The american economy in the 1873-1896 is usually portrayed as the Great Depression of 1873-1896 (Wikipedia). But to say this is a myth is not very far from the truth (Higgs, 1971; Catalan, 2011). One feature of this period is the deflation. And deflation is often viewed as bad, because it has been associated with periods of recession (which is curious given the proof to the contrary). And yet it is important to make the distinction between good and bad deflation (Bordo & Filardo, 2005). What is usually termed good deflation is productivity-driven and what is termed bad deflation is demand-driven. But what the U.S. economy of the 1870-1890s had was a good deflation, which was found to have produced better economic outcomes than inflation (Beckworth, 2007). The characterization that this period was felt as distressful to most people is wrong. Equally false is the claim that the U.S. during this period has gone through many deep recessions (Beckworth, 2007).

Why deflation is better than inflation and constant-price regimes

The fact that deflation is associated with depression is curious. Friedman & Schwartz (1963 [1971], p. 93) reached the conclusion that the forces making for economic growth over the course of several business cycles are largely independent of the secular trend in prices. Similar conclusion is provided by Ryska (2014). In a study using VAR analyses on the U.S. and European countries (U.K., Germany, France) of the 1880-1913, Bordo et al. (2010, p. 540) found that the output was essentially supply driven in the European countries, which implies that money was neutral, whereas money was non-neutral in the U.S. only because of the presence of crises, probably due to unstable banking system. Overall, it cannot be concluded from these studies that deflation causes slower economic growth.

Supply-driven deflation may be considered as good deflation, insofar as productivity gains make goods and services cheaper and cheaper. But the definition given to bad deflation is obviously obscure and inaccurate. The bad deflation owing to falling demand is caused by excessive debt, which is caused by malinvestments as described the Austrian Business Cycle Theory. I insist on this point because keynesians always speak about insufficient demand without any reference to malinvestments but instead attribute (bad) deflation to savings while austrians consider that savings make the economy more productive.

Deflation is particularly feared due to increasing debt burden. If one borrows at 10% during a year which the price level declines by 5% it's as if he would have borrowed at 15.8% when prices are stable. As Selgin (1997, p. 42) noted, an unanticipated increase in debt is offset by an unanticipated increase in real income. But if deflation is the result of the recession (due to accumulated malinvestment), the income won't rise to compensate for increasing debt burden. But perhaps price stability is better than deflation ? Not even so. Selgin (1997, p. 41) has argued that "The argument, like most arguments for a constant price level, is perfectly valid so long as aggregate productivity is unchanging". If productivity increases, there is no specific advantage of price stability. But when productivity falls, such rule requires a contraction (i.e., decline) of all non-fixed money incomes. Besides leading to a further depression of real activity (if prices and wages are sticky), such a rule might well result in certain debts not being paid at all. Some creditors might, in other words, escape the consequences of fallen productivity, by letting others bear a disproportional burden. Selgin (1999) argues that if it is admitted that debtors' and creditors' interests are best served by an increase in prices when productivity declines, then symmetrical reasoning suggests that those same interests are best served by allowing prices to fall as productivity advances. Furthermore, one additional issue with a zero inflation policy arises when debtors and creditors are inclined to index money rates of interest to the rate of inflation or deflation. Under zero inflation, productivity indexing would require an upward adjustment of nominal interest rates proportional to the higher growth rate of real (and, in this case, nominal) income. Otherwise, the interest rates would be allowed to fall if debtors negotiate for a lower interest rate due to anticipation of falling prices. Some of these arguments were also made in Selgin's (1988, ch. 7 & 9) book on the theory of Free Banking.

One unexpected consequence of central policies for maintaining a constant-price regime, is that it may pushes the interest rates temporarily below their natural levels (Selgin, 1995b, pp. 714-715; Selgin, 1997, pp. 32-33). Because nominal prices do not adjust sluggishly to productivity changes but almost immediately, no excess demand for money arises. For this reason, changes in the demand for real money balances based on innovations to aggregate productivity are accommodated by falling prices automatically and well ahead of any possible monetary policy response. Monetary injection in this situation will bring excess money in the hand of people and cause malinvestments.

The belief that sellers are reluctant to adjust their price downwardly is also wrong. Sellers actively seek ways to improve productivity just so that they can charge less than their rivals without sacrificing profits. Productivity-based price cuts are a healthy aspect of the competitive process (Selgin, 1999).

An interesting thing about the zero inflation policy is that it involves more, not less, money price adjustments than what would be the case under productivity norm, a regime under which the price levels are allowed to vary to reflect changes in goods' unit costs of production (Selgin, 1995a, pp. 736-737; Selgin, 1997, pp. 26-27). And the higher the number of distinct prices in factors in production, and the larger the number of exceeding adjustments under the zero inflation policy. Thanks to productivity gains, nominal wages will remain stable or increase slightly, but under price stability regime, productivity gains must take the form of more rapidly increasing nominal wages (Selgin, 1999). Suppose, for example, that labor productivity grows at an annual rate of 3%, while total factor productivity grows at an annual rate of 2%. Then the real wage rate, which reflects labor productivity, should also increase at an annual rate of 3%. If consumer prices are allowed to decline at a rate equal to the rate of growth of total factor productivity, money wage rates will still increase at 1% annual rate. If, in contrast, the authorities insist on stabilizing the CPI, money wage rates must increase 3% a year. And because nominal wages are less flexible than output prices, a policy of avoiding or limiting wage-rate adjustments by allowing prices to fall is less likely to be a source of labor-market frictions and consequent labor misallocation. Productivity norm minimizes the need for changes in the least flexible prices (Selgin, 1995b, p. 720). In addition to this point, price stability requires a contraction in money supply in the face of a decline in productive efficiency. Not only it will result in problems with debt payments but such policy also needs nominal wages to decline (Selgin, 1988, ch. 7; Selgin, 1997, p. 30). In other words, price stability involves nominal wage adjustments that would be absent if prices were allowed to increase. Selgin (1995a, p. 738) even says that the combination of constant and fixed prices and nominal wages (due to, e.g., wage stickiness) will cause a rise in unemployment, when productivity declines.

Generally, authorities seek (mild) inflation more than price stability. But inflation, even in relative terms (i.e., maintaining prices constant when the prices should have declined), produces the so-called malinvestments described by the ABCT. Such boom-bust cycles certainly hurt economic growth and prosperity.

Although Selgin's (1997) treatise offers the best argument for deflation, Reisman's (1996) treatise is not bad at all. There is theoretically no reason to believe that deflation is harmful. Instead, deflation appears to be more conducive to economic growth and prosperity than either price stability or inflation.

Empirical evidence on the American economy of 1873-1896

The best evidence of economic prosperity comes from Beckworth (2007). Figures 1-2 show that the trends in real GNP, real GNP per capita and real wage give an indication that the U.S. economy was clearly not the period of distress portrayed by many historians and economists. The GNP deflator shows that price levels were declining at a modest rate. Interestingly, we don't see any sign of deep recessions in these data. Between 1866 and 1897, secular deflation averaged just over 2% a year while real GNP grew almost 4% a year (Figure 1).

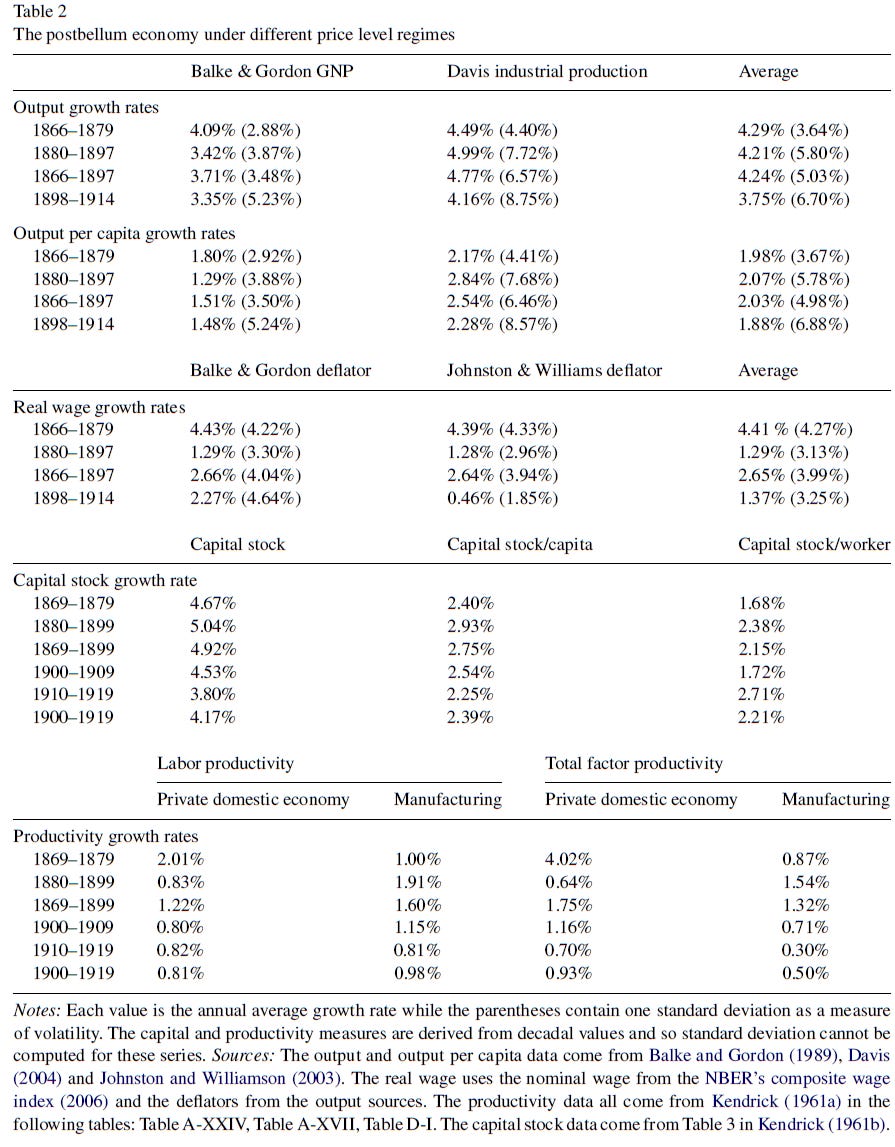

Beckworth (2007) also shows in Table 2 that deflation was more conducive to economic growth than inflation. The real wage growth during the deflation period clearly exceeds the real wage growth during the inflation period, particularly during the 1866-1879 period. These real wage gains are consistent with the productivity growth rates of Kendrick (1961a) shown in Table 2 which indicate greater productivity gains during the deflation period. Table 2 also shows the growth rates of the capital stock, the capital stock per capita, and the capital stock per worker for the postbellum period as reported in Kendrick (1961b). Since firms under normal market conditions will only take on additional investment expenditures if they expect a positive rate of return, the growth of the capital stock can be viewed as a proxy for firms' expectation of current and future profitability.

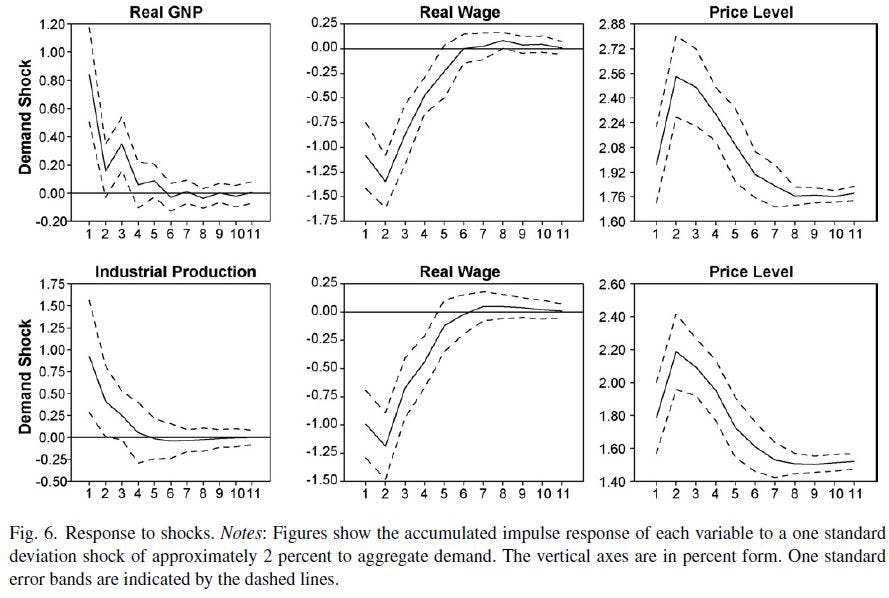

Although deflation was benign, this outcome may be the result of an economy with little-to-no nominal rigidities (price or wage stickiness) that easily could have handled any price level regime. If so, it isn't meaningful because such episode would have no relevance for understanding deflation in the modern world where nominal rigidities are considered important. So, Beckworth applied the vector autoregressions (VARs) to identify economic shocks and their influence on economic activity. Studies usually apply this method. A common identification strategy used in these studies is to impose the Blanchard and Quah decomposition of VAR shocks into permanent and temporary components. Among other things, this approach allows for the identification of nominal shocks and their effect on the real economy. The idea is that if nominal wages are sticky then real wages should be countercyclical (i.e., moving in the opposite direction of the overall economic cycle, or rising when the economy is weakening and falling when the economy is strengthening) and it would show up in an impulse response function following an aggregate demand shock.

The data variables in use are the log of the Balke & Gordon (1989) real GNP and GNP deflator series, and the log of the NBER's composite wage index (2006) to the Balke & Gordon (1989) GNP deflator ratio. The model is also re-estimated using the log of the Davis (2004) industrial production series as a measure of output. First differencing of all three variables is used because there was evidence of nonstationary using standard unit root tests in the levels. Since the data is limited to an annual frequency and VAR lags use up observations, additional years are included up front to offset the lags and increase the degrees of freedom. The Ljung-Box Q statistic indicates at least two lags are needed to eliminate serial correlation and whiten the residuals in both versions of the VAR. Consequently, the VARs are estimated using two lags for the years 1864-1897.

Figure 6 shows the accumulated impulse response functions (AIRFs) of the three endogenous variables over an 11-year response to a 1 SD aggregate demand shock of about 2 percent. The top panel in this figure shows the VAR estimated with real GNP and the bottom panel shows the VAR estimated with industrial production. The top panel reveals a 1 SD shock to aggregate demand increases output by 0.84% upon impact, while the bottom panel indicates output increases to 0.92%. Stated differently, a 1% shock to aggregate demand would be followed by an initial increase in output of 0.42-0.46%. This effect gradually unwinds and is close to zero by year four. This same 1 SD shock causes the real wage upon impact to fall 1.08% in the top panel and 1.00% in the bottom panel. The real wage, therefore, would initially fall by about a half a percent following a 1% shock to aggregate demand. The real wage would return to its original value by year six. The aggregate demand shock, therefore, has a short run effect on output and the real wage, but permanently increases the price level. This contemporaneous increase in the price level and decline in the real wage indicates nominal wages were relatively slow to adjust to the aggregate demand shock during this time. Moreover, these AIRFs imply nominal wage rigidities were nontrivial during the postbellum period of deflation since there was a decline in the real wage accompanied by an increase in output.

Figure 7 reports the VAR's historical decomposition of the output growth rate into an actual path series (solid line), a baseline forecast series (long-dashed line), and a baseline forecast plus the effect of aggregate demand shocks on output (short-dashed line). The baseline forecast is a projection of the growth rate of output that does not include any of the structural shocks in the period being forecasted. We see that although far less important than aggregate supply shocks (the difference between the baseline plus aggregate demand series and the actual path series) the aggregate demand shocks still were consequential to economic activity. The historical decomposition under both output series shows aggregate demand shocks increased output by as much as 3.4% and decreased output by as much as 2.6%. Aggregate demand shocks mattered to the postbellum economy.

One common complaint about deflation is the increased difficulty in repaying debts, and this is especially true for farmers at that time. One way to circumvent this problem is to allow nominal interest rates to decline. This is what happened during the U.S. economy of 1870s-1890s (Higgs, 1971, pp. 97-99; Beckworth, 2007, Figure 4). Interest rates fell for two reasons. First, with increasing accumulation of savings, competition among lenders forced interest rates down. Farm mortgages were generally drawn for terms of 1 to 5 years, and when extensions or new loans were negotiated farmers usually contracted at a new, lower rate of interest. Secondly, the general downward trend in prices has occurred during the three decades before 1897. Recognizing that deflation seemed to be a fact of life, many farmers no doubt bargained with lenders for a lower rate of interest in anticipation of falling prices. Indeed, the interest rate on farm mortgages tended to fall everywhere throughout the last quarter of the nineteenth century, though rate differences among places persisted, reflecting differences in the risks attending loans.

To answer this question more directly, Higgs (1971) explains that debt burden wasn't a problem at all :

In a recent study, Robert Fogel and Jack Rutner have argued, however, that the increased real burden of debt repayment attributable to falling prices was almost negligible for farmers in general. "[C]apital losses on mortgages due to unanticipated changes in the price level had only a slight effect on the average profit of farmers. [See Table 4-4] . . . [T]he debt to asset ratio was low (about 13 percent) for most farmers. It was only the farmer with a high debt to asset ratio who was badly hurt by the declining price level. But such farmers were atypical."

Yet there seems to be some discontent among farmers for a variety of reasons. Higgs (1971, p. 100) observed that, although farmers became substantially better off in absolute terms, they became worse off relative to others. Many farmers probably didn't accept that outcome. while Beckworth (2007, p. 206) observed that farmers complained due to uncertainty, specifically the huge volatility in their purchasing power over the short run, resulting from the integration of U.S. agricultural sector into the world economy and the growing commercialization of farming.

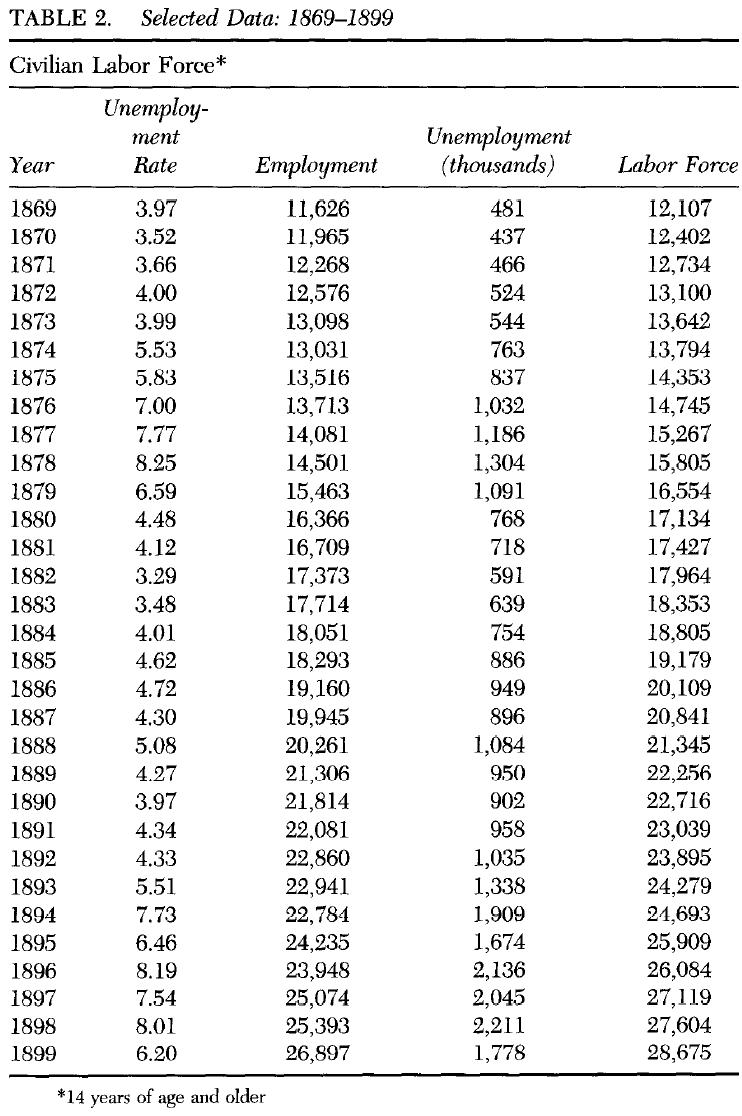

By far the most curious feature of the said period is the data on unemployment rates. Although economic growth is strong, the unemployment rates weren't low, according to most estimates (Lebergott, 1964; Romer, 1986). However, the numbers reported by Vernon (1994) show a much lower estimate. Vernon's estimate should be trusted more than Lebergott because, among other things, these figures exaggerate the cyclical movement in unemployment rate by neglecting a procyclical movement in labor force. Secondly, Vernons' 1890s employment series is interpolated with a single employment index, the Frickey (1947, 212) series covering factory employment in Ohio and several northeastern states. But factory employment is much more volatile cyclically than total employment. Given Vernon's (1994) figures, the unemployment rate peaks at about 8% for just a single year (1878).

Selgin et al. (2012) graphed the data on unemployment rate from 1869 to 2009. Again, these rates were high only during the period of economic crises, i.e., 1874-79 and middle 1890s (see e.g., Rothbard, 2002, pp. 168-169).

Higgs (1971, pp. 123-124) reported high unemployment rates based on Lebergott's data, but he believes this may be the cost of a strong economic growth.

Though inventions led to increased efficiency in production, they often meant bankruptcy for those employing older processes. David A. Wells, despite his pervasive optimism, was perceptive enough to recognize that "nothing marks more clearly the rate of material progress than the rapidity with which that which is old and has been considered wealth is destroyed by the results of new inventions and discoveries." Though migration allowed young people to obtain higher incomes, it often left their parents lonely and unhappy in the old home. Though the settlement of fertile Western lands provided cheaper food for urban dwellers, it often meant ruin for Eastern farmers. And similar contrasts might be recited at great length. We could say that people did adjust; ultimately everyone was better off. But such an interpretation is incomplete and ignores the costs imposed on people by the disruptive transformations that inevitably accompanied economic growth.

The inescapable fact is that economic growth hurt many people. Some recovered their losses, but others did not. Economic growth meant Progress from a social point of view because it created more wealth than it destroyed, but the distribution of the gains and losses was quite unequal. If we are interested in individual welfare, the answer to the question "Was progress worth its price?" must necessarily be that for some it was, and for others it was not. It will hardly do to say that individuals "freely chose to have economic growth," because growth was a social process; the actions of a single individual simply did not matter one way or the other. An individual could determine his own program of saving and investment, but he could neither foresee nor control the future development of the market system. He could not know that the investments made in such hopeful expectations and based on the most reliable available information were often destined to become reductions in his wealth.

In any case, if many economists believe that falling prices cause a rise in production costs and unemployment, a secular decline in prices must be followed by a secular increase in unemployment rate, but which patterns do not appear in the data.

It could be that the high unemployment rate in this period is not the result of deflation but has something to do with the great changes that have accompanied economic growth. Usually, crises share common features such as massive banking failures and layoffs, as well as contraction in economic activity. But those features don't apply to the American period of 1873-1896. For example, the financial crises were probably due to a lack branch banking which makes the banking system more susceptible to external shocks (Beckworth, 2007, p. 205). The absence of branch banking is generally a sign that the banking system wasn't (still) very developed (Selgin, 1988). But not in this case. Beckworth noted that branch banking was literally prohibited. Beckworth also noted that the imposition of a tax on state bank notes made banking under a state charter unprofitable. All of these features work to slow down the economic growth. Concerning the economic transformation as a whole, Higgs (1971, pp. 47-48, 56, 65-66) has a good description of the situation. For instance, during the 1870's steam surpassed water as a source of power, and after 1890 electrical power was increasingly applied in industrial uses. Between 1865 and 1915 aggregate energy consumption increased more than five-fold, and mineral fuels (predominantly coal), which had provided less than 20% of this energy in 1865, furnished over 85% in 1915. The U.S. economy was experiencing an industrial revolution.

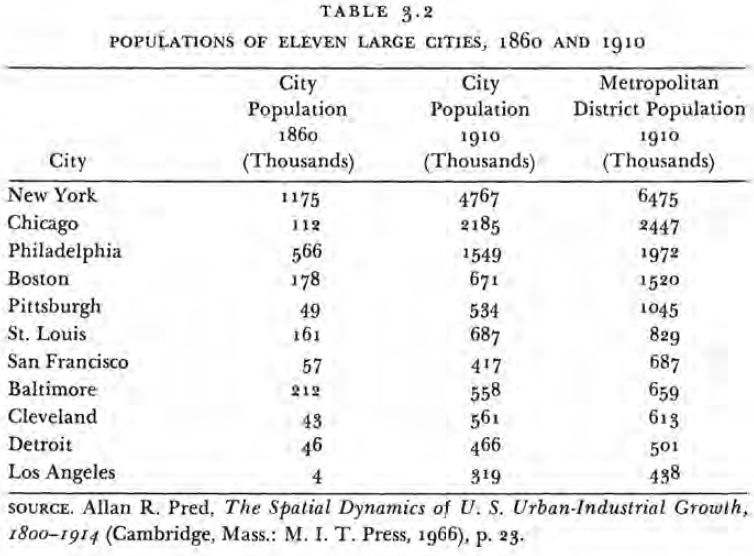

The composition of the economy's total output changed dramatically in the post-Civil War era (Table 2.6). As their incomes rose, consumers increased their spending for the products of agriculture only slowly, and for manufactured products much more rapidly. Moreover, the rise in the fraction of total income used to finance material investment placed a greater demand on the manufacturing industries. As a result, the rate of return in manufacturing enterprises became relatively greater, and entrepreneurs moved to expand such production; at the same time many farmers, discouraged by their relative lack of success, sought to improve their condition by seeking nonfarm occupations. The upshot of these movements was the transformation of a predominantly agrarian economy into a great industrial economy - a transformation so sweeping and pregnant with implications that economic historians have called it an "industrial revolution" and made it the focus of a major part of their research for the past century. In 1870, after several decades of industrial growth, the United States had a manufacturing output equal to that of France and Germany combined, but only about three fourths as large as that of the United Kingdom; by 1913 the American manufacturing output equalled that of France, Germany, and the United Kingdom combined! Still the greatest producer of raw materials and foodstuffs, the United States had become the world's industrial giant as well.

And one consequence of this transformation is illustrated in Table 3.2 :

Apparently, it is due to those great transformations and a frail banking system that unemployment rates weren't as low as we would have expected.

Still, there is another comment on the Great Depression, notably the 1873-79 period. Newman (2014, p. 492) argued that the revised GNP estimates from Davis (2006) show that the depression was only limited to the period 1873-75. Newman (2014, pp. 494-495) continues and says that the belief that there was a depression from 1873 to 1879 was mainly due to faulty economic statistics and reliance on nominal rather than real values. In fact, there was recovery since 1875 (despite declining money supply) without fiscal or monetary stimulus. Balke & Gordon's index didn't show this, because one of the main series they build on was the railroad output-dominated Frickey transportation and communications index. Because railroads suffered a severe decline, their estimated output is downwardly biased. Perhaps more importantly, the high unemployment estimates from either Lebergott or Vernon are implausible. For instance, Vernon derived his estimates based on Balke & Gordon's GNP series, which must certainly understate output growth (Newman, 2014, p. 496). Unemployment rates thus shouldn't be this high.

Similarity with the U.K. economy of 1873-1896

A similar story is reported by Selgin (1997, pp. 51-53) who describes the features of the UK economy in the period of 1873-1896. Falling prices were inspiring people to go shopping. Real wages were rising. Almost all indices of economic activity show an upward trend. The cause of deflation was due to a fall in real unit production costs for most final goods during this entire period. There were just certain branches of economic activity that were depressed; in Britain these included foreign trade prior to 1875, agriculture in the late 1870s, and (as a result of increased foreign competitiveness) 'basic industries' such as the iron industry beginning in the 1880s. Here's the detailed report of the 1873-1896 Depression in the UK.

Reference

Beckworth, D. (2007). The postbellum deflation and its lessons for today. The North American Journal of Economics and Finance, 18(2), 195-214.

Bordo, M., & Filardo, A. (2005). Deflation and Monetary Policy in a Historical Perspective: Remembering the Past or Being Condemned to Repeat It?. Economic Policy 44 (20): 799-844.

Bordo, M. D., Landon-Lane, J., & Redish, A. (2010). Deflation, productivity shocks and gold: evidence from the 1880–1914 period. Open Economies Review, 21(4), 515-546.

Catalan, Jon M.F. (October 3, 2011). America's Greatest Industrial Transformation. Mises Daily.

Friedman, M., & Schwartz, A. J. (1963 [1971]). A monetary history of the United States, 1867-1960. Princeton University Press.

Higgs, R. (1971). The transformation of the American economy, 1865-1914: An essay in interpretation. New York: Wiley.

Newman, P. (2014). The Depression of 1873-79: An Austrian Perspective. Available at SSRN 2518225.

Reisman, G. (1998). Capitalism: A treatise on economics. Ottawa, IL: Jameson Books.

Romer, C. (1986). Spurious volatility in historical unemployment data. The Journal of Political Economy, 1-37.

Rothbard, M. N. (2002). History of Money and Banking in the United States: The Colonial Era to World War II, A. Ludwig von Mises Institute.

Ryska, P. (2014). Deflation and economic growth in long-term perspective (No. 18/2014). IES Working Paper.

Selgin, G. A. (1988). The theory of free banking: Money supply under competitive note issue. Cato Institute.

Selgin, G. (1995a). The Case for a "Productivity Norm": Comment on Dowd. Journal of Macroeconomics, 17(4), 733-740.

Selgin, G. A. (1995b). The 'Productivity Norm' versus Zero Inflation in the History of Economic Thought. History of Political Economy 27 (4): 703–35.

Selgin, G. A. (1997). Less than Zero: The Case for a Falling Price Level in a Growing Economy. London: Institute of Economic Affairs.

Selgin, G. A. (1999). A Plea for (Mild) Deflation. Cato Policy Report 21 (3).

Selgin, G., Lastrapes, W. D., & White, L. H. (2012). Has the Fed been a failure?. Journal of Macroeconomics, 34(3), 569-596.

Vernon, J. R. (1994). Unemployment rates in postbellum America: 1869–1899. Journal of Macroeconomics, 16(4), 701-714.