1. Competitiveness: A Dangerous Obsession

2. Proving My Point

3. Trade, Jobs, and Wages

4. Does Third World Growth Hurt First World Prosperity?

6. Myths and Realities of U.S. Competitiveness

7. Economic Shuttle Diplomacy

8. What Do Undergrads Need to Know about Trade?

9. Challenging Conventional Wisdom

10. The Uncomfortable Truth about NAFTA

11. Asia's Miracle1. Competitiveness: A Dangerous Obsession

Mindless Competition

One might suppose, naively, that the bottom line of a national economy is simply its trade balance, that competitiveness can be measured by the ability of a country to sell more abroad than it buys. But in both theory and practice a trade surplus may be a sign of national weakness, a deficit a sign of strength. For example, Mexico was forced to run huge trade surpluses in the 1980s in order to pay the interest on its foreign debt since international investors refused to lend it any more money; it began to run large trade deficits after 1990 as foreign investors recovered confidence and began to pour in new funds. Would anyone want to describe Mexico as a highly competitive nation during the debt crisis era or describe what has happened since 1990 as a loss in competitiveness? [...]

But surely this changes when trade becomes more important, as indeed it has for all major economies? It certainly could change. Suppose that a country finds that although its productivity is steadily rising, it can succeed in exporting only if it repeatedly devalues its currency, selling its exports ever more cheaply on world markets. Then its standard of living, which depends on its purchasing power over imports as well as domestically produced goods, might actually decline. In the jargon of economists, domestic growth might be outweighed by deteriorating terms of trade.2 So “competitiveness” could turn out really to be about international competition after all.

2 An example may be helpful here. Suppose that a country spends 20 percent of its income on imports, and that the price of its imports are set not in domestic but in foreign currency. Then if the country is forced to devalue its currency – reduce its value in foreign currency – by 10 percent, this will raise the price of 20 percent of the country’s spending basket by 10 percent, thus raising the overall price index by 2 percent. Even if domestic output has not changed, the country’s real income will therefore have fallen by 2 percent. If the country must repeatedly devalue in the face of competitive pressure, growth in real income will persistently lag behind growth in real output.

Careless Arithmetic

Trade Deficits and the Loss of Good Jobs. In a recent article published in Japan, Lester Thurow explained to his audience the importance of reducing the Japanese trade surplus with the United States. U.S. real wages, he pointed out, had fallen six percent during the Reagan and Bush years, and the reason was that trade deficits in manufactured goods had forced workers out of high-paying manufacturing jobs into much lower-paying service jobs.

This is not an original view; it is very widely held. But Thurow was more concrete than most people, giving actual numbers for the job and wage loss. A million manufacturing jobs have been lost because of the deficit, he asserted, and manufacturing jobs pay 30 percent more than service jobs.

Both numbers are dubious. The million-job number is too high, and the 30 percent wage differential between manufacturing and services is primarily due to a difference in the length of the workweek, not a difference in the hourly wage rate. But let’s grant Thurow his numbers. Do they tell the story he suggests?

The key point is that total U.S. employment is well over 100 million workers. Suppose that a million workers were forced from manufacturing into services and as a result lost the 30 percent manufacturing wage premium. Since these workers are less than 1 percent of the U.S. labor force, this would reduce the average U.S. wage rate by less than 1/100 of 30 percent - that is, by less than 0.3 percent.

This is too small to explain the 6 percent real wage decline by a factor of 20. Or to look at it another way, the annual wage loss from deficit-induced deindustrialization, which Thurow clearly implies is at the heart of U.S. economic difficulties, is on the basis of his own numbers roughly equal to what the U. S. spends on health care every week.

2. Proving My Point

Sloppy Math: Part II

For example, Thurow says that imports are 14 percent of U.S. GNP, while exports are only 10 percent, and that reducing imports to equal exports would add $250 billion to the sales of U.S. manufacturers. But according to Economic Indicators, the monthly statistical publication of the Joint Economic Committee, U.S. imports in 1993 were only 11.4 percent of GDP, while exports were 10.4 percent. Even the current account deficit, a broader measure that includes some additional debit items, was only $109 billion. If the United States were to cut imports by $250 billion, far from merely balancing its trade as Thurow asserts, the United States would run a current account surplus of $140 billion – that is, more than the 2 percent maximum of GDP U.S. negotiators have demanded Japan set as a target!

Or consider Prestowitz, who derides my claim that high-technology industries, commonly described as “high value” sectors, actually have much lower value added per worker than traditional “high volume,” heavy industrial sectors. I have aggregated too much by looking at broad sectors like electronics, he says; I should look at the highest-tech lines of business, like semiconductors, where value added per worker is $234,000. Prestowitz should report the results of his research to the Department of Commerce, whose staff has obviously incorrectly calculated (in the Annual Survey of Manufactures) that in 1989 value added per worker in Standard Industrial Classification 3674 (semiconductors and related devices) was $96,487 closer to the $76,709 per worker in SIC 2096 (potato chips and related snacks) than to the $187,569 in SIC 3711 (motor vehicles and car bodies). […]

Beyond these petty, if revealing, errors of fact are a series of conceptual misunderstandings. For example, Prestowitz argues that productivity in sectors that compete on world markets is much more important than productivity in non-traded service sectors because the former determine wage rates throughout the economy. For example, because U.S. manufacturing workers are much more productive than their Third World counterparts, U.S. barbers, who do not have a comparable productivity advantage, also get high wages. But Prestowitz fails to notice that the converse is also true: service productivity affects the real wages of manufacturing workers. Because the high relative productivity of U.S. manufacturing is not matched in the haircut sector, haircuts by those well-paid barbers are much more expensive than haircuts in the Third World; as a result real wages of U.S. manufacturing workers (that is, wages in terms of what they can buy, including haircuts) are not as high as they would be if U.S. barbers were more productive. With careful thought, one realizes that real wages depend on the overall productivity of the economy, with no special presumption that productivity in manufacturing – or in internationally traded sectors in general – deserves any more attention or active promotion than productivity elsewhere.

Cohen makes essentially the same mistake when he complains that I underestimated the effects of competitive pressure because I focused only on import and export prices and did not consider the further impacts of that pressure on profits and wages. He somehow fails to realize that a change in wages or profits that is not reflected in import or export prices cannot change overall U.S. real income – it can only redistribute profits to one group within the United States at the expense of another. That is why the effect of international price competition on U.S. real income can be measured by the change in the ratio of export to import prices – full stop. And the effects of changes in this ratio on the U.S. economy have, as I showed in my article, been small.

Or consider Thurow’s analysis of the benefits that would accrue to the United States if it could roll back imports (leaving aside the inaccuracy of his numbers). He asserts that the United States could create five million new jobs in import-competing sectors, and he assumes that all five million jobs represent a net addition to employment. But this assumption is unrealistic. As this reply was being written, the Federal Reserve was raising interest rates in an effort to rein in a recovery that it feared would proceed too far, that is, lead to excessive employment, producing a renewed surge in inflation. Some people think that the Fed is tightening too soon, but the essential point is that the growth of employment is not determined by the ability of the United States to sell goods on world markets or to compete with imports, but by the Fed’s judgement of what will not set off inflation. So suppose that the United States were to impose import quotas, adding millions of jobs in import-competing sectors. The Fed would respond by raising interest rates to prevent an overheated economy, and most if not all of the job gains would be matched by job losses elsewhere.

Things Add Up

In each of these cases, my critics seem to have forgotten the most basic principle of economics: things add up. Higher employment in import-competing industries must come either through a reduction in unemployment, in which case one must ask whether the implied unemployment rate (about three percent in Thurow’s example) is feasible, or at the expense of jobs elsewhere in the economy, in which case no overall job gain takes place. If higher manufacturing wages lead to a higher wage rate for barbers without higher tonsorial productivity, the gain must come at someone else’s expense. Since it is hard to see how foreigners pay for more expensive American haircuts, that wage gain can only redistribute the benefits of manufacturing productivity from one set of American workers to another, not increase the total gains. In their haste to assign great importance to international competition, my critics, like the inventors of perpetual motion machines, have failed to realize that there are conservation principles that any story about the economy must honor. [...]

Well, that’s not quite the real story. It is true that in the early 1980s professional economists became aware that one of the implications of new theories of international trade was a possible role for strategic policies to promote exports in certain industries. Confronted with a new idea that was exciting, potentially important but untested, these economists began a sustained process of research, probing the weak points, confronting the new idea with the data. After all, lots of things could be true in principle. For example in certain theoretical situations a tax cut could definitely stimulate the economy so much that government revenues would actually rise, and it would be very nice if that were the actual situation; but unfortunately it isn’t. Similarly, it is definitely possible to imagine a situation in which, because of all of the market imperfections Thurow dwells on, a clever strategic trade policy would sharply raise U.S. real income. And it would be very nice if the United States could devise such a policy. But is that possibility really there? To answer that question requires looking hard at the facts.

And so over the course of the last ten years a massive international research program has explored the prospects for strategic trade policy. Two broad conclusions emerge. First, to identify which industries should receive strategic promotion or the appropriate form and level of promotion is very difficult. Second, the payoffs of even a successful strategic trade policy are likely to be very modest – certainly far less even than Thurow’s “seven percent solution,” which is closer to the entire share of international trade in the U.S. economy.

3. Trade, Jobs, and Wages

The real wage of the average American worker more than doubled between the end of World War II and 1973. Since then, however, those wages have risen only 6 percent. Furthermore, only highly educated workers have seen their compensation rise; the real earnings of blue-collar workers have fallen in most years since 1973.

Why have wages stagnated? A consensus among business and political leaders attributes the problem in large part to the failure of the U.S. to compete effectively in an increasingly integrated world economy. This conventional wisdom holds that foreign competition has eroded the U.S. manufacturing base, washing out the high-paying jobs that a strong manufacturing sector provides. More broadly, the argument goes, the nation’s real income has lagged as a result of the inability of many U.S. firms to sell in world markets. And because imports increasingly come from Third World countries with their huge reserves of unskilled labor, the heaviest burden of this foreign competition has ostensibly fallen on less educated American workers.

Many people find such a story extremely persuasive. It links America’s undeniable economic difficulties to the obvious fact of global competition. In effect, the U.S. is (in the words of President Bill Clinton) “like a big corporation in the world economy” – and, like many big corporations, it has stumbled in the face of new competitive challenges.

Persuasive though it may be, however, that story is untrue. A growing body of evidence contradicts the popular view that international competition is central to U.S. economic problems. In fact, international factors have played a surprisingly small role in the country’s economic difficulties. The manufacturing sector has become a smaller part of the economy, but international trade is not the main cause of that shrinkage. The growth of real income has slowed almost entirely for domestic reasons. And – contrary to what even most economists have believed – recent analyses indicate that growing international trade does not bear significant responsibility even for the declining real wages of less educated U.S. workers.

The fraction of U.S. workers employed in manufacturing has been declining steadily since 1950. So has the share of U.S. output accounted for by value added in manufacturing. (Measurements of “value added” deduct from total sales the cost of raw materials and other inputs that a company buys from other firms.) In 1950 value added in the manufacturing sector accounted for 29.6 percent of gross domestic product (GDP) and 34.2 percent of employment; in 1970 the shares were 25.0 and 27.3 percent, respectively; by 1990 manufacturing had fallen to 18.4 percent of GDP and 17.4 percent of employment.

Before 1970 those who worried about this trend generally blamed it on automation - that is, on rapid growth of productivity in manufacturing. Since then, it has become more common to blame deindustrialization on rising imports; indeed, from 1970 to 1990, imports rose from 11.4 to 38.2 percent of the manufacturing contribution to GDP.

Yet the fact that imports grew while industry shrank does not in itself demonstrate that international competition was responsible. During the same 20 years, manufacturing exports also rose dramatically, from 12.6 to 31.0 percent of value added. Many manufacturing firms may have laid off workers in the face of competition from abroad, but others have added workers to produce for expanding export markets.

To assess the overall impact of growing international trade on the size of the manufacturing sector, we need to estimate the net effect of this simultaneous growth of exports and imports. A dollar of exports adds a dollar to the sales of domestic manufacturers; a dollar of imports, to a first approximation, displaces a dollar of domestic sales. The net impact of trade on domestic manufacturing sales can therefore be measured simply by the manufacturing trade balance – the difference between the total amount of manufactured goods that the U.S. exports and the amount that it imports. (In practice, a dollar of imports may displace slightly less than a dollar of domestic sales because the extra spending may come at the expense of services or other nonmanufacturing sales. The trade balance sets an upper bound on the net effect of trade on manufacturing.)

Undoubtedly, the emergence of persistent trade deficits in manufactured goods has contributed to the declining share of manufacturing in the U.S. economy. The question is how large that contribution has been. In 1970 manufactured exports exceeded imports by 0.2 percent of GDP. Since then, there have been persistent deficits, reaching a maximum of 3.1 percent of GDP in 1986. By 1990, however, the manufacturing deficit had fallen again, to only 1.3 percent of GDP. The decline in the U.S. manufacturing trade position over those two decades was only 1.5 percent of GDP, less than a quarter of the 6.6 percentage point decline in the share of manufacturing in GDP.

Moreover, the raw value of the trade deficit overstates its actual effect on the manufacturing sector. Trade figures measure sales, but the contribution of manufacturing to GDP is defined by value added in the sector – that is, by sales minus purchases from other sectors. When imports displace a dollar of domestic manufacturing sales, a substantial fraction of that dollar would have been spent on inputs from the service sector, which are not part of manufacturing’s contribution to GDP.

To estimate the true impact of the trade balance on manufacturing, one must correct for this “leakage” to the service sector. Our analysis of data from the U.S. Department of Commerce puts the figure at 40 percent. In other words, each dollar of trade deficit reduces the manufacturing sector’s contribution to GDP by only 60 cents. This adjustment strengthens our conclusion: if trade in manufactured goods had been balanced from 1970 to 1990, the downward trend in the size of the manufacturing sector would not have been as steep as it actually was, but most of the deindustrialization would still have taken place. Between 1970 and 1990 manufacturing declined from 25.0 to 18.4 percent of GDP; with balanced trade, the decline would have been from 24.9 to 19.2, about 86 percent as large.

International trade explains only a small part of the decline in the relative importance of manufacturing to the economy. Why, then, has the share of manufacturing declined? The immediate reason is that the composition of domestic spending has shifted away from manufactured goods. In 1970 U.S. residents spent 46 percent of their outlays on goods (manufactured, grown or mined) and 54 percent on services and construction. By 1991 the shares were 40.7 and 59.3 percent, respectively, as people began buying comparatively more health care, travel, entertainment, legal services, fast food and so on. It is hardly surprising, given this shift, that manufacturing has become a less important part of the economy.

In particular, U.S. residents are spending a smaller fraction of their incomes on goods than they did 20 years ago for a simple reason: goods have become relatively cheaper. Between 1970 and 1990 the price of goods relative to services fell 22.9 percent. The physical ratio of goods to services purchased remained almost constant during that period. Goods have become cheaper primarily because productivity in manufacturing has grown much faster than in services. This growth has been passed on in lower consumer prices.

Ironically, the conventional wisdom here has things almost exactly backward. Policymakers often ascribe the declining share of industrial employment to a lack of manufacturing competitiveness brought on by inadequate productivity growth. In fact, the shrinkage is largely the result of high productivity growth, at least as compared with the service sector. The concern, widely voiced during the 1950s and 1960s, that industrial workers would lose their jobs because of automation is closer to the truth than the current preoccupation with a presumed loss of manufacturing jobs because of foreign competition.

Because competition from abroad has played a minor role in the contraction of U.S. manufacturing, loss of jobs in this sector because of foreign competition can bear only a tiny fraction of the blame for the stagnating earnings of U.S. workers. Our data illuminate just how small that fraction is. In 1990, for example, the trade deficit in manufacturing was $73 billion. This deficit reduced manufacturing value added by approximately $42 billion (the other $31 billion represents leakage – goods and services that manufacturers would have purchased from other sectors). Given an average of about $60,000 value added per manufacturing employee, this figure corresponded to approximately 700,000 jobs that would have been held by U.S. workers. In that year, the average manufacturing worker earned about $5,000 more than the average nonmanufacturing worker. Assuming that any loss of manufacturing jobs was made up by a gain of nonmanufacturing jobs – an assumption borne out by the absence of any long-term upward trend in the U.S. unemployment rate – the loss of “good jobs” in manufacturing as a result of international competition corresponded to a loss of $3.5 billion in wages. U.S. national income in 1990 was $5.5 trillion; consequently, the wage loss from deindustrialization in the face of foreign competition was less than 0.07 percent of national income.

Many observers have expressed concern not just about wages lost because of a shrinking manufacturing sector but also about a broader erosion of U.S. real income caused by inability to compete effectively in world markets. But they often fail to make the distinction between the adverse consequences of having slow productivity growth – which would be bad even for an economy that did not have any international trade – and additional adverse effects that might result from productivity growth that lags behind that of other countries.

To see why that distinction is important, consider a world in which productivity (output per worker-hour) increases by the same amount in every nation around the world – say, 3 percent a year. Under these conditions, all other things remaining equal, workers’ real earnings in all countries would tend to rise by 3 percent annually as well. Similarly, if productivity grew at 1 percent a year, so would earnings. (The relation between productivity growth and earnings growth holds regardless of the absolute level of productivity in each nation; only the rate of increase is significant.)

Concerns about international competitiveness, as opposed to low productivity growth, correspond to a situation in which productivity growth in the U.S. falls to 1 percent annually while elsewhere it continues to grow at 3 percent. If real earnings in the U.S. then grow at 1 percent a year, the U.S. does not have anything we could reasonably call a competitive problem, even though it would lag other nations. The rate of earnings growth is exactly the same as it would be if other countries were doing as badly as we are.

The fact that other countries are doing better may hurt U.S. pride, but it does not by itself affect domestic standards. It makes sense to talk of a competitive problem only to the extent that earnings growth falls by more than the decline in productivity growth.

Foreign competition can reduce domestic income by a well-understood mechanism called the terms of trade effect. In export markets, foreign competition can force a decline in the prices of U.S. products relative to those of other nations. That decline typically occurs through a devaluation of the dollar, thereby boosting the price of imports. The net result is a reduction in real earnings because the U.S. must sell its goods more cheaply and pay more for what it buys.

During the past 20 years, the U.S. has indeed experienced a deterioration in its terms of trade. The ratio of U.S. export prices to import prices fell more than 20 percent between 1970 and 1990; in other words, the U.S. had to export 20 percent more to pay for a given quantity of imports in 1990 than it did in 1970. Because the U.S. imported goods whose value was 11.3 percent of its GDP in 1990, these worsened terms of trade reduced national income by about 2 percent.

Real earnings grew by about 6 percent during the 1970s and 1980s. Our calculation suggests that avoiding the decline in the terms of trade would have increased that growth to only about 8 percent. Although the effect of foreign competition is measurable, it can by no means account for the stagnation of U.S. earnings.

A more direct way of calculating the impact of the terms of trade on real income is to use a measure known as command GNP (gross national product). Real GNP, the conventional standard of economic performance, measures what the output of the economy would be if all prices remained constant. Command GNP is a similar measure in which the value of exports is deflated by the import price index. It measures the quantity of goods and services that the U.S. economy can afford to buy in the world market, as opposed to the volume of goods and services it produces. If the prices of imports rise faster than export prices (as will happen, for example, if the dollar falls precipitously), growth in command GNP will fall behind that of real GNP.

Between 1959 and 1973, when U.S. wages were rising steadily, command GNP per worker-hour did grow slightly faster than real GNP per hour – 1.87 percent per year versus 1.85. Between 1973 and 1990, as real wages stagnated, command GNP grew more slowly than output, 0.65 percent versus 0.73. Both these differences, however, are small. The great bulk of the slowdown in command GNP was caused by the slower growth of real GNP per worker – by the purely domestic impact of the decline in productivity growth.

If foreign competition is neither the main villain in the decline of manufacturing nor the root cause of stagnating wages, has it not at least worsened the lot of unskilled labor? Economists have generally been quite sympathetic to the argument that increased integration of global markets has pushed down the real wages of less educated U.S. workers.

Their opinion stems from a familiar concept in the theory of international trade: factor price equalization. When a rich country, where skilled labor is abundant (and where the premium for skill is therefore small), trades with a poor country, where skilled workers are scarce and unskilled workers abundant, the wage rates tend to converge. The pay of skilled workers rises in the rich country and falls in the poor one; that of unskilled workers falls in the rich country and rises in the poor nation. Given the rapid growth of exports from nations such as China and Indonesia, it seems reasonable to suppose that factor price equalization has been a major reason for the growing gap in earnings between skilled and unskilled workers in the U.S. Surprisingly, however, this does not seem to be the case. We have found that increased wage inequality, like the decline of manufacturing and the slowdown in real income growth, is overwhelmingly the consequence of domestic causes.

That conclusion is based on an examination of the evidence in terms of the underlying logic of factor price equalization, first explained in a classic 1941 paper by Wolfgang F. Stolper and Paul A. Samuelson. The principle of comparative advantage suggests that a rich country trading with a poor one will export skill-intensive goods (because it has a comparative abundance of skilled workers) and import labor-intensive products. As a result of this trade, production in the rich country will shift toward skill-intensive sectors and away from labor-intensive ones. That shift, however, raises the demand for skilled workers and reduces that for unskilled workers. If wages are free to rise and fall with changes in the demand for different kinds of labor (as they do for the most part in the U.S.), the real wages of skilled workers will rise, and those of unskilled workers will decline. In a poor country, the opposite will occur.

All other things being equal, the rising wage differential will lead firms in the rich country to cut back on the proportion of skilled workers that they employ and to increase that of unskilled ones. That decision, in turn, mitigates the increased demand for skilled workers. When the dust settles, the wage differential has risen just enough to offset the effects of the change in the industry mix on overall demand for labor. Total employment of both types of labor remains unchanged.

According to Stolper and Samuelson’s analysis, a rising relative wage for skilled workers leads all industries to employ a lower ratio of skilled to unskilled workers. Indeed, this reduction is the only way the economy can shift production toward skill-intensive sectors while keeping the overall mix of workers constant.

This analysis carries two clear empirical implications. First, if growing international trade is the main force driving increased wage inequality, the ratio of skilled to unskilled employment should decline in most U.S. industries. Second, employment should increase more rapidly in skill-intensive industries than in those that employ more unskilled labour.

Recent U.S. economic history confounds these predictions. Between 1979 and 1989 the real compensation of white-collar workers rose, whereas that of blue-collar workers fell. Nevertheless, nearly all industries employed an increasing proportion of white-collar workers. Moreover, skill-intensive industries showed at best a slight tendency to grow faster than those in which blue-collar employment was high. (Although economists use many different methods to estimate the average skill level in a given industrial sector, the percentage of blue-collar workers is highly correlated with other measures and easy to estimate.)

Thus, the evidence suggests that factor price equalization was not the driving force behind the growing wage gap. The rise in demand for skilled workers was overwhelmingly caused by changes in demand within each industrial sector, not by a shift of the U.S.’s industrial mix in response to trade. No one can say with certainty what has reduced the relative demand for less skilled workers throughout the economy. Technological change, especially the increased use of computers, is a likely candidate; in any case, globalization cannot have played the dominant role.

It may seem difficult to reconcile the evidence that international competition bears little responsibility for falling wages among unskilled workers with the dramatic rise in manufactured exports from Third World countries. In truth, however, there is little need to do so. Although the surging exports of some developing countries have attracted a great deal of attention, the U.S. continues to buy the bulk of its imports from other advanced countries, whose workers have similar skills and wages. In 1990 the average wages of manufacturing workers among U.S. trading partners (weighted by total bilateral trade) were 88 percent of the U.S. level. Imports (other than oil) from low-wage countries – those where workers earn less than half the U.S. level – were a mere 2.8 percent of GDP.

Finally, increasing low-wage competition from trade with developing nations has been offset by the rise in wages and skill levels among traditional U.S. trading partners. Indeed, imports from low-wage countries were almost as large in 1960 as in 1990 – 2.2 percent of GDP – because three decades ago Japan and most of Europe fell into that category. In 1960 imports from Japan exerted competitive pressure on labor-intensive industries such as textiles. Today Japan is a high-wage country, and the burden of its competition falls mostly on skill-intensive sectors such as the semiconductor industry.

4. Does Third World Growth Hurt First World Prosperity?

Model 1: A One-Good, One-Input World

Imagine a world without the complexities of the global economy. In this world, one all-purpose good is produced – let’s call it chips – using one input, labor. All countries produce chips, but labor is more productive in some countries than in others. In imagining such a world, we ignore two crucial facts about the actual global economy: it produces hundreds of thousands of distinct goods and services, and it does so using many inputs, including physical capital and the “human capital” that results from education.

What would determine wages and standards of living in such a simplified world? In the absence of capital or differentiation between skilled and unskilled labor, workers would receive what they produce. That is, the annual real wage in terms of chips in each country would equal the number of chips each worker produced in a year – his or her productivity. And since chips are the only good consumed as well as the only good produced, the consumer price index would contain nothing but chips. Each country’s real wage rate in terms of its CPI would also equal the productivity of labor in each country.

What about relative wages? The possibility of arbitrage, of shipping goods to wherever they command the highest price, would keep chip prices the same in all countries. Thus the wage rate of workers who produce 10,000 chips annually would be ten times that of workers who produce 1,000, even if those workers are in different countries. The ratio of any two nations’ wage rates, then, would equal the ratio of their workers’ productivity.

What would happen if countries that previously had low productivity and thus low wages were to experience a large increase in their productivity? These emerging economies would see their wage rates in terms of chips rise – end of story. There would be no impact, positive or negative, on real wage rates in other, initially higher-wage countries. In each country, the real wage rate equals domestic productivity in terms of chips; that remains true, regardless of what happens elsewhere.

What’s wrong with this model? It’s ridiculously oversimplified, but in what ways might the simplification mislead us? One immediate problem with the model is that it leaves no room for international trade: if everyone is producing chips, there is no reason to import or export them. (This issue does not seem to bother such competitiveness theorists as Lester Thurow. The central proposition of Thurow’s Head to Head is that because the advanced nations produce the same things, the benign niche competition of the past has given way to win-lose head-to-head competition. But if the advanced nations are producing the same things, why do they sell so much to one another?)

While the fact that countries do trade with one another means that our simplified model cannot be literally true, this model does raise the question of how extensive the trade actually is between advanced nations and the Third World. It turns out to be surprisingly small despite the emphasis on Third World trade in such documents as the Delors white paper. In 1990, advanced industrial nations spent only 1.2% of their combined GDPs on imports of manufactured goods from newly industrializing economies. A model in which advanced countries have no reason to trade with low-wage countries is obviously not completely accurate, but it is more than 98% right all the same.

Another problem with the model is that without capital, there can be no international investment. We’ll come back to that point when we put capital into the model. It’s worth noting, however, that in the U.S. economy, more than 70% of national income accrues to labor and less than 30% to capital; this proportion has been very stable for the past two decades. Labor is clearly not the only input in the production of goods, but the assertion that the average real wage rate moves almost one for one with output per worker, that what is good for the United States is good for U.S. workers and vice versa, seems approximately correct.

One last assertion that may bother some readers is that wages automatically rise with productivity. Is this realistic?

Yes. Economic history offers no example of a country that experienced long-term productivity growth without a roughly equal rise in real wages. In the 1950s, when European productivity was typically less than half of U.S. productivity, so were European wages; today average compensation measured in dollars is about the same. As Japan climbed the productivity ladder over the past 30 years, its wages also rose, from 10% to 110% of the U.S. level. South Korea’s wages have also risen dramatically over time. Indeed, many Korean economists worry that wages may have risen too much. Korean labor now seems too expensive to compete in low-technology goods with newcomers like China and Indonesia and too expensive to compensate for low productivity and product quality in such industries as autos.

The idea that somehow the old rules no longer apply, that new entrants on the world economic stage will always pay low wages even as their productivity rises to advanced-country levels, has no basis in actual experience. (Some economic writers try to refute this proposition by pointing to particular industries in which relative wages don’t match relative productivity. For example, shirtmakers in Bangladesh, who are almost half as productive as shirtmakers in the United States, receive far less than half the U.S. wage rate. But as we’ll see when we turn to a multigood model, that is exactly what standard economic theory predicts.)

Our one-good, one-input model may seem silly, but it forces us to notice two crucial points. First, an increase in Third World labor productivity means an increase in world output, and an increase in world output must show up as an increase in somebody’s income. And it does: it shows up in higher wages for Third World workers. Second, whatever we may eventually conclude about the impact of higher Third World productivity on First World economies, it won’t necessarily be adverse. The simplest model suggests that there is no impact at all.

Model 2: Many Goods, One Input

In the real world, of course, countries specialize in the production of a limited range of goods; international trade is both the cause and the result of that specialization. In particular, the trade in manufactured goods between the First and Third worlds is largely an exchange of sophisticated high-technology products like aircraft and microprocessors for labor-intensive goods like clothing. In a world in which countries produce different goods, productivity gains in one part of the world may either help or hurt the rest of the world.

This is by no means a new subject. Between the end of World War II and the Korean War, many nations experienced a series of balance-of-payments difficulties, which led to the perception of a global “dollar shortage.” At the time, many Europeans believed that their real problem was the overwhelming competitiveness of the highly productive U.S. economy. But was the U.S. economy really damaging the rest of the world? More generally, does productivity growth in one country raise or lower real incomes in other countries? An extensive body of theoretical and empirical work concluded that the impact of productivity growth abroad on domestic welfare can be either positive or negative, depending on the bias of that productivity growth – that is, depending on the sectors in which such growth occurs.

Sir W. Arthur Lewis, who won the 1979 Nobel Prize in economics for his work on economic development, has offered a clever illustration of how the effect of productivity growth in developing countries on the real wages in advanced nations can work either way. In Lewis’s model, the world is divided into two regions; call them North and South. This global economy produces not one but three types of goods: high-tech, medium-tech, and low-tech. As in our first model, however, labor is still the only input into production. Northern labor is more productive than Southern labor in all three types of goods, but that productivity advantage is huge in high-tech, moderate in medium-tech, and small in low-tech.

What will be the pattern of wages and production in such a world? A likely outcome is that high-tech goods will be produced only in the North, low-tech goods only in the South, and both regions will produce at least some medium-tech goods. (If world demand for high-tech products is very high, the North may produce only those goods; if demand for low-tech products is high, the South may also specialize. But there will be a wide range of cases in which both regions produce medium-tech goods.)

Competition will ensure that the ratio of the wage rate in the North to that in the South will equal the ratio of Northern to Southern productivity in the sector in which workers in the two regions face each other head-to-head: medium-tech. In this case, Northern workers will not be competitive in low-tech goods in spite of their higher productivity because their wage rates are too high. Conversely, low Southern wage rates are not enough to compensate for low productivity in high-tech.

A numerical example may be helpful here. Suppose that Northern labor is ten times as productive as Southern labor in high-tech, five times as productive in medium-tech, but only twice as productive in low-tech. If both countries produce medium-tech goods, the Northern wage must be five times higher than the Southern. Given this wage ratio, labor costs in the South for low-tech goods will be only two-fifths of labor costs in the North for this sector, even though Northern labor is more productive. In high-tech goods, by contrast, labor costs will be twice as high in the South.

Notice that in this example, Southern low-tech workers receive only one-fifth the Northern wage, even though they are half as productive as Northern workers in the same industry.

Many people, including those who call themselves experts on international trade, believe that kind of gap shows that conventional economic models don’t apply. In fact, it’s exactly what conventional analysis predicts: if low-wage countries didn’t have lower unit labor costs than high-wage countries in their export industries, they couldn’t export.

Now suppose that there is an increase in Southern productivity. What effect will it have? It depends on which sector experiences the productivity gain. If the productivity increase occurs in low-tech output, a sector that does not compete with Northern labor, there is no reason to expect the ratio of Northern to Southern wages to change. Southern labor will produce low-tech goods more cheaply, and the fall in the price of those goods will raise real wages in the North. But if Southern productivity rises in the competitive medium-tech sector, relative Southern wages will rise. Since productivity has not risen in low-tech production, low-tech prices will rise and reduce real wages in the North.

What happens if Southern productivity rises at equal rates in low- and medium-tech? The relative wage rate will rise but will be offset by the productivity increase. The prices of low-tech goods in terms of Northern labor will not change, and thus the real wages of Northern workers will not change either. In other words, an across-the-board productivity increase in the South in this multigood model has the same effect on Northern living standards as productivity growth had in the one-good model: none at all.

It seems, then, that the effect of Third World growth on the First World, which was negligible in our simplest model, becomes unpredictable once we make the model more realistic. There are, however, two points worth noting.

First, the way in which growth in the Third World can hurt the First World is very different from the way it is described in the Schwab letter or the Delors White Paper. Third World growth does not hurt the First World because wages in the Third World stay low but because they rise and therefore push up the prices of exports to advanced countries. That is, the United States may be threatened when South Korea gets better at producing automobiles, not because the United States loses the automobile market, but because higher South Korean wages mean that U.S. consumers pay more for the pajamas and toys that they were already buying from South Korea.

Second, this potential adverse effect should show up in a readily measured economic statistic: the terms of trade, or the ratio of export to import prices. For example, if U.S. companies are forced to sell goods more cheaply on world markets because of foreign competition or are forced to pay more for imports because of competition for raw materials or a devalued dollar, real income in the United States will fall. Because exports and imports are about 10% of GNP, each 10% decline in the U.S. terms of trade reduces U.S. real income by about 1%. The potential damage to advanced economies from Third World growth rests on the possibility of a decline in advanced country terms of trade. But that hasn’t happened. Between 1982 and 1992, the terms of trade of the developed market economies actually improved by 12%, largely as a result of falling real oil prices.

In sum, a multigood model offers more possibilities than the simple one-good model with which we began, but it leads to the same conclusion: productivity growth in the Third World leads to higher wages in the Third World, end of story.

Model 3: Capital and International Investment

Let’s move a step closer to reality and add another input to our model. What changes if we now imagine a world in which production requires both capital and labor? From a global point of view, there is one big difference between labor and capital: the degree of international mobility. Although large-scale international migration was a major force in the world economy before 1920, since then all advanced countries have erected high legal barriers to economically motivated immigration. There is a limited flow of very highly skilled people from South to North – the notorious “brain drain” – and a somewhat larger flow of illegal migration. But most labor does not move internationally.

In contrast, international investment is a highly visible and growing influence on the world economy. During the late 1970s, many banks in advanced countries lent large sums of money to Third World countries. This flow dried up in the 1980s, the decade of the debt crisis, but considerable capital flows resumed with the emerging-markets boom that began after 1990.

Many of the fears about Third World growth seem to focus on capital flows rather than trade. Schwab’s fear that there will be a “massive redeployment of productive assets” presumably refers to investment in the Third World. The famous estimate by the Economic Policy Institute that NAFTA would cost 500,000 U.S. jobs was based on a completely hypothetical scenario about diversion of U.S. investment. Even Labor Secretary Robert Reich, at the March 1994 job summit in Detroit, attributed the employment problems of Western economies to the mobility of capital. In effect, he seemed to be asserting that First World capital now creates only Third World jobs. Are those fears justified?

The short answer is yes in principle but no in practice. As a matter of standard textbook theory, international flows of capital from North to South could lower Northern wages. The actual flows that have taken place since 1990, however, are far too small to have the devastating impacts that many people envision.

To understand how international investment flows could pose problems for advanced-country labor, we must first realize that the productivity of labor depends in part on how much capital it has to work with. As an empirical matter, the share of labor in domestic output is very stable. But if labor has less capital at its disposal, productivity and thus real wage rates will fall.

Suppose, then, that Third World nations become more attractive than First World nations for First World investors. This might be because a change in political conditions makes such investments seem safer or because technology transfer raises the potential productivity of Third World workers (once they are equipped with adequate capital). Does this hurt First World workers? Of course. Capital exported to the Third World is capital not invested at home, so such North-South investment means that Northern productivity and wages will fall. Northern investors presumably earn a higher return on these investments than they could have earned at home, but that may offer little comfort to workers. [...]

How much capital has been exported from advanced countries to developing countries? During the 1980s, there was essentially no net North-South investment – indeed, interest payments and debt repayments were consistently larger than the new investment. All the action, then, has taken place since 1990. In 1993, the peak year of emerging-markets investment so far, capital flows from all advanced nations to all newly industrializing countries totaled about $100 billion.

That may sound very high, but compared with the First World economy, it isn’t. Last year, the combined GNPs of North America, Western Europe, and Japan totaled more than $18 trillion. Their combined investment was more than $3.5 trillion; their combined capital stocks were about $60 trillion. The record capital flows of 1993 diverted only about 3% of First World investment away from domestic use and reduced the growth in the capital stock by less than 0.2%. The entire emerging-market investment boom since 1990 has reduced the advanced world’s capital stock by only about 0.5% from what it would otherwise have been.

How much pressure has this placed on wages in advanced countries? A reduction of the capital stock by 1% reduces productivity by less than 1%, since capital is only one input; standard estimates put the number at about 0.3%. A back-of-the-envelope calculation therefore suggests that capital flows to the Third World since 1990 (and bear in mind that there was essentially no capital flow during the 1980s) have reduced real wages in the advanced world by about 0.15% – hardly the devastation that Schwab, Delors, or the Economic Policy Institute presume.

There is another way to make the same point. Anything that draws capital away from business investment in the advanced countries tends to reduce First World wages. But investment in the Third World has become considerable only in the last few years. Meanwhile, there has been a massive diversion of savings into a purely domestic sink: the budget deficits run up by the United States and other countries. Since 1980, the United States alone has run up more than $3 trillion in federal debt, more than ten times the amount invested in emerging economies by all advanced countries combined. The export of capital to the Third World attracts a lot of attention because it is exotic, but the amounts are minor compared with domestic budget deficits.

At this point, some readers may object that one cannot compare the two numbers. Savings absorbed by the federal budget deficit simply disappear; savings invested abroad create factories that make products that then compete with ours. It seems plausible that overseas investment is more damaging than budget deficits. But that intuition is wrong: investing in Third World countries raises their productivity, and we’ve seen in the first two models that higher Third World productivity per se is unlikely to lower First World living standards.

The conventional wisdom among many policymakers and pundits is that we live in a world of incredibly mobile capital and that such mobility changes everything. But capital isn’t all that mobile, and the capital movements we have seen so far change very little, at least for advanced countries.

Model 4: The Distribution of Income

We seem to have concluded that growth in the Third World has almost no adverse effects on the First World. But there is still one more issue to address: the effects of Third World growth on the distribution of income between skilled and unskilled labor within the advanced world.

For our final model, let’s add one more complication. Suppose that there are two kinds of labor, skilled and unskilled. And suppose that the ratio of unskilled to skilled workers is much higher in the South than in the North. In such a situation, one would expect the ratio of skilled to unskilled wages to be lower in the North than in the South. As a result, one would expect the North to export skill-intensive goods and services – that is, employ a high ratio of skilled to unskilled labor in their production, while the South exports goods whose production is intensive in unskilled labor.

What is the effect of this trade on wages in the North? When two countries exchange skill-intensive goods for labor-intensive goods, they indirectly trade skilled for unskilled labor; the goods that the North ships to the South “embody” more skilled labor than the goods the North receives in return. It is as if some of the North’s skilled workers migrated to the South. Similarly, the North’s imports of labor-intensive products are like an indirect form of low-skill immigration. Trade with the South in effect makes Northern skilled labor scarcer, raising the wage it can command, while it makes unskilled labor effectively more abundant, reducing its wage.

Increased trade with the Third World, then, while it may have little effect on the overall level of First World wages, should in principle lead to greater inequality in those wages, with a higher premium for skill. Equally, there should be a tendency toward “factor price equalization,” with wages of low-skilled workers in the North declining toward Southern levels.

What makes this conclusion worrisome is that income inequality has been rapidly increasing in the United States and to a lesser extent in other advanced nations. Even if Third World exports have not hurt the average level of wages in the First World, might they not be responsible for the steep declines since the 1970s in real wages of unskilled workers in the United States and the rising unemployment rates of European workers?

At this point, the preponderance of the evidence seems to be that factor price equalization has not been a major element in the growing wage inequality in the United States, although the evidence is more indirect and less secure than the evidence we brought to our earlier models. In essence, trade with the Third World is just not that large. Since trade with low-wage countries is only a little more than 1% of GDP, the net flows of labor embodied in that trade are fairly small compared with the overall size of the labor force.

More careful research may lead to larger estimates of the effect of North-South trade on the distribution of wages, or future growth in that trade may have larger effects than we have seen so far. At this point, however, the available evidence does not support the view that trade with the Third World is an important part of the wage inequality story.

Moreover, even to the extent that North-South trade may explain some of the growing inequality of earnings, it has nothing to do with the disappointing performance of average wages. Before 1973, average compensation in the United States rose at an annual rate of more than 2%; since then it has risen at a rate of only 0.3%. This decline is at the heart of our economic malaise, and Third World exports have nothing to do with it.

5. The Illusion of Conflict in International Trade

Who Is Right?

The World Competitiveness Report puts that threat starkly: “Today, the so-called industrialized nations employ 350 million people who are paid an average hourly wage of $18. However, during the past ten years, the world economy gained access to large and populated countries, such as China, the former Soviet Union, India, Mexico, etc. Altogether, it can be estimated that a labour force of some 1,200 million people has thus become reachable, at an average hourly cost of $2, and in many regions, under $1 [...]

This offers a clear and compelling vision. Low-wage nations are now able to attract capital and technology from the advanced world. As a result, they can achieve productivity close to Western levels, while paying much lower wages. The result seems obvious: the low-wage countries will run huge trade surpluses, creating either large-scale unemployment or sharply falling wages in the erstwhile high-wage nations.

Sounds persuasive, doesn’t it? There’s only one problem: it is a vision that quite literally makes no sense. The reason lies in a basic fact of accounting, perhaps the most essential equation in international economics:

Savings - Investment = Exports - Imports

This is not a hypothetical theory: it is an unavoidable accounting identity, a statement of an adding-up constraint that any consistent story about any economy must honor. And yet it is an equation that the story in the World Competitiveness Report clearly violates.

Consider that story again. It asserts that capital will move from Western nations to low-wage countries – that is, that those nations will be able to invest more than their domestic savings because foreign capital will also be investing there. So for these economies the left-hand side of the equation is negative: investment exceeds savings. At the same time, it asserts that low-wage countries will export much more than they import, “deindustrializing” the advanced nations. So the right hand side is… positive?

When I have tried to explain this problem to people who find the story about low-wage competition persuasive, their first reaction is to ask what alternative story I propose. The obvious answer is that as capital and technology flow to low-wage nations, their wage rates will rise along with their productivity. As a result they will not run huge trade surpluses with advanced nations, indeed, they will run deficits, as the counterpart to the capital inflows. The usual reaction to this is that it is implausible, and that it is a typical economist’s assertion that markets will always do the right thing. I then ask what the questioner proposes; he replies that he believes that low-wage countries will run big trade surpluses. “So you think that low-wage countries are going to export large quantities of capital to high-wage nations?” At this point the conversation gets unpleasant, with some remark about this kind of thing being the reason why people hate economists.

It might also be worth noting that in these arguments people often bring in the observation that when multinational corporations have opened plants in low-wage countries, they often achieve near-First-World productivity but continue to pay Third World wages. The economist’s answer to this is that it is exactly what one should expect: wage rates should reflect average national productivity, not productivity in a particular factory; if only a few modern factories have opened in a country, they will not raise that country’s average productivity by much and should therefore not be expected to pay high wages. (And of course a country with low overall productivity that is able to achieve near-U.S. productivity in a few goods will tend to export those goods; it’s called comparative advantage). But no matter how much one tries to explain that this outcome is exactly what the standard model predicts, it seems to be viewed as somehow a decisive rejection of the economist’s optimism about the trade balance.

6. Myths and Realities of U.S. Competitiveness

Myths of Competitiveness

The classic analysis of the equilibrating forces in international trade is more than two centuries old. David Hume, living in a world in which precious metals were still the principal medium of exchange, pointed out that a country that had for some reason become uncompetitive, and as a result was importing more than it exported, would suffer a steady drain of gold and silver coins. This fall in the money supply, however, would lead to a fall in the level of prices and wages in that country; eventually goods and labor would become sufficiently cheap in the deficit nation that its goods would again become attractive to buyers, and the trade deficit would be corrected.

In the modern world the adjustment process is more complex and less automatic. In a world of national currencies no longer backed by gold, deficit countries usually adjust by depreciating their currencies rather than by letting wages and prices fall. Also, international capital movements have as their counterpart trade imbalances: A country that is able to attract an inflow of foreign capital will (as a matter of sheer accounting identity) also run a trade deficit, whereas a country that is exporting capital will run a surplus. Nonetheless, over the long term, major industrial countries show a strong tendency toward equality of imports and exports, regardless of their productivity and technological performance. Table 6.1 shows the balance on current account (a broad definition of trade in goods and services) of the three major industrial countries as a percentage of their national incomes for selected time periods. The average imbalances over the long term are quite small. During the mid-1980s large imbalances emerged, attributed by many economists to the unprecedented U.S. budget deficit and other special factors. By early 1991 about half of this divergence had again been eliminated (due in large part to a sharp rise of the dollar value of the yen and the mark), and the United States in particular was experiencing a broad-based export recovery.

Suppose that a country lags behind other nations in productivity. The equilibrating forces first noticed by Hume ensure that it will nonetheless be able to find a range of goods and services to export. But what will it export? The answer, pointed out by David Ricardo in 1817, is that a country whose productivity lags that of its trading partners in all or almost all industries will export those goods in which its productivity disadvantage is smallest. In the standard terminology of international economics, a country will always find a range of goods in which it has a “comparative advantage” even if there are no goods in which it has an “absolute advantage.”

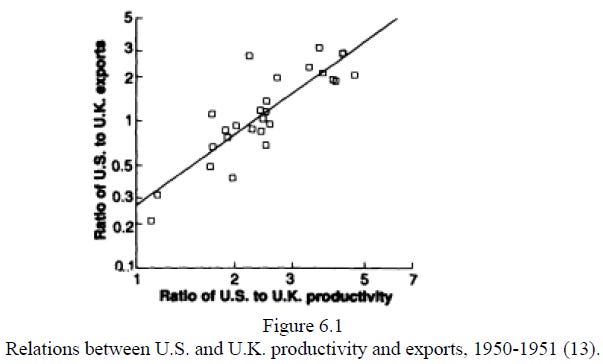

The classic empirical example of the principle of comparative advantage at work comes from the early post-war comparison of Britain and the United States. At that time, British productivity was far less than that of the United States – labor productivity in manufacturing was below U.S. levels in all major industries, and on average was less than half of the United States. The British economy, however, was much more dependent on foreign trade, and therefore was obliged to generate approximately the same dollar value of export earnings. If one looks at the comparative pattern of exports, one seems a clear picture of comparative advantage at work. Figure 6.1, plotted from data for a set of 22 industries, shows that there is a clear-cut association between relative productivity and relative exports. U.S. productivity was higher in all cases; but only in industries in which U.S. productivity was more than about 2.5 times U.K. productivity did the United States have larger exports. That is, Britain did not have an absolute advantage in anything, but it had a comparative advantage in those goods in which its productivity exceeded 40% of the U.S. level.

Britain’s ability to outsell the United States in industries in which its productivity was inferior depended, of course, on the fact that British workers were paid less than U.S. workers – a pay differential that was greatly widened by the 1949 devaluation of the pound from $4.80 to $2.80. A common reaction to this observation, and to such events as the recovery of U.S. exports that followed the decline in the dollar between 1985 and 1988, is that coping with international competition by lowering relative wages must lower a country’s living standards. Ricardo’s 1817 discussion of comparative advantage showed, however, that trade between two nations ordinarily raises the standard of living of both, even if one must compete on the basis of low wages.

We may see this point with a hypothetical example, similar to one introduced by Ricardo. Imagine a world in which the United States and Britain are the only trading countries and that there are only two goods, wool and aircraft. Suppose also that labor is the only input into production, and that U.S. labor is more productive than British in both. The U.S. advantage is, however, much more pronounced in aircraft. Table 6.2 illustrates a hypothetical set of productivity numbers.

Clearly, if these two countries are going to be able to sell goods to each other, the U.S. wage rate must be at least 1.5 times that of Britain – otherwise both goods would be cheaper to produce in America – but no more than 6 times as high. The actual wage rate would depend on demand conditions and the relative size of the economies, but let us simply suppose that the relative wage rate is 3. At that wage rate, wool would be cheaper to produce in Britain, which would therefore export it, whereas aircraft would be cheaper to produce in the United States. If prices are proportional to labor cost, one unit of wool, which requires one-half unit of British labor, would trade for one unit of aircraft, which requires one-sixth unit of the more expensive U.S. labor.

Now we ask, “Is Britain better or worse off trading with the United States, on the basis of a wage rate only one-third as high, than it would be in the absence of trade?” The answer is that it is better off. In the absence of trade, it would take one unit of British labor to produce one unit of aircraft. By trading with America, Britain can acquire an aircraft by trading a unit of wool for it, which requires the use of only one-half unit of labor. That is, the opportunity to trade with America raises the purchasing power of British labor.

This is a grossly simplified example, but it makes a crucial point. A country that is less productive than its trading partners across the board will be forced to compete on the basis of low wages rather than superior productivity. But it will not suffer catastrophe, and indeed will normally still benefit from international trade. The point is that international trade, unlike competition among businesses for a limited market, is not a zero-sum game in which one nation’s gain is another’s loss. It is positive-sum game, which is why the word “competitiveness” can be dangerously misleading when applied to international trade.

Although this is a crucial point to appreciate, it is also important to understand what the example has and has not demonstrated. Returning to our thought experiment, we have not shown that the United States, with its 1% annual productivity growth, is as well off as it would be if it shared the rest of the world’s 4% growth; clearly, it is not. Nor have we even shown that the United States is better off with the rest of the world growing at 4% than at 1%. In fact, it could be either better or worse off; this depends on details, specifically on whether rest-of-world growth is biased toward goods the U.S. exports (in which case the United States is hurt) or toward goods that the United States imports (in which case the United States is helped)5. All that we have shown is that low productivity does not pose a worse problem for a country that is engaged in international trade than for one that is not. Britain in 1950 had a productivity problem (and still does); the negative impact of that problem on Britain’s standard of living, however, was no greater, and in fact less, because Britain was a trading nation rather than a self-sufficient society.

We should also note that the discussion here has so far omitted a factor that is critical in the real-world politics of international trade: income distribution. Changes in international trading patterns often have strong effects on the distribution of income within countries, so that even a generally beneficial change produces losers as well as winners (at least in the short run). If foreigners are willing to sell us high-quality goods cheaply, that is a good thing for most of us, but a bad thing for the domestic industry that competes with the imports. This observation cuts both ways. On one side, economists sometimes blithely speak of the benefits of free trade, ignoring the sometimes substantial costs of adjustment. On the other hand, much opposition to free trade represents special interest pleading, and an appeal to the need for “competitiveness” is often used as a cloak for narrow self-interest.

Realities of Competitiveness

The discussion so far seems to suggest that competitiveness, if it means anything, is a non-issue: Even unproductive countries have a range of goods in which they have a comparative advantage, and more or less automatic forces will always ensure that a country is competitive in industries in which it has a comparative advantage. Yet we should not be too quick to dismiss the idea that there is some real problem to which concerns about competitiveness are a response. For in the discussion above I have made an implicit assumption that is clearly untrue in some instances – that countries’ comparative advantages determine their pattern of trade, rather than the other way around.

Much international trade is driven by enduring national differences in resources, climate, and society. Brazil is a coffee exporter because of soil and climate, Saudi Arabia an oil exporter because of geology, Canada a wheat exporter because of the abundance of land relative to labor, and so on. Trade in manufactured goods among advanced industrial countries, however, particularly in higher sophisticated products, is harder to explain6. In many cases industries seem to create their own comparative advantage, through a process of positive feedback.

The process through which comparative advantage can be created is illustrated in Fig. 6.2. Suppose that a country has for whatever reason established a strong presence in a particular industry. Then this presence may produce what in standard terminology are called “external economies” that reinforce the industry’s strength. External economies come in two main variants. So-called technological external economies involve the spillover of knowledge between firms: to the extent that firms can learn from each other, a strong national industry can give rise to a national knowledge base that reinforces the industry’s advantage. Pecuniary external economies depend on the size of the market: a strong domestic industry offers a large market for specialized labor and suppliers, and the availability of a flexible labor pool and an efficient supplier base reinforces the industry’s strength.

When external economies are powerful, international specialization can have a strong arbitrary quality. During an industry’s informative years, or during a transitional period when shifts in technology or markets have invalidated existing patterns of advantage, a country may establish a lead in an industry due to historical accident – or government support. Once this lead is established, it becomes self-reinforcing and tends to persist.

The importance of external economies is obvious in interregional specialization within the United States. Such famous industry clusters as Silicon Valley and Route 128, as well as less well-known examples like the cluster of carpet manufacturers around Dalton, Georgia (or the insurance cluster in Hartford, Connecticut) clearly reflect the self-reinforcing effects of success rather than underlying resources. International examples include Swiss watches, Italian ceramic tiles, and the role of London as a financial center.

It is probably true that external economies are a more important determinant of international trade in high-technology sectors than elsewhere, although they are by no means restricted to high tech. There is some dispute over whether the basis of international trade has shifted away from traditional comparative advantage toward created advantage. What is definitely true is that although the idea of external economies is an old one, going back to Marshall, recent developments in the analysis of international trade have placed increasing emphasis on the role of history, accident, and government policy in producing trade patterns.

The proposition that comparative advantage may be created rather than exogenously given somewhat qualifies the generally benign picture of international competition given in the first part of this paper. It suggests that under some circumstances countries may lose, or fail to establish, industries in which in the long run they might have been able to acquire a comparative advantage. This, in turn, provides a potential case for government intervention.

The traditional version of this line of reasoning is the infant industry argument for developing countries. Countries new to industrialization, the argument goes, face established competitors who already have the knowledge base, suppliers, and specialized skills in industries where these are important. Absent government intervention, the new entrants will therefore find themselves producing only goods in which external economies are unimportant, and will be stuck with permanently lower wages. By promoting targeted industries, they can in principle escape from this trap.

The new version of the argument involves established countries but new industries. Let us set up an exaggerated case, bearing in mind that it overstates the reality. Suppose that the United States trades with Japan and that Japan systematically promotes new high-technology industries as they emerge. This promotion may take the form of government subsidy, but it can also take the form of explicit or implicit protection of the domestic market, which both denies U.S. firms an important market and ensures Japanese firms of sales. Then, other things equal, Japan will tend to establish a competitive advantage in emerging high-technology sectors. This will not be catastrophic for the United States: the principle of comparative advantage still applies, and the United States will still find a range of goods to export. It will, however, increasingly be forced to compete on the basis of low wages rather than high productivity.

This story bears enough resemblance to reality to touch some raw nerves. Japan does not engage in extensive subsidy to industry, and on paper its markets are quite open to imports of manufactured goods. In practice, however, as indicated in Table 6.3, the Japanese market for high-technology goods has remained a virtually closed preserve for Japanese firms, whereas such markets have become increasingly internationalized not only in the United States but also in Europe.

This, then, is the real competitiveness issue: The possibility that international competition will exclude the United States from some industries in which it could or should have had a comparative advantage. Having identified this as a valid argument, we need to offer some strong warnings against overuse.

First, although government subsidy and unequal access to markets have surely played an important role in determining the outcome of international competition in a few industries, they are unlikely to be the major explanation of disappointing U.S. economic performance. Most of the output of U.S. economy is not traded internationally: in 1990, imports and exports were only 13 and 12.3% of gross national product, respectively. Furthermore, as Table 6.4 shows, since 1980 the United States has actually experienced a striking revival of productivity growth in manufacturing, which is precisely the sector most exposed to international competition. To the extent that the United States continues to perform poorly compare with other major industrial nations, this has a great deal to do with a low national savings rate, low spending on R&D, and low-quality basic education. Failure to create advantage is at best a contributing factor.

Second, the national pursuit of competitive advantage should not be unrestrained, because unilateral pursuit of advantage can work to everyone’s disadvantage. For example, the United Kingdom undoubtedly derives significant benefits from the London’s role as the financial capital of Europe, benefits that would be lost if that capital were in, say, Frankfurt instead. Yet Europe as a whole would almost surely be worse off if nationalistic policies led to a fragmented financial system divided among Frankfurt, Paris, Milan, and London. That is, it is better for the British that the City be in Britain rather than elsewhere; but it is in the common interest that there be a City (or a Silicon Valley or Route 128) somewhere, so that the advantages of such a cluster’s external economies can be realized.