Proponents of minimum wage laws usually cite the study “Minimum Wages and Employment: A Case Study of the Fast-Food Industry in New Jersey and Pennsylvania” (1994), by David Card and Alan Krueger, as a defense against criticism of the minimum wage. Far from creating more unemployment, a higher minimum wage may also increase employment, they say. But the argument is filled with numerous flaws.

First of all, relying just on a single controversial study, while ignoring the many other studies reporting a negative effect of the increase of the minimum wage, is not very rigorous. More damaging is the fact that it is inconsequential to the criticisms of minimum wage that pose the argument that minimum wage increases unemployment when the cost of a laborer exceeds its productivity. If the minimum wage does not increase unemployment at all, one could multiply it by 2, 5, or 10. It is not difficult to understand why no serious economist would advocate such a policy. The jobs will disappear altogether.

Proponents of the minimum wage may argue that higher wages is likely to increase employee’s productivity. But this argument does not hold when firms as a whole pay such efficiency wages (i.e., a wage rate above the equilibrium level). Such efficiency wages can attract the best employees through an incentive effect but at the moment when all firms decide to pay a wage above the equilibrium level, this incentive will simply disappear. (see, A Criticism of the Efficiency-Wage Theory)

Another argument is that an increase of the minimum wage does not necessarily increase unemployment to the extent that employers can bypass this law, either by degrading working conditions, or by increasing the pace of work, or by reducing some benefits. However, if the final goal of the minimum wage was to reduce the bargaining power of employers, then this goal is a complete failure. Furthermore, if firms decide to degrade working conditions, it is plausible that such a measure would lead to reduce the productivity of (non marginal) employees, dismayed and demoralized by the policy of the firm, which would no longer find it so advantageous to bypass a surge in minimum wage.

Another criticism of the critics made against the minimum wage laws points to the imperfection of the market competition. This theory supposes that employers have local market power which places them in a strong position to dictate the salary. Thus, the wage rates are artificially low. For that matter, a monopsony will not be negatively affected by an increase of the minimum wage. This explains why an increase in the level of the minimum wage sometimes does not lead to an increase of unemployment but instead in a decrease of unemployment. The three reasons invoked are : limited geographical mobility, lack of information, and monopoly power.

First, the theory neglects a very important factor : monetary overexpansion. Indeed, as it is well explained by the Austrian Business Cycle Theory, see de Soto, monetary overexpansion will trigger malinvestments and bubbles. Therefore, the increase of house prices tends to diminish the bargaining power of poor people, since their geographical mobility is seriously weakened by the ever-increasing prices of houses.

Second, the lack of information about job opportunities may be tied to some extent to IQ. It is well informed that, even when social economic status (SES) is held constant, high IQ people tend to be much more informed about almost everything (Gottfredson, 1997, 2003). And IQ is highly heritable. Even the heavily financed educational programs, aimed to rise IQ of poor children, have all failed to produce lasting effects. The government can hardly hope to solve the problem by such means. Some may argue that SES helps to overcome the problem of a lack of information, but this neglects the fact that IQ is a better predictor of economic success than is parental SES (see, The Bell Curve). That there are information asymmetries (see, Some Flaws with Akerlof’s Adverse Selection) does not necessarily mean that the market cannot correct or reduce these asymmetries, as long as there is a demand for labor. And one must still consider the economic environment, regulated at every level, that is likely to reduce market efficiency to transmit information.

As for the monopoly power, Rothbard convincingly dismantled the monopoly theory and the monopoly-price theory, in chapter 9 and 10 of Man, Economy and State. Cartel and monopoly are not sustainable, unless governments impose barriers to entry in order to limit competition.

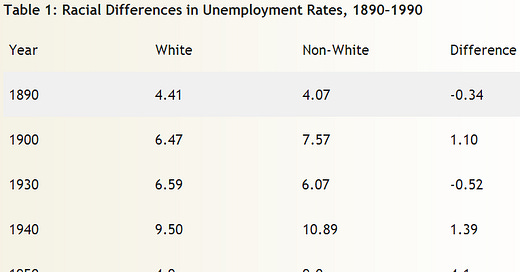

Another fact that seems to be ignored by the proponents of the minimum wage is that its increase will widen black-white disparity in unemployment rate.

Prior to the first federal minimum wage bill passed on the 1930s, there was virtually no difference between black and white teenage (i.e., unskilled) unemployment, at a time when many assume that racism was more prevalent than today. After the minimum age bill is passed, however, we see an increase in black teenage unemployment relative to whites, since as employers are now forced to pay a wage that is higher than the value of many workers’ marginal revenue product, they no longer incur a market penalty for allowing racism to dictate their market decisions.

“Diversity, Yes; Force, No” Mises Daily: Monday, December 18, 2006 by Christopher Westley

Some facts that should not be ignored :

Studies have found that increases in the minimum wage encourage some teenagers to drop out of school earlier than they otherwise would. These teenagers take jobs that would go to unskilled adults, making it harder for those adults to make the transition from welfare to work.

“We can’t ignore law of supply and demand” By N. Gregory Mankiw, 6/24/2001

David Neumark and William Wascher found that a 10 percent increase in minimum wages decreased on-the-job training for young people by 1.5–1.8 percent. Since on-the-job training is the way most people build their salable skills, these findings suggest that minimum wage laws also reduce future opportunities for the unskilled.

“Minimum Wages” by Linda Gorman

Before looking at the evidence, let’s do some a priori theorizing based on the history of US corporate regulation. Historians such as Robert Higgs, Butler Shaffer, Dominick Armentano, and Gabriel Kolko have chronicled how the rise of business regulation, including intervention in market wages, was pushed by large companies for one main reason: to impose higher costs on smaller competitors.

This is how child labor legislation, mandated pensions, labor union impositions, health and safety regulations, and the entire panoply of business regimentation came about. It was pushed by big businesses that had already absorbed the costs of these practices into their profit margins so as to burden smaller businesses that did not have these practices. Regulation is thus a violent method of competition. [...]

The current minimum is $5.15. According to studies, Wal-Mart pays between $8.23 and $9.68 as its national average. That means that the minimum wage could be raised 50% and still not impose higher costs on the company. [...]

So who would it affect if not Wal-Mart? All of its main competitors. And the truth is that there are millions of businesses that compete with it every day. Many local stores have attempted to copy Wal-Mart’s price-competitive model, but face lower costs and can actually thrive.

“Wal-Mart Warms to the State” Mises Daily: Friday, October 28, 2005 by Llewellyn H. Rockwell Jr.