Empirical Evidence for the Austrian Business Cycle Theory: A Wealth of Econometric Studies

I have regrouped the series of articles on the ABCT. The present post is subject to modification and improvement over time, with my readings on the empirical works on the ABCT. Because this article is already too long, the studies not covered here will be treated in another article. The evidence is overwhelmingly supportive of the ABCT.

(Last update : December 2014)

CONTENT

1. Short introduction to time series regression.

2. Empirical studies.

Empirical Evidence on the Austrian Business Cycle Theory. Keeler, 2001.

Austrian Business Cycle Theory: Evidence from Scandinavia. Anker, 2011.

Austrian business cycle theory: Empirical evidence. Bismans & Mougeot, 2009.

An Empirical Examination of Austrian Business Cycle Theory. Mulligan, 2006.

A Hayekian Analysis of the Term Structure of Production. Mulligan, 2002.

Is Austrian Business Cycle Theory Still Relevant? Carilli & Dempster, 2008.

Is Austrian Business Cycle Theory Still Relevant? Carilli et al. 2006.

Empirical Evidence for Hayek’s Theory of Economic Fluctuations. Wainhouse 1984.

Evidence Regarding the Structure of Production. Sechrest, 2004.

Financial Market Shocks during the Great Depression. Chin & Warusawitharana, 2010.

The Recession of 1990: An Austrian Explanation. Hughes, 1997.

The recession and Austrian business cycle theory: An empirical perspective. Butos, 1993.

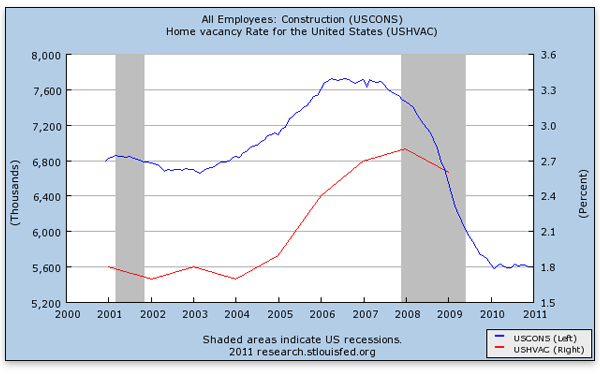

Can Austrian Theory Explain Construction Employment? Murphy, 2011.

Putting Austrian Business-Cycle Theory to the Test. Murphy, 2010.

1. Short introduction to time series regression.

Most macroeconomic time series are non-stationary or have means, variances and covariances that change over time. They should not be used because non-stationary data are unpredictable and cannot be modeled or forecasted. Time series regression may be spurious since they may indicate a relationship between two variables where one does not exist. Non-stationary behaviors can be trends, cycles, random walks or combinations of the three. There exists several forms of non-stationary processes : (1) Pure Random Walk denoted Yt=Yt-1+εt, (2) Random Walk with Drift denoted Yt=α+Yt-1+εt, (3) Deterministic Trend Yt=α+βt+εt, (4) Random Walk with Drift and Deterministic Trend Yt=α+Yt-1+βt+εt. The random walk (with or without drift) must be transformed into a stationary process by differencing (subtracting Yt-1 from Yt, i.e., Yt minus Yt-1) correspondingly to Yt-Yt-1=εt or Yt-Yt-1=α+εt and then the process becomes difference-stationary. If the data has a deterministic trend, detrending is needed. In the case of a random walk with a drift (a slow steady change) and deterministic trend, detrending can remove the deterministic trend and the drift, but the variance will continue to go to infinity. As a result, differencing must also be applied to remove the stochastic trend. The disadvantage of differencing is that the process loses one observation each time the difference is taken. If a series must be differenced once (or twice) before it becomes stationary, then it is said to be integrated of order one, I(1), or two, I(2), and it must have one (or two) unit root(s) (random walk). A stationary series without a trend is said to be integrated of order 0. For detrending we use Yt=α+βt+εt is transformed into a stationary process by subtracting the trend βt, i.e., Yt-βt=α+εt. No observation is lost when detrending is used to transform a non-stationary process to a stationary one. When the level of the series is not stable in time, i.e., increasing or decreasing trends, we say that the series is not stable in the mean. If it was variability or autocorrelation, we say the series are not stationary in the variance or autocovariance. If the distribution of the variable at each point in time varied over time, we say that the series is not stationary in distribution. On the other hand, the stationary process reverts around a constant long-term mean and has a constant variance independent of time.

For these reasons, these artifacts should be taken care of by way of unit root tests, such as Dickey-Fuller tests. But auto-correlation (error term at time t depending on previous error term at time t-1) may pose problems. The Augmented Dickey-Fuller (parametric) and Phillips-Perron (non-parametric) are the recommended methods in that situation. ADF and PP regressions attempt to control for serial correlations by including the lagged values of the differenced variable (also called lagged difference terms). In ADF, the number of lags is to be specified by the researcher. To determine the appropriate number of lags, model fit indices can be used, e.g., Akaike’s information criterion (AIC). The null hypothesis is that the variable is not stationary (have unit roots). It is rejected by examining the p-value, which may be problematic to the extent that it becomes smaller the larger the number of observations. When a given variable is not stationary, it must be transformed and used in unit root tests. If the t-test is significant, it is ready to be used in the fixed effect regression.

It is also possible, given stationarity, to use a Granger causality (multiple regression) test. A variable (X) is said to Granger cause another variable (Y) if Y can be better predicted by the lagged values of both X and Y than by the lagged values of Y alone. In other words, the test evaluates whether or not the lagged values of one variable improve the forecasts of another variable. But it would lead to incorrect inferences about causality when there is an error correction process. If variables have unit roots but are cointegrated, then there exists a Vector Error Correction Mechanism. If the series are I(1), we must perform regressions in differences, but this loses one observation. This problem can also be overcome through Error Correction Model (ECM).

Within ECM framework, one key concept is the cointegration. Two processes are said to be cointegrated if there is a linear combination (sum) of the processes that is stationary, which in this case will be called cointegrating relationship. In general, it is not possible to make a meaningful linear regression of one integrated process, e.g., variable I(1), over another. However, regression is possible if the two processes are cointegrated. For example, stock prices may be in random walk but there are portfolios that are stationary (if the aggregate variables Y and X are proportional in the long run, then Zt=Yt/Xt would be stationary). Such cointegrated processes are thus characterized by short-term dynamics (shocks) and a long-run equilibrium : this is the key point of ECM. In consequence of X and Y being both stationary and cointegrated, the residuals must be stationary, and should be tested with unit root analyses before its inclusion in a regression. The residuals Z is obtained by regressing Yt on Xt. This removes the influence that X has on Y. This equilibrium error, Z, captures the error correction by capturing the degree to which Y and X are out of equilibrium. ECM allows inferences based on both levels and first-differences in variables to be possible.

2. Empirical studies.

1. Empirical Evidence on the Austrian Business Cycle Theory (Keeler, 2001)

Keeler (2001) examines 8 U.S. (post-war) business cycles during the 20th century with standardized quarterly data. His general exposition reads :

According to Austrian business cycle theory, a cycle caused by a monetary shock should exhibit the following patterns: 1) the liquidity effect lowers market interest rates below the natural interest rate, and creates a steeper yield curve at a lower position; 2) investment flows and capacity utilization are systematically increased for more capitalistic production processes in the expansion; 3) short-term interest rates adjust to long-term interest rates with a mechanism related to the cycle; and 4) the expansion phase entails the contraction phase as resource allocations are reversed.

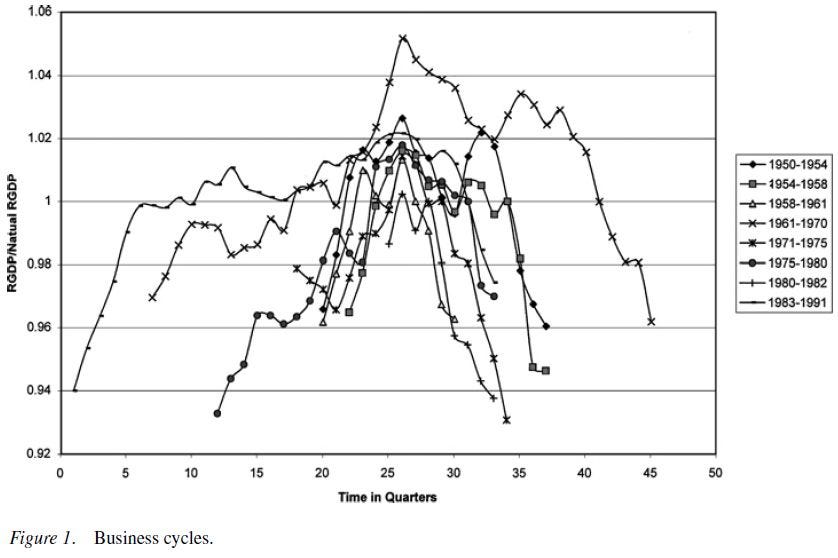

Figure 1 below depicts the ratio RGDP/NRGDP, i.e., real GDP to natural real GDP. The natural real GDP is defined as the real GDP which would have been observed if it had increased at its long term rate of growth. This is supposed to approximate the changes in equilibrium because money over-expansion should produce the impulse that generates the business cycle through actual GDP. Keeler justifies it as follows :

The natural real GDP, measured on a constant growth path between business cycle peaks, is an ex-post estimate of natural real GDP, rather than an estimate based on resource quantity and productivity. This concept permits the possible non-neutrality of money in the long run following a monetary shock, and does not require real values to return to pre-shock values. The income ratio, as a representation of the aggregate cyclical activity, incorporates the change in the equilibrium and serves as a more appropriate measure of an Austrian concept of aggregate economic activity.

Anyway, we see an increase in this ratio until they reach a peak at the 25th quarter before diminishing again after this.

Keeler approximates the market and natural interest rates with short- and long-term interest rates by way of yield curves. The reason given for these variables as proxies reads as follows :

The time period of long-term interest rates, ten years for corporate bonds and U.S. Treasury bond rates, corresponds to the longer time period for the life of capital goods. Assuming that changes in the marginal physical productivity of the existing capital stock are slow, of low volatility and long lived, that behavior is matched by market long-term interest rates. The misperceptions which cause business cycle phenomena, as discussed earlier, include errors in financing capital investments. One of the decisions that investors must make is matching the availability of funds with the cost requirements in the building process for a capital investment project. The risk of that choice may be reduced by aligning the term of borrowing with the occurrence of expected costs of the project during the time-to-build. Long-term financing for capital projects avoids the problems of increases in short-term interest rates before the completion of the project, and appropriate matching of flows of costs and benefits will immunize the project from interest rate risk. The demand for credit for financing capital projects with a long-term flow of benefits and with a long time-to-build will occur in long-term credit markets and be coordinated with the natural rate of interest or expected profit rate.

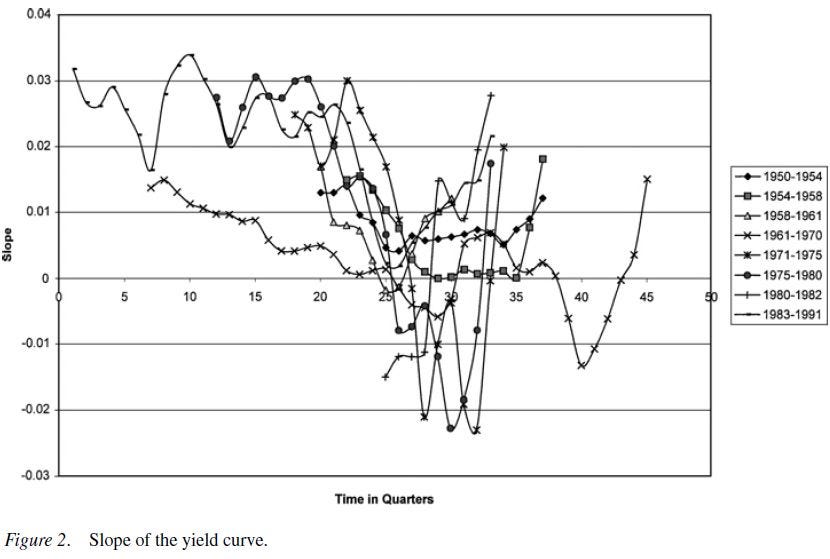

Graphically, a yield curve is depicted by plotting interest rates in the Y axis (vertical) and maturity length in X axis (horizontal). The three types of yield curves must be distinguished, however. A positive yield curve reflects the higher yield (i.e., interest rates) of longer maturity bonds compared to shorter term maturity bonds (due to entrepreneurial risks associated with time regarding longer-term maturity contracts). It is also called the normal yield curve because long-term bonds have generally higher interest rates. Conversely, an inverted (i.e., negative) yield curve is one in which the yield is higher in short-term than in long-term, perhaps a sign of a forthcoming downturn. Finally, a flat yield curve indicates identical interest rates for short-term and long-term debts. In a nutshell, a greater/steeper yield curve slope must be associated with greater discrepancy between short and long-term interest rates (i.e., yields). According to Keeler :

... The yield curve arrays rates of return by maturity of the financial instrument, and in general equilibrium, the yield curve would be characterized by a positive slope as term premiums increase with maturity. Then a monetary expansion will have a liquidity effect that lowers short-term interest rates to a greater degree than long-term interest rates (Romer 1996:395–396). Long-term interest rates are affected since they are an average of short-term rates, but the effect is moderated. Relative to its position and shape in equilibrium, the yield curve can be expected to shift down as both short-term and long-term rates fall, and to become steeper as short-term rates fall relative to long-term rates as a result of the monetary shock.

... Consider the short-term interest rate as representing the market rate in a short-term credit market and the long-term interest rate as representing the natural rate for the long-term market. Then the slope of the yield curve is offered in this analysis as a measure to capture Wicksell’s concept of the interest rate differential. In the disequilibrium created by the monetary shock, short-term rates differ from the long-term rates by more than the risk and liquidity premiums justify, and the yield curve is steeper than in general equilibrium. The implied path of these rates is a steep yield curve (a large magnitude for the slope) early in the business cycle and a flatter or inverted yield curve (a smaller magnitude or negative slope) in the recession phase. The yield curve is expected to shift down early in the cycle as both short-term and long-term rates fall, and to shift up in the recession phase as both rates rise.

Figure 2 above illustrates well the overall picture. The slope is positive in the early phase of the expansion but, as time goes on, the positive slope comes closer and closer to zero over the course of the cycle. In some of the historical periods, and between 25-35 in time quarters, the slope is zero or negative. Generally, short-term rate is low relative to the long-term rate in the expansion phase, while the short-term rate rises relative to the long-term rate in late expansion and in recession.

Short-term interest rates fluctuate much more than long-term interests. Keeler cites Bernanke (1990) surveys showing correlations of short- and long-term interests with money supply growth, respectively, 0.29-0.33 and 0.06-0.20. This is important in itself since the long-term interest is a much better approximation of the natural interest rate(s) than is the short-term interest. Bernanke also found that 2 measures of the yield curve, the interest rate spread and the slope of the yield curve, were highly correlated with his measures of monetary policy. In Keeler’s data, slope of yield curve shows the highest correlation with money growth, at 0.55.

... Data for the eight U.S. business cycles show both nominal and real long-term interest rates to be comparatively stable during each cycle. Most cycles show a slight cyclical pattern of a slow and steady rise in the level of the rate through the business cycle peak and then a decline, but three of the eight cycles have long-term rates that are either flat or decrease steadily. Only two cycles exhibit a rise in long-term rates at the end of the cycle. Most cycles show nominal and real long-term rates in a similar range with the exception of the 1980–82 and 1983–91 cycles, which have much higher levels. A variety of inflation adjustments calculates a few negative real long-term rates during the 1950–54, 54–58, 71–75 and 75–80 cycles. The expectations hypothesis implies a pattern of a shift down of the yield curve at the start of the cycle followed by a shift up during the recession, and that is not apparent across the eight U.S. cycles. There is no consistent evidence that long-term rates respond to monetary shocks.

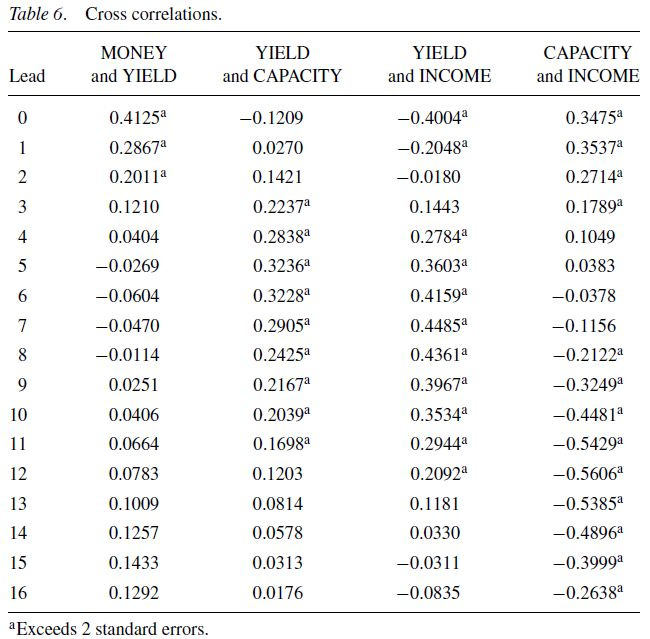

Table 6 is highly relevant for ABCT. Money growth (variable MONEY, which is the compound growth rate of the money supply, using M1 and GDP Deflator chain-type price index) has correlations with changes in slope of yield curve (variable YIELD), i.e., discrepancy between actual market rates and natural rates of interest in the ABCT framework, but only during the 0th through 3rd periods, not after that. This reflects a short but strong liquidity effect. And interestingly, that steepening of the yield curve (variable YIELD) correlates non-trivially with a rise in the ratio of capacity utilization rate in long production processes to short production processes in primary processing industries relative to that in advanced processing industries (variable CAPACITY) only from 3rd through 11th period, but not at the 0th and 1th periods, and only modestly at the 2th period. The same pattern of positively high correlations also exists between YIELD and INCOME (i.e., the variable of the ratio RGDP/NRGDP) with positive relationship only starting at the 3rd period, not before. That seems to suggest that YIELD impacts both CAPACITY and INCOME only after MONEY impacted YIELD. During the 12th through 16th periods, the correlation YIELD-CAPACITY approaches zero, which is not surprising because the market and natural interest rates should come close to each other at the end of the boom and because the ratio long/short production processes is also expected to diminish. Keeler noted, finally : “The cross-correlations do not show significant reversals of correlation within the cycle, but a steeper yield curve is consistently correlated with higher capacity utilization in primary production processes”. Previously, a unit root test was performed.

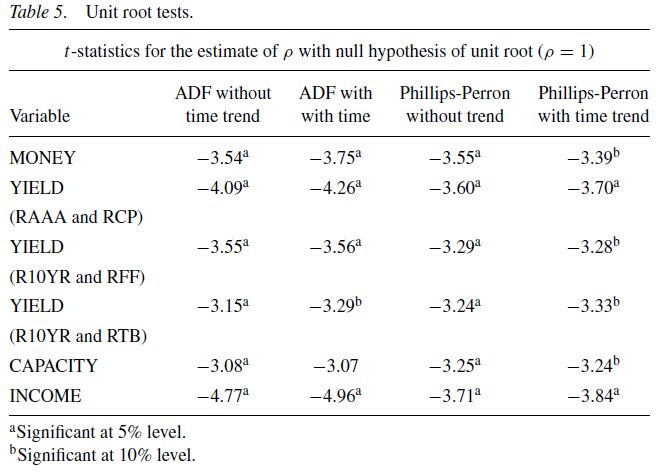

Each variable was tested for the presence of a unit root. The null hypothesis of the available tests is that the variable has a unit root, and if true the behavior of the variable would be consistent with a random walk process. Then the changes in the value of the variable from one time period to the next would show non-stationarity. The Augmented Dickey-Fuller test was specified with only a constant since all series exhibit no trend but a non-zero mean, and the Phillips-Perron test was specified with a constant and a trend. Tests were performed with four lags. Results are presented in Table 5, including alternative measures of YIELD. The null hypothesis of a unit root is rejected at the 5% level of significance for all variables. The time trend variable is not significant for any of the variables at the 5% level in either the ADF or Phillips-Perron test. Rejecting the null hypothesis of a unit root implies that the variable does not follow a random walk process. The probability of Type II error is large for these tests, but the results, considered with the correlograms, support the notion that the variables are stationary in the forms presented in Table 2, despite the variation in means and variances across cycles.

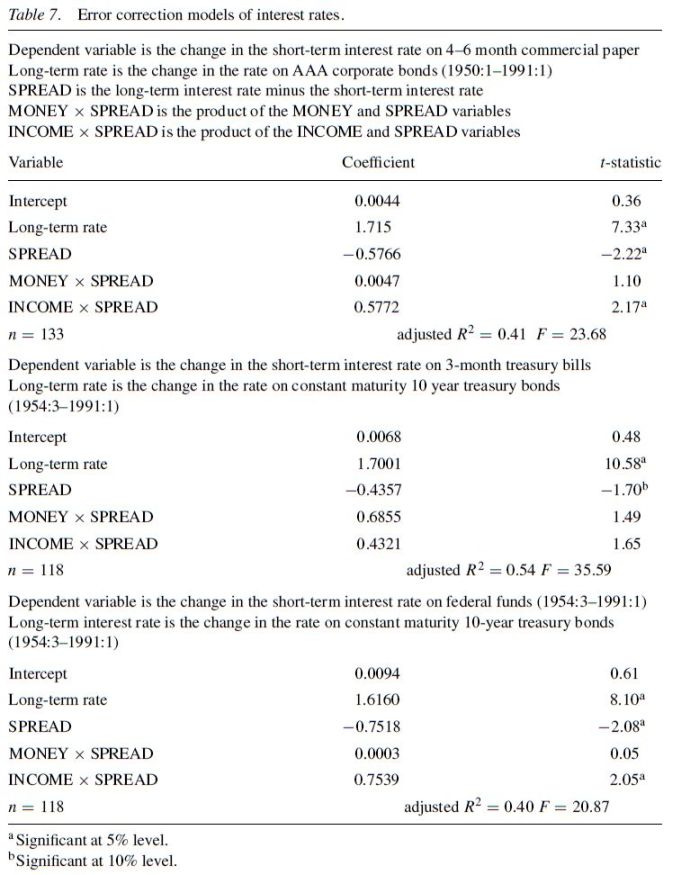

Table 7 reports the Error Correction Model (ECM) which is a dynamical system with the characteristics that the deviation of the current state from its long-run relationship will be fed into its short-run dynamics. It’s a category of multiple time series models that directly estimate the speed at which a dependent variable Y returns to equilibrium after a change in an independent variable X.

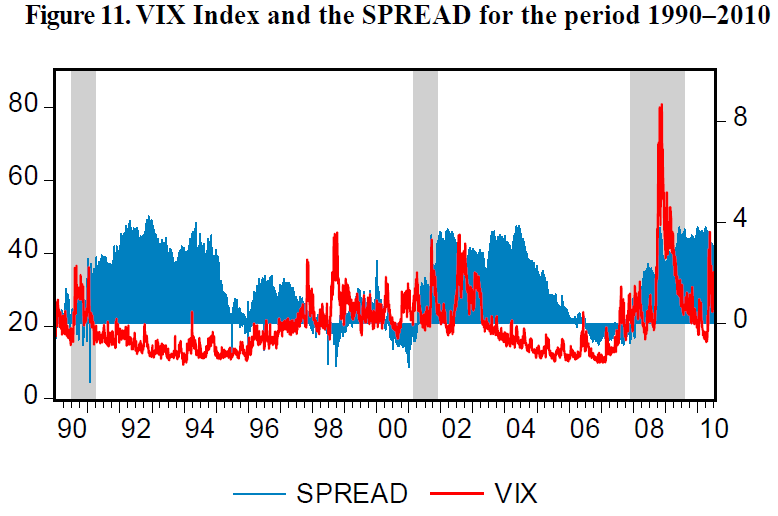

In all specifications in Table 7, SPREAD variable (i.e., long-term rate minus short-term rate) has a large negative coefficient whereas INCOME*SPREAD interaction has large positive coefficient and MONEY*SPREAD is not very consistent. That means the rate of real money supply growth does not have an effect on the rate of adjustment between interest rates whereas the ratio RGDP/NRGDP (i.e., INCOME variable) does have an effect on interest rates adjustment. It is because the main effect of SPREAD (on short-term interest rate as the dependent variable) was negative, net of the interaction effect, but because the interaction effect has an opposite sign, it means that SPREAD variable is closing due to the effect of INCOME*SPREAD interaction.

The Austrian business cycle theory also specifies a long-term relation between market interest rates and the natural rate of interest. The business cycle process is one of response to a divergence in these two interest rates, which culminates in a return to a stable term structure. The changes in sectoral resource use and in aggregate income, characteristics of the cycle, bring the market rate into long-term relation with the natural rate. An Error Corrections Model (ECM), using data on short-term and long-term interest rates, provides confirmation of this relation between the interest rate differential and the business cycle. On the assumption that there is a long-term proportional relation between short-term and long-term interest rates, the change in the short-term rate is modeled as a function of the change in the long-term rate, with a short-term adjustment mechanism based on the difference between the rates, the interest rate spread (SPREAD). ... The simple ECM has statistically significant coefficient estimates for the change in the long-term interest rate and the short-term adjustment component. The magnitudes of these coefficients are large relative to the change in the short-term interest rate, and imply that the effects of one standard deviation changes in these influences are empirically important. The rate of real money supply growth does not have a statistically significant effect on the rate of adjustment between interest rates in any specification. For the YIELD measures using the private market interest rates and the Federal Funds rate, the phase of the business cycle, expressed through the INCOME x SPREAD variable, does affect adjustment. ... As real income increases relative to its trend, short-term or market rates adjust faster toward the long-term or natural rate. The Austrian theory contains such an adjustment of market to natural rates of interest, and the ECM estimate exhibits not only a short-term adjustment mechanism but also an important role of income growth in resolving term structure distortions.

Keeler argues nonetheless that the R²=0.40 and R²=0.54 leave a great portion of variance unexplained. But Hunter & Schmidt (2004) showed that r² underestimate the effect size, and that the r (not r²) should be used. Furthermore, the main problem with significance tests is the sensitivity to sample size.

2. Relative Prices and the Business Cycle (Keeler, 2001)

Keeler (2001) examines U.S. data for the time period 1959:1 through 2001:2. Federal funds interest rates existed at the beginning of this period already, but the federal funds market, with its role in monetary policy, started its development in 1966. Several variables are the targets of analysis. The slope of the yield curve variable is given by the ratio of long-term rate to short-term rate; a positive yield curve reflects the higher yield (i.e., interest rates) of longer maturity bonds compared to shorter term maturity bonds (due to entrepreneurial risks associated with time regarding longer-term maturity contracts). The income variable is given by the ratio of real GDP to natural real GDP; the natural real GDP is defined as the real GDP which would have been observed if it had increased at its long term rate of growth. The monetary policy variable is a mix of borrowed and non-borrowed reserves in total reserves (NBRX) suggested by Strongin (1995) and has been considered as providing a good measure of the effects of monetary policy. Two measures of resource allocations are provided. NRSRS is the ratio of quarterly investment in Non-Residential Structures to investment in Residential Structures and IETE is the ratio of investment in Industrial Equipment to investment in Transportation Equipment.

Keeler submitted all variables to a unit root test, the Augmented Dickey-Fuller. The null hypothesis of unit root was rejected for income, slope of yield curve, and resource allocation, but not the Strongin’s measure of monetary policy. Most of the series exhibited autocorrelations that quickly decreased to zero. The results from Vector Autoregressive (VAR) modeling reads as follows :

The VAR method is a “backward-looking autoregressive structure” (Bagliano and Favero, 1998), and still subject to the Lucas Critique; that the estimated responses within the system are specific to the policy regime. Over the period of this sample, there certainly were developments and changes in monetary policy, from reliance on lending at the discount rate, to a free reserves target without specific goals, to interest rate or monetary aggregate targeting with specific goals (Strongin, 1995). ... An advantage of the VAR is that the restrictions that must be imposed for identification of equations involve fewer assumptions about the equation structure. A Choleski factorization for example, orders the variables in the system’s causal sequence, but does not add further constraints on the coefficients. The flexibility of the VAR method permits modeling a changeable process, as well as structure in terms of the choice of variables and identification. ...

Each of the four equations in the VAR estimate of the business cycle model had a relatively high R-squared value. For each equation, the lags of the dependent variable are significant. Lagged income is significant in the NBRX equation which suggests the endogenous nature of the money measure. Lagged income is significant for only one coefficient in the SLOPE equation, showing some evidence of the endogenous nature of the interest rate adjustment mechanism. One coefficient of INCOME is also significant in the RESOURCE equation, implying that the phase of the business cycle affects the resource allocation between primary and advanced production processes. One SLOPE coefficient is significant at the 10% level in the INCOME equation, providing only slight evidence that relative prices and resource use guide the cyclical behavior of aggregate income. The residual correlation matrix shows especially low correlations between the NBRX residual and other equation residuals, and generally low correlations.

Impulse Response Functions were derived from VAR models. The IRFs display (in Figure 6) the dynamic responses of the endogenous variables of the model to a one-standard-deviation shock to the error terms of system equations (here, the NBRX). At the beginning of the cycle, the yield curve becomes steeper but during the expansion phase of income increase, the yield curve flattens and returns toward its initial value. The investment in non-residential structures rises relative to investment in residential structures after the shock in NBRX, and then declines as the cycle progresses. The response of the income ratio variable to NBRX innovation is also consistent with the ABCT prediction, as the actual real GDP rises relative to natural real GDP, then falls toward the original ratio.

Figure 7 shows the variance decomposition for each variable. The decomposition shows the contribution of each variable (in different equations) through the cycle. For example, in the INCOME equation (upper left) there is an increasing role of the variable slope, which peaks at about 30% after 10 periods. The variable INCOME shows a response in the NBRX and SLOPE equations.

3. Austrian Business Cycle Theory: Evidence from Scandinavia (Anker, 2011)

Anker (2011) attempts to empirically test the ABCT in Denmark, Norway and Sweden with the economic data collected ranging from first fiscal quarter of 1980 to fourth fiscal quarter of 2010. The study uses the following variables : REV for the ratio RGDP/NRGDP, DEP for the ratio consumption/investment expenditure, PRIX_REL for the ratio consumption/production price index, SPREAD for the long-term rate minus short-term rate. Concerning DEP, it’s calculated by consumption aggregates as a percentage of total economic activity (consumption) and the investment percentage calculated by 1 minus consumption. The ratio is then calculated as the consumption divided by investment.

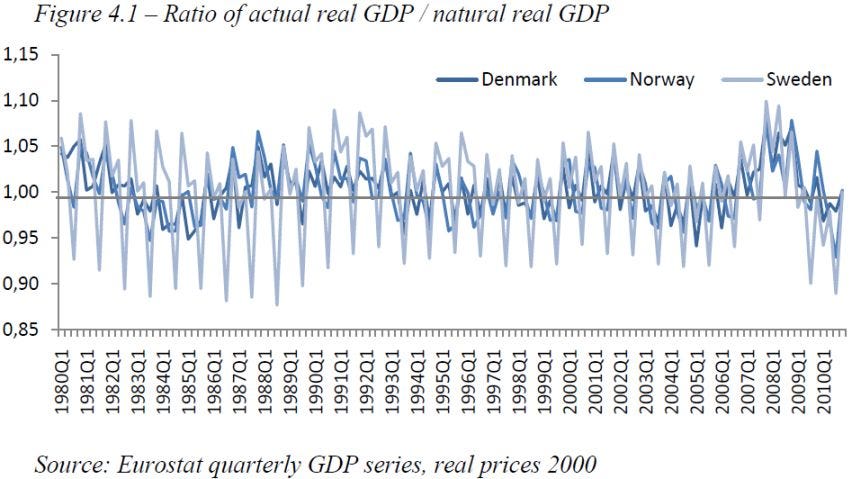

Figure 4.1 presents the trend RGDP/NRGDP ratio :

In the expansionary phase real GDP rise relative to the natural level and the ratio and moves above 1, whereas in the recession phase the real GDP decreases relative to its natural level and the ratio moves below 1.

Figure 4.3 depicts the trend consumption/investment expenditure ratio :

Because the ABCT does not expect the consumption to rise at the very beginning of the boom, the ratio will begin to peak later during the boom phase, probably extending to the recession phase. This illustrates the relative increase in capital goods production which is followed then by a relative increase in consumption goods production.

Figure 4.4 shows the ratio consumption/production price index. It could have been expected that the price of capital goods would go up relative to the prices of final goods due to a change in relative demand for more capital goods. At least, if everything else is constant. Its trend, when compared with phases of expansion/recession pictured in Figure 4.1, suggests no relationship between these two variables, as it will be seen in econometric tests displayed further below.

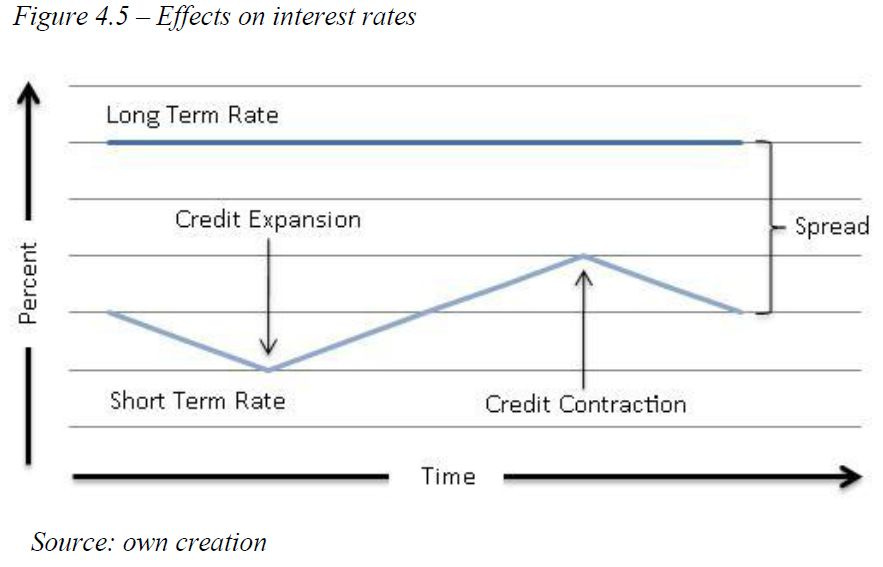

The “term spread” or SPREAD variable is best illustrated as follows :

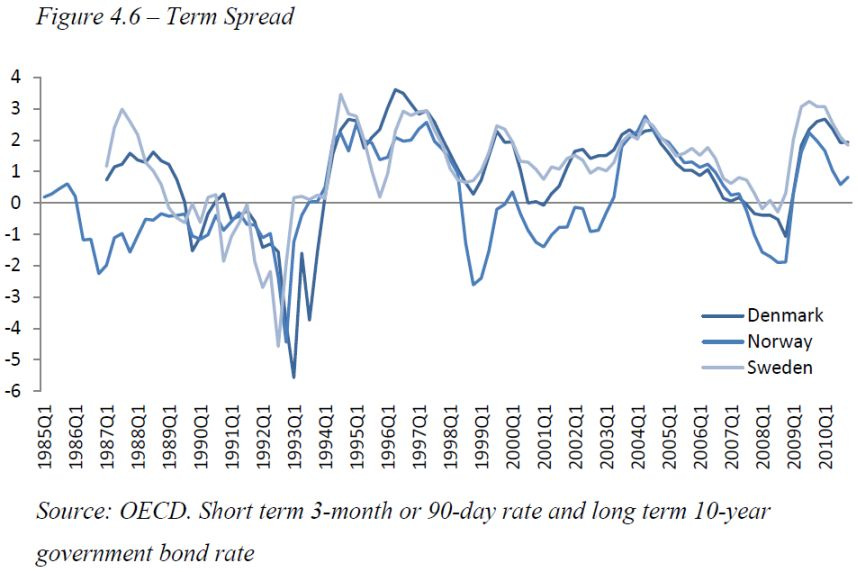

The remarkable negative spread in figure 4.6 is a consequence of the ERM crisis of 1992 and 1993. More interestingly the figure shows a pattern where shocks increase the spread and then gradually declines and becomes negative, before experiencing another sharp increase. This can be seen most clearly in the period between 2002 and 2010.

Having presented the data, he makes use of regression models in the following configuration :

REVit= β0 + β1DEPit + β2PRIX_RELit + β3SPREADitαi + uit

where REV is the ratio RGDP/NRGDP, DEP the ratio consumption/investment expenditure, PRIX_REL the ratio consumption/production price index, SPREAD the long-term rate minus short-term rate, β0 the constant and the following β (or Beta) are the coefficients of independent variables, αi is the deterministic constant (i.e., intercept) specific to each of the three countries, uit being the error term, i is the number of countries (=3) and t the number of quarters from 1rst quarter 1980 to last quarter 2010 (=124) so that 3*124=372.

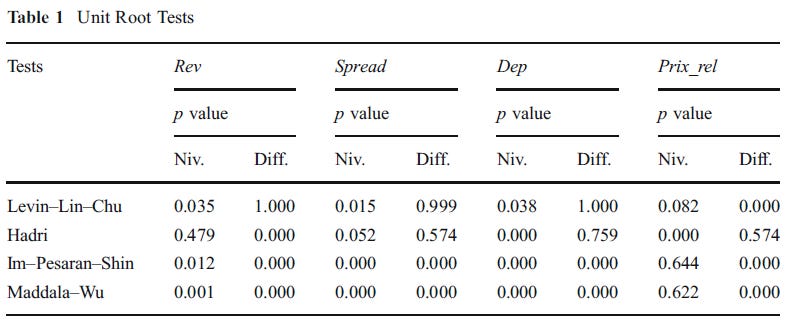

But a unit root test is first performed to test the null hypothesis of the variable being non-stationary and having unit root. As Anker makes it clear : “Stationarity is a basic requirement for time series modeling which implies that the mean, variance and autocorrelation structure of the variables are independent of time”. The result is that the null (H0) is rejected due to the significant p-values for all variables except changes in ratio consumption/production price, denoted ΔPRIX_REL.

ADF and PP tests are commonly used to remove any autocorrelation (also known as serial correlation or autoregression) which takes the form of correlated error terms, i.e., error term depending on the previous error term. ADF regression includes lags of the first differences of yt. It appears that Rev, Dep and Spread are significant, thus are stationary. But Prix_rel is not, and for this reason should not be used in the fixed effects regression (see Table 4.3). Nonetheless, the variable has been first-order differenced, yielding a new variable (ΔPrix_rel) that appears stationary. Their regression model in Table 4.3 and related discussion can be read :

As for the estimated α-values specific to each country; Denmark has 0.00935, Norway has -0.02889 and Sweden has 0.00432. This indicates that the joint constant in table 4.2 minus the country specific α-values, are lower for Denmark and Sweden and higher for Norway. The intuitive explanation behind this is that the variables have more explanatory power in Denmark, as less information is stored in the constant compared to Norway and Sweden. ...

Post-estimation verifies the fixed effects model and the results can be seen in appendix E. The Hausman test for testing the fixed effects model against a random effects model shows a strong significance in favor of the fixed version. Serial correlation test shows that there is no serial correlation in the residuals with the test unsuccessful in rejecting the null hypothesis for just that. Wald tests for testing the linear relationship of the explanatory variables yields significant results for the consumption to investment ratio and the term spread but not for the relative price ratio as expected. Finally, testing for the country specific effects, results in a rejection of the null hypothesis that these are jointly significant.

According to the theory, the influence of Dep and Spread, should be negative. This is exactly what we see in the fixed effects model. An increase in the ratio consumption/investment expenditure (Dep) has a negative impact on the ratio of actual real GDP to natural real GDP. In recession, natural GDP outgrows actual GDP because of the liquidation of malinvestments. This is accompanied by an increase in the term spread, and this is why it also has a negative coefficient on the ratio actual/natural real GDP. When the term spread increases it brings real economic activity to accelerate compared to its natural GDP until the short term market interest rate converges to its natural level.

Globally, Anker and Bismans & Mougeot present the same feature. But one would like to question why the coefficient (probably unstandardized) of Dep and Spread are all so small, and yet statistically significant, either looking at t-test or at the p-values, considering they are in fact highly dependent on sample sizes, especially with total observation of NT=283. At the very least, the R² of 0.153 suggests the model having good explanatory power if expressed in r by square rooting the R².

4. Austrian business cycle theory: Empirical evidence (Bismans & Mougeot, 2009)

Bismans & Mougeot (2009) examined four countries, France, Germany, Great Britain, and USA between 1980 and 2006. Data come from Eurostat and OECD. The method is similar to that subsequently used by Anker (2011) with exactly the same variables’ names.

The ratio RGDP/NRGDP is expected to be 1 at equilibrium, so that any deviation from 1 corresponds to changes in economic activity through the cycle. Figure 1 depicts the following :

Figure 3 shows the ratio consumption/production price index. Like in Anker, there is no apparent relationship between the changes in structure of relative prices and economic fluctuations or production structure changes. But Figure 2 shows the consumption/investment expenditure ratio, used again as an indicator of the production structure distortion through the cycle, and the pattern seems coherent with the ABCT :

Figure 2 shows that in each country, this ratio tends to increase during the last steps of expansions and to lower at the end of recessions. This pattern seems to be true to the Austrian hypothesis according to which the beginning of expansion is characterised by a relative increase of capital goods production, whilst the rise of consumption goods production accelerates later. Figure 2 also shows that the maxima of the ratio of consumption expenditures to investment expenditures are often reached during the quarters of recession or during the quarters just after recessions. This observation corroborates the Austrian hypothesis of overinvestment liquidation marking crisis.

Since long-term rates are equal to the weighted average of short-term rates plus a risk premium, credit expansion lowers short-term rates higher than long-term rates. So, to repeat, the term spread (equivalent to SPREAD variable in Keeler’s 2001 study) should rise at the beginning of the boom, gradually decreasing, and perhaps becoming negative during the quarters just before a recession. Bismans & Mougeot noted :

In other words, the term spread inversions mark the turning points of the aggregate economic activity. When the term spread decreases, the structure of production becomes less roundabout as entrepreneurs reallocate resources away from production goods to consumption goods.

At the beginning of expansions, the short-term interest rate is smaller than the long-term interest rate (the difference is one of the order of two to four points). Then, the difference filled itself and is reversed before recessions.

Like what has been observed in Keeler as well, the authors argue : “Temporary credit expansions involve decreases in short-term interest rate that slightly influence long-term interest rate. There is no consistent evidence that long-term respond to monetary shocks”. Their econometric analysis, similar as that of Anker, reads :

Unlike L-L-C, I-P-S, or M-W, the Hadri’s null hypothesis is that the variable’s process is stationary, i.e., the Hadri must have non-significant p-value whereas the others must have significant p-value. This condition holds for REV and SPREAD. But while the Hadri is unfortunately significant for DEP, all other tests displayed evidence of stationarity for DEP. PRIX_REL, in the last panel, however shows no stationarity in all of the 4 different tests under column “Niv.” (levels of the series) but it shows evidence of stationarity in all tests under column “Diff.” (i.e., first-differenced or lagged series) which means PRIX_REL is not stationary in levels of its values whereas ΔPRIX_REL is stationary.

The constant β0 (Eq. 4) is positive and equal to 1.068. In comparison, the estimated values of the fixed effects (αi parameters) specific to each country are 0.00079 for France, −0.01926 for Germany, 0.0314 for Great Britain and −0.01313 for the USA. Consequently, the joint constant, that is β0-αi, i=1, ..., 4, is lower for Germany and the USA than for France and Great Britain. This difference implies that the explanatory power of the variables is greater in Germany and in the USA. ...

The explanatory power of term spread and relative expenditures differs among countries. The joint constant of the present model is lower in Germany and in the USA than in France and Great Britain. This difference means that the explicative variables are more decisive in Germany and the USA than in the other countries. This result confirms Bernanke's (1990) conclusion that the explanatory power of the term spread is higher in Germany and the USA than in the other countries (France, Japan and Great Britain). He explains this difference by the difference of monetary market regulation.

Again, problems with significance testing are related with sample sizes and/or data points. But if that can be taken at face value, then, the impact is really non-zero. More informative would be to obtain the magnitude of the effect size, which is not expected to be impacted by sample size artifacts. In any case, they conclude :

The hypotheses concerning the path of the term spread and of the relative expenditures are empirically confirmed. According to the Austrian business cycle theory, their influence is expected to be negative. This result is obtained empirically with the negative sign of the coefficients. … In other words, the growth of the difference between the long-term and the short-term interest rates tends to lower the difference between actual real GDP and natural real GDP. This lowering reflects an acceleration of the economic activity to meet its natural level. This result confirms the main Austrian hypothesis that expansion is created by a decrease of the interest rate under its natural level and lasts until the market interest rate moves towards the natural interest rate.

Here again, Bismans & Mougeot (2009) confirmed the absence of a relationship between consumption/production prices and business cycles and agreed with Keeler (2001) on the notion that prices will not convey the signals of real behaviour. They pointed out that Mises (1949) was right in abandoning his first idea (in 1912) of such a relationship. Mises (1966, p. 561) insists on the importance, not of the high/low price levels, but of the difference between costs of production and anticipated prices of the products, i.e., profits. This crucial point has not been well understood by Wainhouse (1984), Anker (2011) and Lester & Wolff (2013), however. The simple fact that the ratio consumption/investment expenditure followed a path readily predictable by the ABCT argues in favor of the ABCT. It's just that the ratio consumption/production price is probably affected by other external factors and thus does not faithfully reflect the magnitude or pattern of distortion of the ratio consumption/investment expenditure or the interest rates gap. Another possibility is the applied methodology (e.g., variables used). For instance, Young (2012) found evidence that the more roundabout industries have experienced a steeper increase in their prices during the 2000s on the onset of the subprime episode.

5. Empirical Testing of the Austrian Business Cycle Theory: Modelling of the Short-run Intertemporal Resource Allocation (Helmersson & Selleby, 2009)

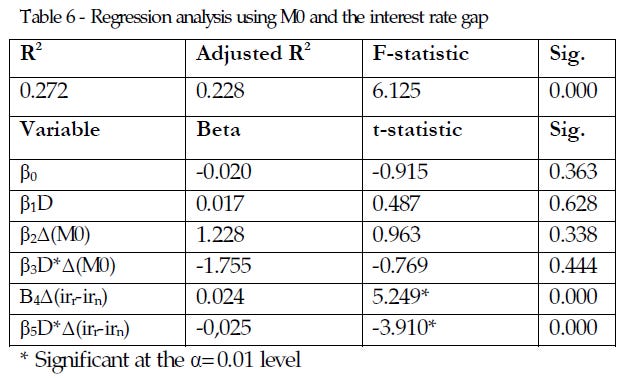

Tobias & Karl (2009) modeled the ABCT by evaluating the impact of interest rate gap, money supply and credit had on the intertemporal resource allocation, denoted C/I, or the ratio of consumption to investment, given a short-run framework, by using quarterly data. The data in use is collected from the Bank of England and UK National Statistics (all seasonally adjusted) beginning at first quarter (Q1) 1984 to first quarter (Q1) 2006 with 421 observations in total. The business cycle phases studied in their models are splitted based on unemployment levels.

In their regression models (equations given at page 17), the interest rate gap, credit, ΔM0, ΔM4 are the independent (predictor) variables with ΔC/I being the dependent variable. M4 is expressed here as M4 aggregate minus M0. The beta (β) without the letter D indicates expansionary phase whereas the beta with letter D indicates the recession phase.

They followed Carilli & Dempster (2008) recommendation of using consumption/savings ratio as proxying the natural interest rates. The natural interest rate is thus calculated as the average propensity to save divided by the average propensity to consume. This allows the intertemporal relationship in purchasing patterns and the opportunity cost of holding money to be fully incorporated in the model. The Consumption index is “Household final consumption expenditure” and the Investment index is “Gross fixed capital formation: Business Investment”. As for M0 and M4 :

M0 is the narrow monetary aggregate of the UK, and M4 is the broad money supply measure. M0 cover notes and coins in circulation, banks’ vault cash holdings and bankers’ deposit at Bank of England (BOE), also known as BOE’s and the government’s liabilities (Janssen & Andrews, 2005). M4 contain private sector holdings of sterling pounds, sterling pounds in deposit (here equivalent to certificates of deposit and debt securities up to five years) at banks and financial institutions, and sterling shares issued by financial institutions (Burgess & Janssen, 2007). M0 consists of roughly five percent of the amount of M4 (Congdom, 2007, p. 319).

Unlike Anders (2011) and Bismans & Mougeot (2009) these authors haven’t conducted a test for unit-root, perhaps because they estimate the correlation between changes in the dependent var. with changes in each of the independent var., and they expect it to remove problems of non-stationarity and autocorrelation. The expectations of the models are presented.

The variable M0 is expected to have a positive impact on C/I, as the narrow money supply is very liquid and flexible but also because M0 is less useful for business projects that need long term financial capital (e.g., credit to finance structural investments). The positive effect on C/I should be less in recession because of employment uncertainty and debts. M4 should have a negative effect on C/I ratio. The reason is because this monetary aggregate is a less liquid measure of money, consisting of time deposits in banks and financial institutions, making it more suitable for long-term projects and investments. In recession, M4 is supposed to have a negative impact on C/I as well, but less in magnitude. The interest rate gap is assumed to have more influence on investment than consumption, thus lowering C/I ratio in expansion. Although in recession the market rate should increase relative to the natural rate, the governments may attempt to stimulate the economy through money injection. Still, credit is expected to have more (positive) impact on investment during the boom than during the bust. The authors assume that even if the credit gets distributed more to consumption, the consumption will not increase much, as output is fixed in the short run, where inventories diminish and prices increase, whereas businesses can start increasing investment into the structure of production by using credit.

The results are displayed below. Significance does not matter because it conflates sample size with effect size. Yet, it still gives information about the relative strength of the independent variables. The variables with larger t-stats or lower p-values must have a larger effect. The variables may not be expressed in the same unit-scale (e.g., interest rates compared to money aggregates). The betas are unstandardized. In each model, β0 is the constant (or intercept) for the expansion, and β1D is the same for recession.

Given table 5, ΔM0 is negative in the two phases, but the magnitude of the beta is much larger in recession. According to the authors, M0 should have been positive in expansion and recession (although stronger in expansion) because M0 is closer to consumption and increases in M0 would have impacted C more than I. So, C must increase relative to I, causing beta to be positive. And because we don't see it during the expansion, that is not consistent with ABCT. As we will see, the beta for ΔM0 is negative only in this model, perhaps different variables are included in the subsequent models. Different variables are controlled (i.e., held constant) while measuring the impact of ΔM0. So, when M4 is taken into account, it looks as if M0 does not predict increases in C/I anymore. Next, ΔM4 is negative in expansion, positive in recession. Because the expectation was a negative sign in both phases, this pattern follows ABCT prediction (only in expansion) because M4 should be closer to I than to C, causing I to increase relative to C in expansion, and thus the ratio C/I must decrease as I increase.

Given table 6, ΔM0 is positive in expansion, negative in recession. According to the authors, this is consistent with ABCT only in expansion. The interest gap variable is the natural rates minus market rates, that is, higher values indicate less interest rate discrepancies. And the interest gap has positive sign in expansion (lower discrepancy decreases I relative to C thus causing C/I to be higher) and negative sign in recession (lower discrepancy decreases C relative to I, causing C/I to be lower). The ABCT predicts this pattern in expansion, not in recession. The interest rate gap variable must have a positive sign in both expansion and recession, according to the authors.

Given table 7, ΔM0 is positive in expansion, negative in recession. According to the authors, this is consistent with ABCT only in expansion. The changes in credit should increase I relative to C, causing C/I to be lower. This is what we see. The sign in β4 is indeed negative. However, in β5 it is positive, which means credits increase consumption more than investment in recession, even though the magnitude of the beta is much smaller. An indication that consumption increases (in recession) had been much smaller than investment increases (in expansion). In all likelihood, the positive sign of β5 can be explained by keynesian stimulus. We can point out a mistake in the authors' interpretation since they have written that M0 is positive in both phases and credit is negative in both phases, which is not true with regard to their tables.

Despite the (adjusted) R² being under-estimation of the real-world effect size, the (adjusted) R² is much higher in Table 6, i.e., the model with interest rate gap has the best explanatory power among all of the models. The SQRT of 0.228 is 0.477. A meaningful effect size. This was also suggested by the p-value of interest gap variables, all being 0.000.

While the empirics don’t follow ABCT prediction in recession phases, they are coherent with ABCT in expansion phases. Why the data shows this pattern is obvious. It’s due to external forces in the recessions. Similar speculations have been advanced by the authors in their thorough explanation of the conflicting findings :

There is also the possibility that using a short-run model creates problems in finding significance as it fails to capture the underlying predictions observable in the long run. Logically, a theory that is designed to have long run impact due to accumulating changes does not have the identical outcome when the incremental stages are examined. Narrowing the time frame of observation naturally leads to more uncertainty, hence observations in the short run need not necessarily match observations in the long run.

The narrow monetary aggregate M0 was predicted to track fluctuations in consumption better than the investment part of the C/I ratio. While consumption in the short run is rigid due to the scarcity of consumer goods available as explained, it can increase incrementally in relation to investments. The broader money aggregate, M4 was expected to have stronger effect on investment, which the data supports. Rothbard (1978, p. 153) defined the Austrian school’s supply of money concept: “all entities which are redeemable on demand in standard cash at a fixed rate”. Neither of the two considered official monetary aggregates in the UK corresponds to this statement, as M0 do not include redeemable time deposits while M4 includes illiquid deposits with constraints on withdrawal. Perhaps due to not being appropriate “Austrian monetary aggregates” both give conflicting coefficient signs compared to predictions. The finding that M4 and M0 as predicted affect C/I differently is important in further discussions of the ABC theory, with a proper monetary aggregate located in-between M4 and M0. ...

The effect of liquidation force can be seen to some extent. The ambiguity found in some of the results when predictions are made for variables in recessionary periods, could be the result of conflicting liquidation and stimulating forces. These are arguably common as policies can distort the fundamental market movements.

And since the ABCT is an accounting of how the expansion occurs and develops itself, these findings are in line with the theory.

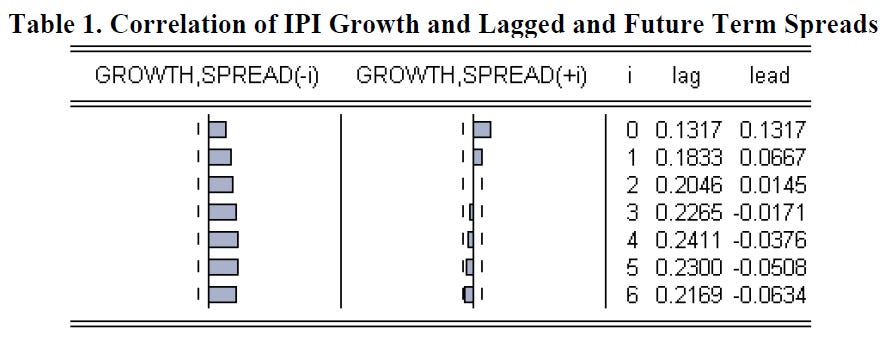

6. An Empirical Examination of Austrian Business Cycle Theory (Mulligan, 2006)

Mulligan (2006) uses the (January)1959-(March)2003 monthly data, reported by the U.S. Department of Commerce Bureau of Economic Analysis, to examine the relationship between real consumable output and the interest rate term spread. The price index was used to obtain real personal consumption expenditures, which is the measure of real consumable output. The term spread used is the ten-year constant maturity Treasury bond rate minus the three-month Treasury bill secondary market rate, from the Fed of St Louis. When the term spread decreases, the structure of production becomes less roundabout as entrepreneurial managers reallocate resources away from producers’ goods toward consumers’ goods. If the term spread is interpreted as a measure of the real interest rate, the cumulative term spread can be interpreted as the real return over time.

Whenever interest rates rise, higher rates of return in production are necessary to compete with financial instruments, such as relatively higher-yielding government bonds. This is manifested in a shifting of resources away from early stages of production to later stages, and can be shown as a shortening of the base of the Hayekian triangle.

From Mulligan’s perspective, monetary over-expansion must cause a decline in real (consumable) output which is “the subjective use value extracted by each consumer” because it cannot be easily reallocated. This is due to capital degree of specificity :

When the interest rate rises, capitalists should liquidate their own productive activities to the extent possible, and lend the money out to take advantage of the higher return. However, physical capital comprises illiquid assets, and once savings is invested in productive activities, it cannot be extracted without delay and loss of value. Physical or installed capital is characterized first by its complementarity with other components of an entrepreneurial production plan, and only secondarily by its substitutability in alternative plans ...

As a rule more illustrative than actually descriptive, the need for additional complementary resources for production is approximately proportional to the amount already in use, for example, the amount of physical capital already installed. Thus more capital installed means more additional resources required, so the demand for additional credit accelerates. If the supply of additional credit remains steady as the demand for it increases, the interest rate must rise.

Mulligan also performs the unit-root and cointegration tests (see Murray, 1994; Smith & Harrison, 1995). Those two conditions should be met before ECM application. The variables involved in ECM should be cointegrated, and they are said to be I(1) or I(2) if they contain 1 or 2 unit root(s). Their data points have means, variances and covariances that change over time, that is, the variables’ levels are not time-invariant. If two series are said to be cointegrated, they must be integrated of the same order (e.g., avoiding something like I(0) for variable1 and I(1) for variable2) and a linear combination (e.g., the sum) of them must be stationary (i.e., yt-βxt=ut where β is the cointegrating coefficient). This equilibrium error, ut, which captures the error correction by capturing the degree to which Y and X are out of equilibrium, is sometimes denoted zt and can be obtained by regressing yt on xt in order to remove the influence of x on y, so z (or u) is the portion of Y (in levels) that is not attributable to x. Cointegration is needed to establish long-term (equilibrium) relationship.

Because stationarity of money growth has been confirmed, the next step can proceed. He applies ECM, a multiple regression analysis that attempts to predict the effect of X (independent var.) on Y (dependent var.) controlling for lagged X (i.e., Xtime-1) and lagged Y (i.e., Ytime-1). Thus, the model might look like : Yt=α+β0Yt-1+β1Xt+β2Xt-1+εt. The constant α expresses the contemporaneous effect of X on Y whereas the long-term effect of X on Y at t+1 can be obtained by X value minus lagged X value (See: Robin Best, 2008).

Error-correction models are useful for testing the ABCT, by providing estimates of both a structural or equilibrium process toward which adjustment is generally effected, and the error-correction or disequilibrium adjustment process through which adjustment is made toward the hypothesized equilibrium. The error correction model consists of two parts, a structural equation which defines the long-term equilibrium process, and a short-term disequilibrium adjustment process. The residual of the structural equation is an estimate of the disequilibrium in any given time period.

The Johansen-Juselius tests for cointegration reveals a stable, cointegrated relationship between real consumable output and the cumulative yield spread. The next step can proceed.

The OLS estimate also allows for a test of the hypothesis that a lower interest rate accompanies a permanently lowering of the level of real consumable output, the key assertion of Austrian business cycle theory. This interpretation assumes that interest rates fall only due to expansionary monetary policy and not due to general lowering of time preference. The adjusted R square is 97 percent. The intercept and coefficient on the cumulative term spread are both positive and significant. Coefficient values of 6.862 for the intercept and 0.162 for the slope indicate that a one percent increase in interest rates permanently raises consumption expenditure by 955.3 billion chained 1996 dollars each month the higher interest rate persists.

Perhaps more revealingly, a one-percent decrease in the cumulative term spread, such as results from policy induced monetary expansion, has on average decreased real consumable output over the long run by the same amount. The results of the t-test on the cumulative term spread provide strong empirical confirmation of Austrian business cycle theory. This amount is more than great enough to account for any historic recession. Further, the output measure used here, real consumption expenditures, comprises only approximately 70 percent of GDP, thus any impact on real consumption implies a somewhat greater impact on total real output.

The estimate of the vector error correction model (VECM) is reported in Table 5. To facilitate interpretation, the VECM is normalized with respect to and solved for consumption. Estimated coefficients of the cointegrating equation are similar in sign and magnitude to those found by OLS. The VECM intercept and slope coefficients 7.120 and 0.136, indicating a one-percent decrease in the cumulative term spread decreased real consumable output by approximately 1.2 trillion 1996 dollars for every month the term spread falls. [7] This is significantly greater than the amount indicated by OLS, but the two estimates are reasonably consistent. The t-test on the VECM estimate of the structural equation provides further evidence in support of Austrian business cycle theory’s key assertion that lowering the real interest rate lowers real consumable output over the long run.

[7] The impact of the interest rate on consumption is evaluated by taking the slope coefficient estimate of 0.136, multiplied by 1.0 representing a decrease (increase) of the interest rate by 1 percent for one month, and taking the antilog of 0.136, which equals a 1.15 billion chained 1996 dollar loss (gain) in consumable output (consumption spending) for every month the cumulative term spread is lowered by 1 percent. The longer the interest rate is kept 1 percent below the sustainable market rate, the greater the impact on the cumulative term spread and thus on real output. See table 6.

Table 6 shows that whenever the term spread has been lowered significantly below its average value, real consumable output is permanently lowered by a significant amount.

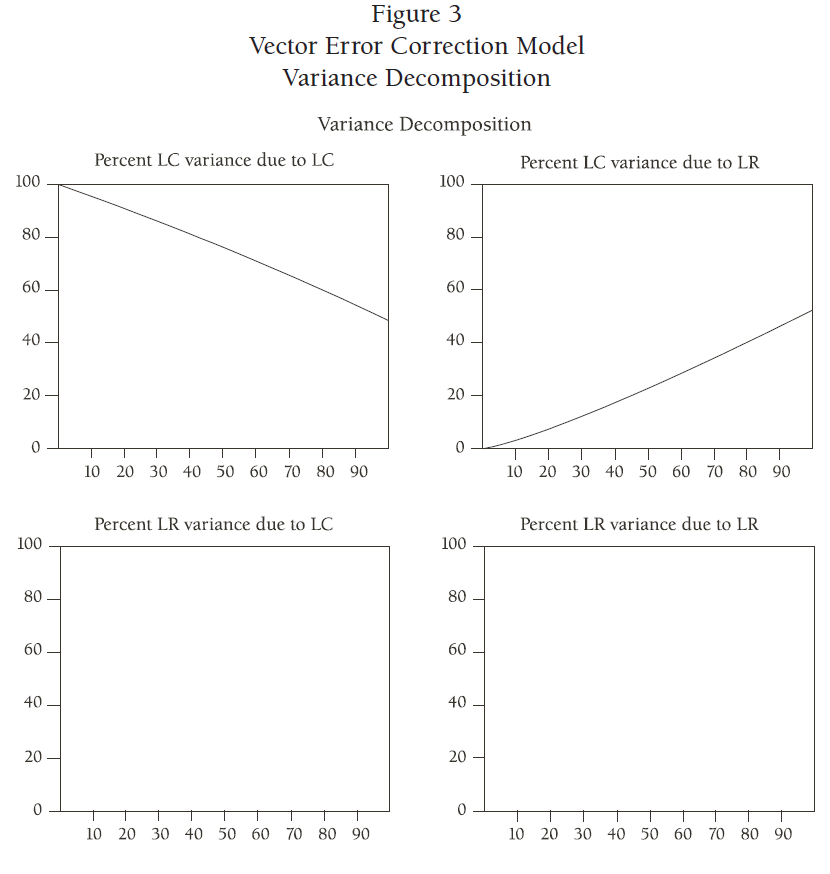

Graphs of the impulse response functions are presented in Figure 2. The upper-right-hand graph is the one of interest for Austrian business cycle theory. It indicates that over the period studied, a one standard-deviation increase in the term spread has resulted, on average, in an upward adjustment of approximately .004 in the logarithm of consumption, equivalent to 1.004 billion 1996 dollars after eight years or 96 months. A one standard deviation decrease in the yield spread decreased real consumable output by an equivalent amount, on average.

The variance decomposition functions are presented in Figure 3. The upper-right-hand graph indicates that after 96 months, nearly 45-50% of the variance in real consumption (LC) expenditures has been attributable to variation in the cumulative term spread (LR). Conversely, no variation seems to be transmitted from consumption to the interest rate, given the lower-left-hand graph. The author says this is not surprising since interest rates are set by policy, and that output, including consumption, responds unfavorably to policy initiatives.

7. The Austrian Business Cycle: a Vector Error-correction Model with Commercial and Industrial Loans (Mulligan, 2005)

Mulligan (2005) uses data from the FRED-II series. Output Index is the industrial production, reinitialized at January 1959 = 100. It estimates the value added in mining, manufacturing, and utilities industries, excluding virtually all services. Consumption Index is the annualized real personal consumption expenditure, observed monthly for January1959-March2003. Consumption spending includes both consumption goods and services. Investment Index is imputed based on the difference between total real output and real consumption. Monthly percent growth rates are computed for the industrial production index and the consumption index. It is assumed that any real output produced which is not consumer goods is producer goods. The percent growth rate of the consumption index is subtracted from the percent growth rate of the industrial production index. The resulting difference is taken as the imputed percent growth rate for real investment. Starting with January 1959 = 100, the imputed real investment index for period t+1 is constructed by multiplying the index for period t times one plus the imputed percent growth rate. Credit Index is the commercial and industrial loans at all commercial banks, observed monthly. This nominal value is adjusted for changes in the price level. The producer price index (PPI) for all commodities is used as a deflator, observed monthly. The deflated series is converted to an index with January 1959 = 100. The credit variable is not without problems, as Mulligan notes :

A potential criticism of commercial and industrial loans as a measure of credit expansion is that credit injected through capital markets is ignored. During expansions, credit is injected into the stock market, dramatically inflating equity prices. However, almost all credit allocated to capital markets goes to purchase already-issued equities. Additions to capital-market credit contribute to inflating stock market prices and indices, but very little becomes available for investment projects, through initial public offerings and initial sales of corporate bonds and commercial paper. Furthermore, commercial and industrial loans proxy the two latter forms of credit very well.

The ADF test results with 48 lags indicate output, investment, and commercial and industrial loans are all I(1), but that consumption may be 1(2) or integrated of higher order. This outcome is detrimental for ECM which needs variables to be integrated of the same order. However, Phillips-Perron tests indicate that all variables are I(1). The Johansen-Juselius test shows the cointegration needed for use of ECM. The ECM is employed to estimate the stable long-term relationship between the variables.

Table 4 shows that the effect of credit on industrial production is positive but only significant at 10% level. Mulligan believes this is because the effects cancel out, being positive during the boom and negative during the bust. The positive coefficient (significant at 5% level) of consumption index shows that credit expansion permanently increases real consumption expenditures. This also suggests that consumers save less in response to lower interest rates. The slope coefficient for investment is negative and very significant, and this indicates that credit expansion permanently lowers investment expenditure.

Adjusted R-squares for the disequilibrium adjustment processes in the cointegrating vector are very low. In spite of the low R-squares, disequilibrium adjustment terms [Θ, Ψ, and Ξ] are significant at the 5% level, only in the disequilibrium adjustment process for consumption. This is an especially interesting result, which is easy to account for according to ABC theory. Apparently market disequilibria, measured by non-zero residuals in the three structural equations, effect correction chiefly through changes in consumption spending. Below-equilibrium consumption, measured by positive residuals in the consumption equation, results in positive adjustments to consumption accompanied by decreases in industrial output and investment, as indicated by significantly negative coefficients on the disequilibrium adjustment terms. Consumption itself adjusts upward, as indicated by the significantly positive coefficient. Little or no adjustment occurs through total output or through investment, suggesting that credit-induced increases in consumption generally occur at the expense of investment and output, rather than as additions to them. Consumer behavior is highly responsive to market disequilibria, but producer behavior exhibits much more inertia, likely due to the fixed capital embodied in the production structure.

The Impulse Response Functions (IRFs) show that IP, consumption and investment go down by -40%, -12% and -25% after a positive shock in commercial and industrial loans after 48 months.

8. A Hayekian Analysis of the Term Structure of Production (Mulligan, 2002)

To the extent that the Error Correction Model evaluates how fast the disequilibrium error (i.e., short-term changes) of a given relationship adjusts itself to its long-term relationship, Mulligan considers it relevant for the study of the ABCT. He uses the data from the U.S. Department of Labor which provides seasonally adjusted monthly sectoral employment data for the 1959–2000 period. Interest rates for several maturities, ranging from three months to five years, were used to capture the apparent implicit time preference latent in the nominal term structure. The purpose is to examine how fast the employment in industrial sectors responds to changes in interest rates. This point is very important because if the evidence was supportive, then, any hypothesis that does not involve the role of interest rates in resource reallocation will be unable to explain the data :

If resource reallocation occurred because of changes in intertemporal consumption preferences or technological change, that reallocation should not be systematically related to interest rates, especially nominal interest rates. In the sample period of over 40 years, dramatic technological advances and changes in consumer time preference certainly occurred, due, for example, to demographic changes in age distribution. Unlike policy-induced credit expansion, these factors do not play any systematic role in driving the business cycle. Technological change is generally interest-neutral (Garrison 2001, pp. 59–62), while credit expansion never is. Also, like technological change, changes in time preference never cause unsustainable reallocation of productive resources.

The technique ECM must fulfill the assumption of cointegration, given non-stationary time series, e.g., I(1). Obviously, the variables must be integrated of the same order (both I(1) and not I(1) and I(0) for example). Here’s a discussion of some of these issues :

The finding that mining may be I(0) indicates it might be deleted from the vector error-correction model, but mining was retained in the model because it remains a part of the nation’s employment statistics, though declining in importance throughout the sample period, and because there is some support for the conclusion that mining is I(1). The null hypothesis of a unit root is always rejected for the first-differenced series, demonstrating all are integrated of order one [I(1)] and not of higher order. Somewhat surprisingly, the interest rates are found to be I(1). A priori, interest rates are expected to be I(0). This would not present any difficulty for interpreting vector error-correction models that include I(0) interest rates and I(1) employment rates, because in order for the I(1) employment rates to enjoy stable, long-run relationships with any I(0) series, the employment rates would have to be cointegrated. Since more than five cointegrating vectors are found, there must be some cointegration among the employment rates.

The five-equation model, where the dependent variables are interest rates, is reported in Table 3. Each cointegrated vector is normalized with respect to, and solved for, different interest rates with maturities ranging from six months to five years. Cointegrated vectors are solved for the interest rate to which they are normalized. The coefficients are interpreted as inverse elasticities of employment with respect to interest.

From a Hayekian perspective, two sets of cointegrating vectors are of interest:

1. Five cointegrating vectors normalized with respect to the five interest rates. These five equations indicate how employment in each of the nine industrial sectors responds to changes in each interest rate. 2. Nine cointegrating vectors normalized with respect to sectoral employment. These nine equations would indicate how changes in the different interest rates affect employment in each sector.

A positive relationship between an employment rate and an interest rate indicates a late stage of production, while a negative relationship indicates an early stage. Table 3 indicates that mining (Min.), transportation and utilities (Trns.), retail trade industry (Ret.), and wholesale trade industry (Whl.) belong to the late stages of production because of their positive signs. The negative coefficients for manufacturing (Mfg.), construction (Con.), finance, insurance, and real estate (Fin.), government (Gov.), and services (Svs.), suggest they are early stages. The obvious incoherence is that mining is, here, a late stage of production. Mulligan says that if the data is less aggregated, it would be certainly possible to better disentangle the problem. For example, some mining activities like petroleum production and field services are better conceptualized as late stages. The same production can be either early or late stage depending on whether the output is sold to a final consumer or another firm. Another possibility is that they will find it easier to increase both output and labor employment, rather than to expand the infrastructure, and they will act more like late-stage producers, even while producing primarily in early stages. Mulligan further states that their behavior would be attributable to the circumstance that the primary way to expand early-stage mining operations is to construct new mines, not expand existing ones.

For manufacturing, none of the negative coefficients are significant at 5% levels. This may perhaps suggest that Mfg tends toward the early stage unless it is better characterized as an intermediate stage. For services, the negative coefficients are significant only for long term maturities (e.g., 3- and 5-years). Mulligan affirms it may indicate that employment in services responds only to long-term interest rates, which is not surprising for early-stage production because it is considered more roundabout. For finance, the fact that the negative signs are significant only for 3- and 6-months maturities suggest this sector responds only to short-term maturities. The contrast between services and finance, Mulligan believes, may be due to the lack of capital intensity in the financial sector. Service-sector producers maintain large and expensive capital stocks and are less free to adjust the size of their workforces. Financial, insurance, and real estate employers are less dependent on capital equipment and do adjust workforce size very quickly to accommodate changing business climates. In addition, finance employers face demand that responds more directly to short-term interest rates than demand faced by service employers.

The fact that the standard errors for wholesale are (three times) greater than for retailing may suggest that retail is better characterized as late stage than wholesale.

Mulligan summarizes his findings by stating that, although early (late) stages have seen their employment levels decrease (increase) when the interest rates go up, in times of recession the employment at every stage diminishes but it occurs faster among the early stages of production.

9. Is Austrian Business Cycle Theory Still Relevant? (Carilli & Dempster, 2008)

Carilli & Dempster (2008) also carried out a Granger causality test on U.S. data (1959Q1-2007Q2). These authors reviewed briefly some previous studies. They noticed some shortcomings; none of them has ever tested the ABCT prediction against other theories’ predictions. That is, these previous studies confirmed the data is consistent with ABCT but not that the ABCT provides the best explanation, against the other theories. Thus, Carilli & Dempster note with regard to Keeler 2001 study :

Monetarist theory provides an alternative hypothesis in that central bank authorities react to steeper yield curves (which signal increased inflationary expectations) by dampening money supply growth, reversing the aforementioned liquidity effects of an earlier monetary expansion and bringing a liquidity-induced boom to an end.

Unlike Keeler, Carilli & Dempster don’t use the term spread (long-term minus short-term interest rates) on the grounds that it assumes that the long-short term spread is driven solely by expectation of future short-term rates. They point out that :

... other factors, such as liquidity preference and price risk (which are themselves sensitive to monetary policy changes), seem to play an important role in the structure of interest rates. These factors, along with central bank management of the long–short spread, distort the influence of personal time preferences on the term structure. Therefore, any result based on the assumptions of a purely expectations-driven term structure and money-neutral long-term rates is suspect. [6] The important point here is that the measure of the natural interest rate should be materially independent of monetary policy actions.

They thus use two other indices of the natural interest rate(s) : 1) the real growth rate in GDP 2) personal savings-consumption ratio. The first is the mainstream specification. The second has been defended by Rothbard in “Man, Economy and State” (1962 [2009]). They described the strength of this proxy as follows :

To illustrate, consider a monetary inflation (reserve increase) that not only lowers effective market rates, but also decreases the natural rate proxy. If the latter effect is transitory, which is the case according to ABCT because the natural rate is a pure reflection of time preference, the endogenously determined lag structure will eliminate the distorting influence of these monetary effects on our proxy, so that the estimated relationships reflect the direct influences of reserves on the underlying (and unobservable) interest rate gap.

The ADF tests reveal that total reserves (U.S. (FFR) federal funds rate) and real GDP are not stationary, and are I(1). This problem is corrected through first-differencing. They then make use of the vector autoregression (VAR) and Granger causality tests to evaluate whether central bank policy (with a variable they call “reserves” through the use of the proxy FFR) can cause interest rate gap (divergence between market and natural rates) which in turn cause GDP. This causal chain is sine qua non for the tenability of ABCT. Concretely, the test is splitted in two phases :

Δ Reserves → Δ Interest Rate gap

Δ Interest Rate gap → Δ Output

Both linkages must hold for the causality to be tenable. Using the first approximation of the natural interest rate(s) they failed to reject the null hypothesis of no Granger causality with regard to Δ Reserves → Δ Interest Rate gap. However, using Rothbard’s recommendation of the natural interest rate(s) they succeeded in rejecting the null hypothesis for both linkages.

And they perform another, more thorough test of the ABCT, by answering whether or not the interest rate gap leads to an artificial expansion followed by a contraction. This is accomplished by a polynomial distributed lag (PDL) function. Concretely, in regression modeling we expect to see β0, ..., βp > 0 and βp+1, ..., βk < 0, i.e., the first set of intermediate multipliers must be positive and the second set to be negative. As the lag of interest rate gap increases, the (positive) coefficient must become negative, having a quadratic curve.

For each natural rate proxy, the effects of an interest rate innovation (through central bank manipulation) are at first positive and then negative on GDP. In the case of the mainstream natural rate proxy (Table 3), the negative effects are short-lived, occurring for about three quarters about 2 years after the interest rate gap appears. In quarters t-11 and t-12, the effect becomes positive again. For the Rothbardian natural rate proxy (Table 4), however, the effects become negative about ten quarters after the gap appears and remain so afterward.

By providing evidence of an endogenous turning point in the relationship between interest rates gap and output, they strengthened the relevance of the austrian theory of the business cycle versus the alternative theories.

10. Is Austrian Business Cycle Theory Still Relevant? (Carilli, Dempster & Rasmussen, unpublished)

Carilli, Dempster & Rasmussen previously examined the case of the Japan’s lost decade (1981-1996) by way of Granger causality tests. They tested the null hypothesis of whether the japanese discount rate (money supply, M2) does not Granger cause interest rate gap. The consumption-savings ratio is chosen for proxying the gap between the market and natural interest rates (but not the mainstream specification of the natural interest rates) :

To calculate our proxy, we followed two steps. First, after determining that consumption-savings ratios were trend stationary, we detrended the ratio accordingly to obtain the long-term average (predicted) values. Second, the residuals from this detrended series were indexed to the appropriate money supply series to remove the effects of money supply variation on the ratio. The indexed series represents the natural rate (which is unaffected by variations in money supply). The interest rate gap is defined as the difference between this ratio and the actual (non-indexed) “market” ratio, which is caused to fluctuate by means of central bank-directed monetary policy.

The results were again compelling for the austrian theory. The p-value of 0.007 implies rejection of the null hypothesis. Their second test is whether or not the interest rate gap does not Granger cause nominal GDP. The p-value was 0.013. Here again, the hypothesis of no causality must be rejected.

These authors also investigated the U.S. business cycles during the 1980-1999 period. Here again, they discover that the US federal funds rate (money supply, MZM) Granger caused the interest rate gap, with p-value of 0.041. The interest rate gap also Granger caused nominal GDP, with p-value of 0.003.

A further test, again, involved the ABCT hypothesis that the movements in GDP will be upward at first only and then downward as malinvestment makes itself apparent. They seek to determine whether GDP growth has a turning point endogenous to the interest rate innovation. The interest gap is expected to have a positive impact on GDP in earlier periods and a negative impact in later periods. For both the Japan and the U.S., the expected pattern was apparent.

11. Empirical Evidence for Hayek’s Theory of Economic Fluctuations (Wainhouse, 1984)